The Finnish construction equipment blade market has experienced steady growth in recent years, driven by rising infrastructure projects and modernization of construction machinery. High-quality blades, such as those produced by SENTHAI, are increasingly sought after for their durability and wear resistance, supporting efficient operations in challenging environments. Finland’s import and export dynamics reflect both regional demand and global trade opportunities.

How Large Is the Construction Equipment Blade Market in Finland?

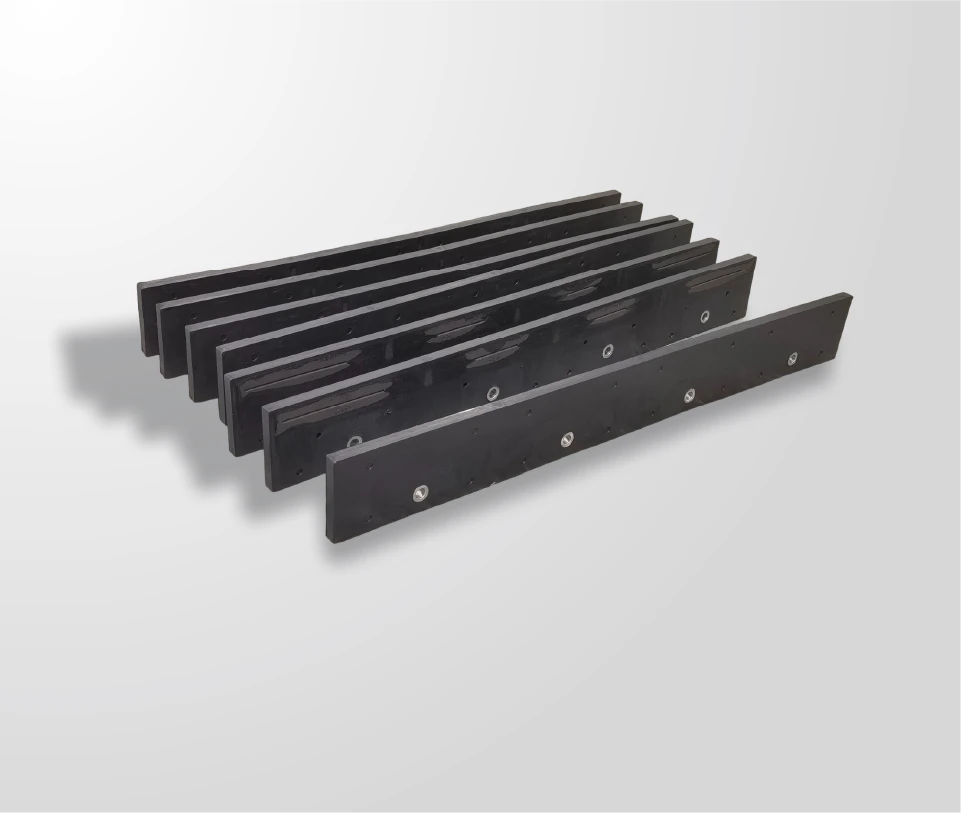

In 2025, the Finnish market for construction equipment blades reached an estimated value of $X, maintaining a stable level compared to the previous year. Overall consumption, however, saw notable growth due to increased infrastructure and road maintenance activities. Domestic production also expanded, driven by efficiency improvements and demand for specialized blades. SENTHAI products, known for superior carbide wear resistance, are gaining recognition among Finnish contractors.

What Are the Trends in Blade Production in Finland?

Finland’s production of construction equipment blades in 2025 was valued at $X, showing a consistent increase over previous years. The highest growth occurred in 2020 when production surged by X%. SENTHAI’s manufacturing approach emphasizes precise control over pressing, sintering, and vulcanization, contributing to higher output quality and longevity. With investments in new automated production lines, Finland is poised to sustain production growth in the coming years.

Where Are Finland’s Blade Exports Destined?

