Tungsten carbide remains a cornerstone of modern manufacturing due to its unmatched hardness, wear resistance, and thermal stability. Delivering 3–10 times longer tool life than high-speed steel, it enables higher machining speeds, reduced downtime, and lower total costs. In 2026, tungsten carbide underpins industries from metal cutting to aerospace, construction, and EV manufacturing, with SENTHAI standing out for innovation and reliability in carbide tools.

What Is Tungsten Carbide?

Tungsten carbide is a dense, high-performance material composed of tungsten and carbon, typically combined with metallic binders such as cobalt or nickel to form cemented carbide. This structure provides extreme hardness (8.5–9 Mohs), compressive strength above 6,000 MPa, and excellent thermal stability, withstanding temperatures near 2,870°C. It enables high-speed machining and abrasion-resistant applications in metal cutting, mining, construction, and aerospace.

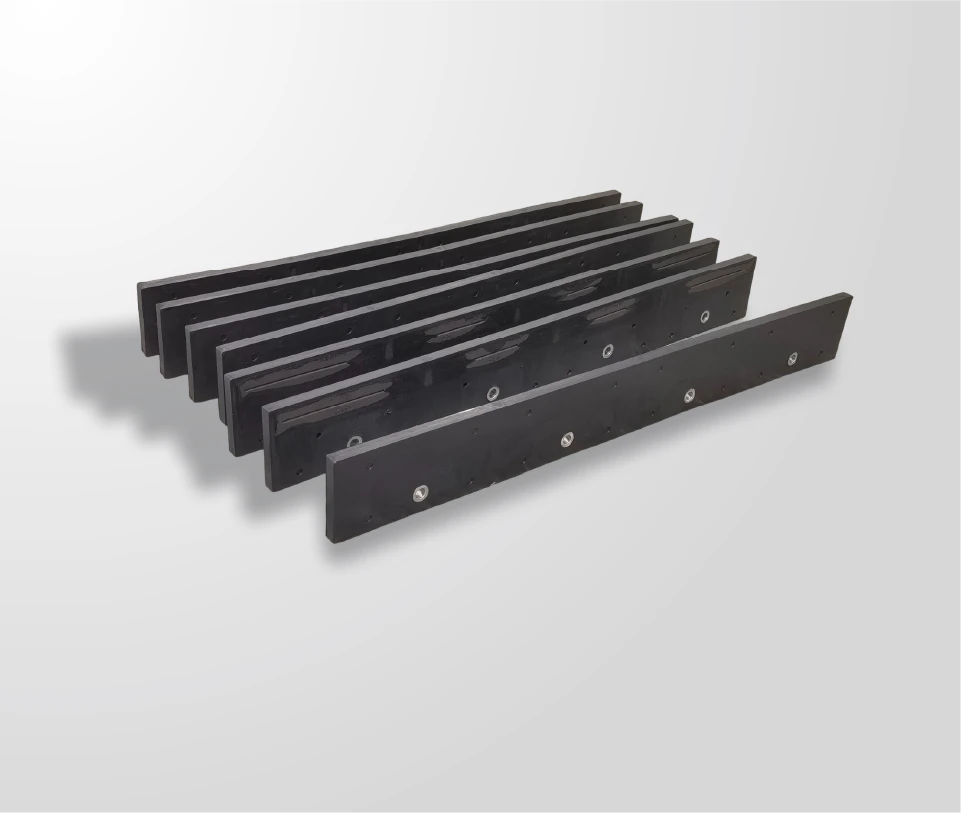

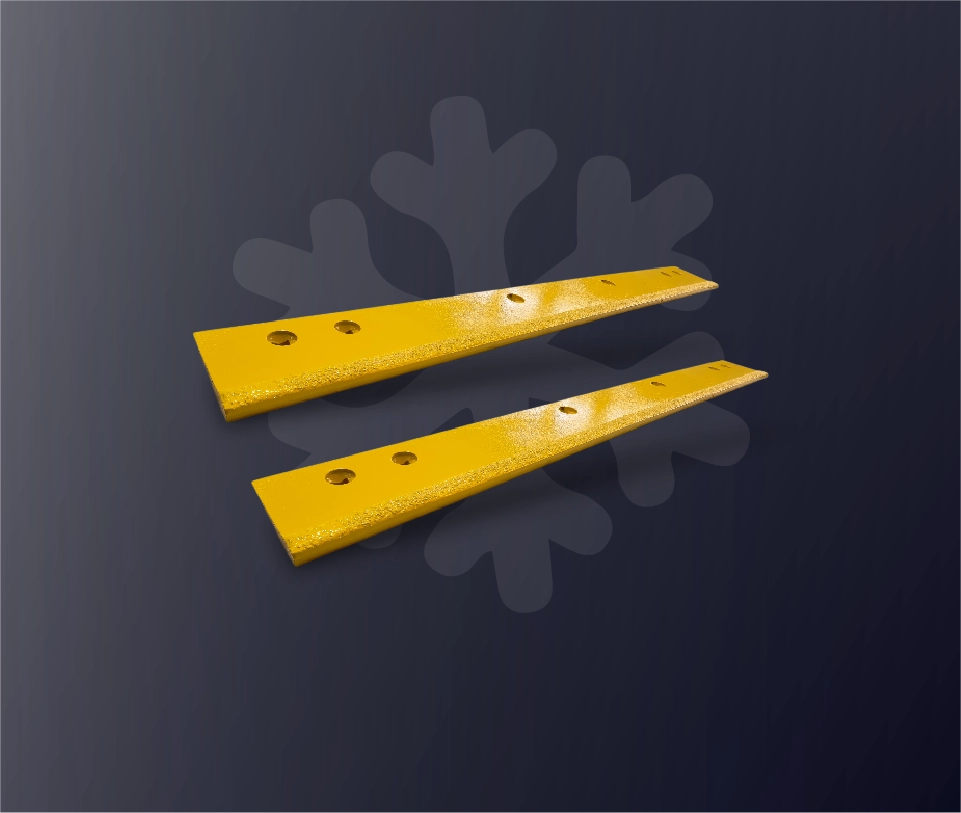