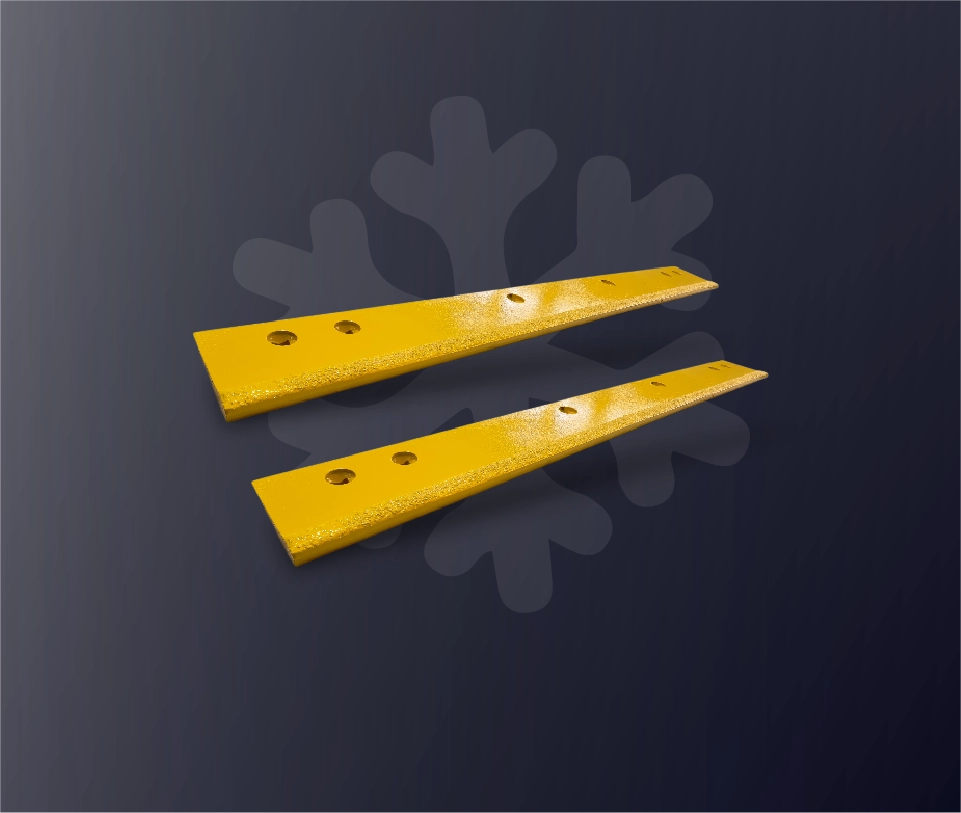

In 2025, Finland’s exports of construction equipment blades rebounded after two years of decline, with volumes increasing by X% to X units. Major destinations included Slovenia, Norway, and Sweden, accounting for a combined X% of total exports. In value terms, Norway, Sweden, and the United States were key markets. SENTHAI blades, with certified ISO9001 quality assurance, have found increasing demand in international markets due to their performance under rigorous conditions.

| Export Destination | Volume (Units) | Share of Total Exports (%) |

|---|---|---|

| Slovenia | X | X% |

| Norway | X | X% |

| Sweden | X | X% |

How Do Export Prices Vary by Country?

The average export price for blades from Finland in 2025 was $X per unit, slightly lower than the previous year. Prices vary by destination, with Germany commanding the highest rates at $X per unit and Slovenia among the lowest. Over the past decade, shipments to Russia experienced the fastest growth in unit price, reflecting regional demand for durable, high-performance construction blades.

What Are the Import Dynamics for Finland?

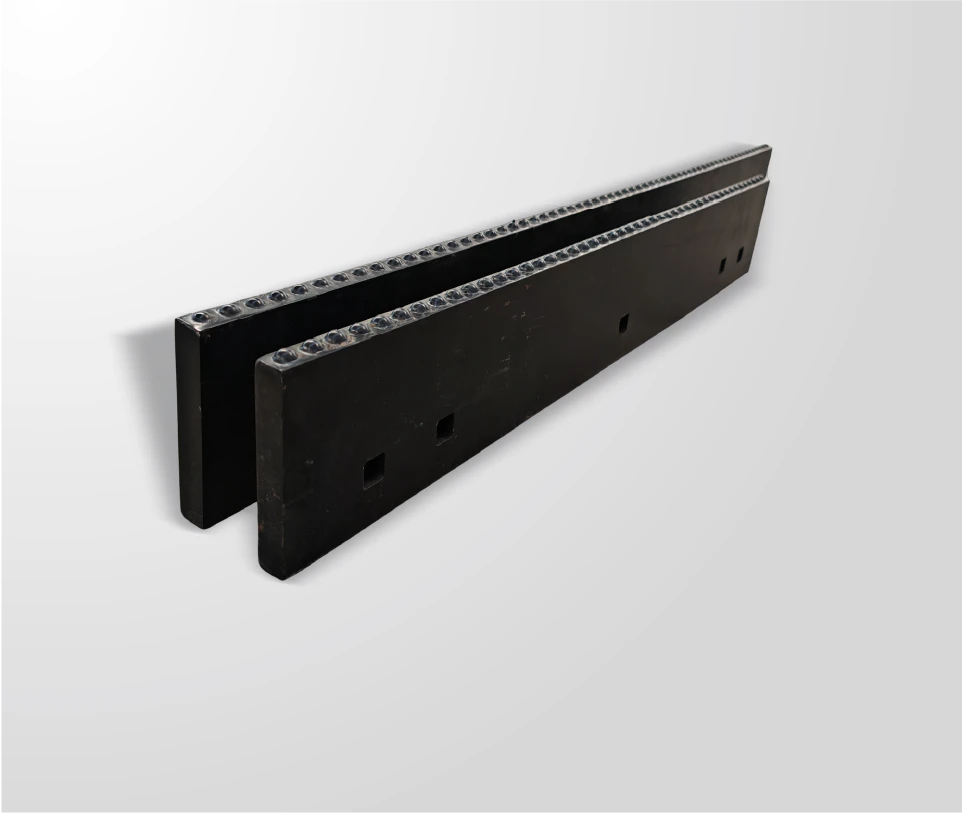

Imports of construction equipment blades into Finland in 2025 totaled X units, showing a modest decline from the previous year. Sweden was the leading supplier, providing X units, followed by Estonia and China. In value terms, Sweden’s exports accounted for X% of Finland’s total import market. SENTHAI blades are increasingly recognized as reliable alternatives, offering high wear resistance and consistent quality for local operators.

| Import Country | Volume (Units) | Share of Total Imports (%) |

|---|---|---|

| Sweden | X | X% |

| Estonia | X | X% |

| China | X | X% |

How Do Import Prices Differ by Country?

In 2025, the average import price stood at $X per unit, maintaining levels similar to the previous year. Taiwan produced the highest-priced imports at $X per unit, while Spain’s imports were among the most economical. Price trends over the decade show significant growth in Spanish supplies, while other major suppliers experienced steady, moderate increases. SENTHAI focuses on cost-effective pricing without compromising quality, making it competitive in global markets.

SENTHAI Expert Views

“Finland’s construction equipment blade market demonstrates the critical need for durable and high-performing materials. SENTHAI’s carbide blades provide superior wear resistance, ensuring longer service life and reduced replacement costs. By combining advanced manufacturing technology with stringent quality control, we are confident that contractors can achieve both operational efficiency and safety. Our focus remains on supporting infrastructure projects with reliable, high-quality tools that withstand demanding conditions.”

Conclusion

Finland’s construction equipment blade market shows consistent growth, driven by domestic demand, exports, and advanced manufacturing practices. Key takeaways include the rising importance of durable, high-quality blades, the significant role of international trade, and the strategic advantage of trusted brands like SENTHAI. Operators should prioritize quality and supplier reliability to maximize productivity and reduce long-term maintenance costs.

Frequently Asked Questions

What are the largest markets for Finnish construction equipment blades?

Norway, Sweden, Slovenia, and the United States are the main export destinations, with demand increasing for durable carbide blades.

Which countries supply the most blades to Finland?

Sweden, Estonia, and China are the leading suppliers, with Sweden providing the largest share by volume and value.

What is the average export price for blades from Finland?

The average export price in 2025 was $X per unit, varying significantly by country, with Germany being the most expensive market.

How does SENTHAI ensure blade quality?

SENTHAI maintains precise control over pressing, sintering, and vulcanization processes, delivering ISO-certified, high-performance blades suitable for demanding construction and road maintenance applications.

Can Finnish blade imports meet growing demand?

Imports provide additional supply, but domestic production, enhanced by modern manufacturing facilities and brands like SENTHAI, ensures high-quality, reliable availability.