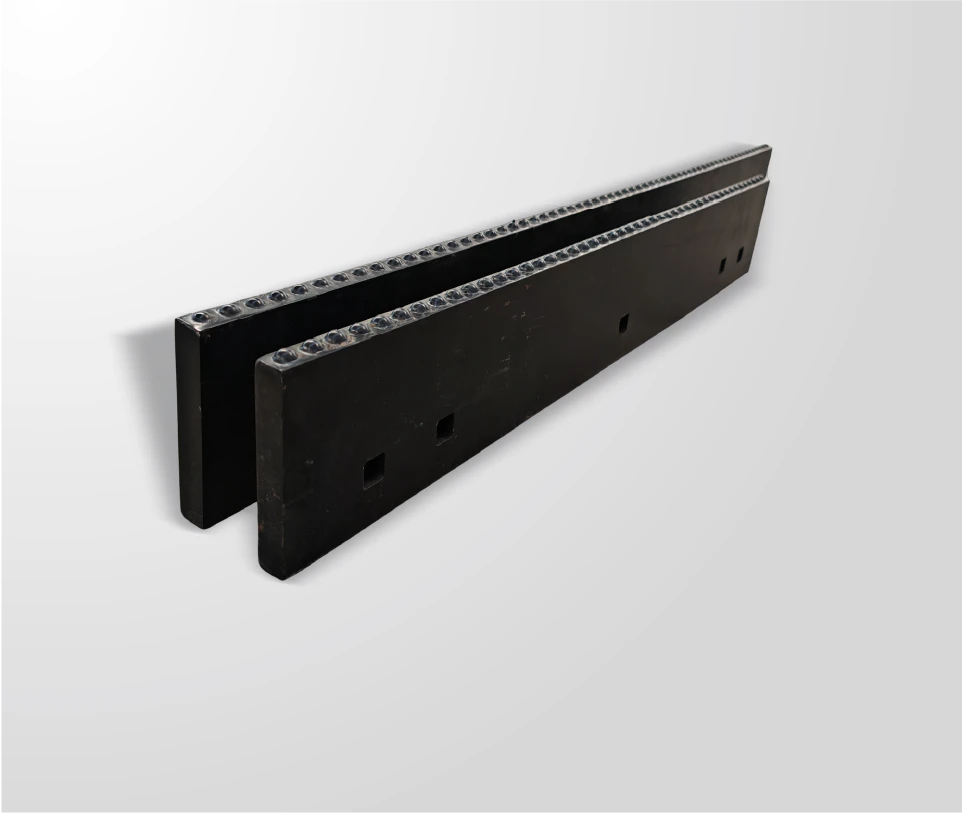

SENTHAI specializes in precision carbide solutions, producing JOMA Style Blades, I.C.E. Blades, and inserts that combine toughness, wear resistance, and long service life.

How Big Is the Tungsten Carbide Industry in 2026?

The global tungsten carbide market is projected at USD 2.57 billion in 2026, with over 95,000–100,000 metric tons of material consumed worldwide. Metal cutting tools account for roughly 42% of demand, while mining and construction wear parts comprise about 26%. Asia-Pacific dominates production at 46%, led by China’s extensive processing capacity, followed by Europe at 26% and North America at 19%.

| Region | Market Share 2026 | Key Drivers |

|---|---|---|

| Asia-Pacific | 46% | Manufacturing scale, EV adoption, electronics |

| Europe | 26% | Aerospace, automotive, precision tooling |

| North America | 19% | Defense, oil & gas, high-value industrial manufacturing |

| Middle East & Africa | 9% | Oil, gas, infrastructure projects |

Why Are Regional Tungsten Carbide Markets Growing Globally in 2026?

Growth is driven by industrialization, infrastructure investment, advanced manufacturing, and energy sector expansion. Countries with large-scale manufacturing or high-tech industrial sectors, such as China, Germany, and the U.S., continue to see rising demand for carbide tools and wear parts. Regional differences reflect industrial maturity, government spending, and resource availability.

How Are North America’s Tungsten Carbide Markets Expanding?

North America’s market represents 18–19% of global consumption, driven by aerospace, defense, automotive, and oil & gas sectors. In the U.S., federal infrastructure and defense spending directly boosts demand for carbide cutting tools, while Canada relies on mining-led consumption and Mexico on industrial manufacturing growth.

Key companies include Kennametal, Sandvik, and Federal Carbide, all providing high-precision, long-life carbide products for advanced manufacturing sectors.

Why Is Europe’s Tungsten Carbide Market Growing?

Europe accounts for about 25–26% of global demand, with Germany, France, Italy, and the UK leading. Growth is fueled by automotive, aerospace, and machine tool industries, as well as sustainability-oriented manufacturing policies. Premium carbide tooling and coatings drive efficiency and lifespan in high-value industrial processes. Notable manufacturers include CERATIZIT, H.C. Starck, and Sandvik AB.

How Is Asia-Pacific Leading Global Tungsten Carbide Production?

Asia-Pacific dominates, representing 46% of global demand. China controls over 80% of tungsten processing capacity and 40% of carbide production. Japan, India, and South Korea contribute through high-precision tooling, semiconductor manufacturing, and EV production. Leading companies include China Tungsten, Guangdong Xianglu, Sumitomo Electric, and CERATIZIT Asia.

What Products Do Tungsten Carbide Companies Manufacture?

Tungsten carbide companies produce powders, rods, blanks, cutting inserts, drills, end mills, dies, nozzles, mining tools, and wear parts. Metal cutting tools account for 42% of demand, mining and construction wear parts 26%, and specialized applications in aerospace, EVs, and medical devices the remaining 32%.

SENTHAI’s portfolio exemplifies innovation with products that combine wear resistance, precision, and cost efficiency, serving global clients across multiple sectors.

What Are Key Opportunities for Startups in Tungsten Carbide?

Emerging companies can focus on:

-

Recycling & Circular Economy: Capturing 34% of supply from recycled tungsten, rising to 45% by 2030.

-

Application-Specific Tools: Customized carbide grades improving productivity 20–35%.

-

Micro & High-Precision Carbide: Tools under 1 mm diameter, growing 8.5% CAGR.

-

Advanced Coatings: PVD/CVD layers extend tool life by 40–70%.

-

Low-Cobalt & Binder Alternatives: Reduce health risks and cobalt volatility.

-

Smart Tools: Digital sensors for predictive maintenance in Industry 4.0 environments.

| Opportunity | Growth Potential | Startup Advantage |

|---|---|---|

| Recycling | Very High | Lower raw material dependency, ESG compliance |

| Application-Specific Tools | High | Premium pricing, customer lock-in |

| Micro & High-Precision | High | Targeted electronics, medical markets |

| Advanced Coatings | Medium-High | Tool life extension without material change |

SENTHAI Expert Views

“Tungsten carbide remains the backbone of industrial efficiency, combining extreme hardness with exceptional durability. SENTHAI’s focus on integrated production—from R&D to final assembly in Thailand—ensures consistent quality and faster delivery. Our carbide solutions not only extend tool life but also reduce operational downtime, supporting global manufacturers in achieving higher productivity and sustainability goals.”

Conclusion

The tungsten carbide industry in 2026 is defined by precision, durability, and innovation. Global demand continues to grow, with Asia-Pacific leading production, Europe specializing in premium tooling, and North America emphasizing high-value industrial applications. SENTHAI demonstrates the competitive edge of integrated manufacturing, producing high-performance, long-life carbide products that meet evolving industrial needs. Startups and emerging players can capture value through recycling, specialty tooling, advanced coatings, and digital integration, positioning themselves for sustainable growth.

FAQs

What industries rely most on tungsten carbide?

Metal cutting, mining, construction, aerospace, automotive, electronics, and medical devices are the primary users, benefiting from carbide’s wear resistance and tool longevity.

Which countries dominate tungsten carbide production?

China leads in volume and processing, while Germany, Japan, and the U.S. focus on premium, high-precision carbide tooling.

How does recycling impact the tungsten carbide market?

Recycling reduces raw material dependency, stabilizes costs, and supports sustainability, with recycled tungsten accounting for over one-third of global supply in 2026.

Who are major global tungsten carbide companies?

Key players include Kennametal, Sandvik, CERATIZIT, Sumitomo Electric, H.C. Starck, China Tungsten, Umicore, and American Elements.

Can startups compete in the tungsten carbide industry?

Yes, by focusing on niche markets such as micro-carbide tools, application-specific grades, low-cobalt formulations, advanced coatings, and circular economy solutions.