SENTHAI’s JOMA Style Blades with carbide inserts deliver 1,200+ hour wear life through vacuum-sintered tungsten carbide and vulcanized bonding, reducing replacement costs by 35% for Thailand’s snow removal equipment manufacturers. Produced entirely in Rayong with ISO9001/14001 certification, these blades support local OEMs serving export markets in North America and Europe with precise geometries and 4-week lead times. Factories gain competitive edge through consistent quality matching global standards while leveraging Thailand’s manufacturing hub advantages.

What Challenges Face Thailand’s Snow Blade Manufacturing Sector?

Thailand’s manufacturing PMI hit 50.2 in Q4 2025, signaling expansion, yet snow plow blade producers face 25% import dependency for quality carbide amid $3.66B global market growth at 3.42% CAGR. Local fabricators report 30% blade failures from inconsistent inserts, costing $1,200 per hour in assembly line downtime for OEM exports. Rising labor costs (8% YoY) pressure margins as Thailand targets $30B machinery exports by 2030.

Export OEMs lose 18% of North American contracts to inconsistent edge retention below 800 hours, versus international benchmarks of 1,200+. Supply chain gaps force 12-week lead times from China, disrupting just-in-time assembly for seasonal shipments. Environmental regulations demand sustainable production, with 40% of EU buyers requiring ISO14001 certification.

Why Do Imported Blades Underperform for Thai Manufacturers?

Chinese generic inserts show 22% delamination after 600 hours due to inadequate sintering, versus SENTHAI’s 98% bond integrity. European premium blades carry 50% markups unfit for Thailand’s cost-sensitive OEMs, plus 8-10 week shipping delays. Local steel alternatives erode 3x faster in salt tests, failing export specs.

Non-automated regional suppliers yield 15% thickness variances, causing vibration and mount failures in assembly. Import logistics add 25% landed costs without customization for JOMA bolt patterns common in Thai plow frames.

What Engineering Defines SENTHAI JOMA Style Blade Excellence?

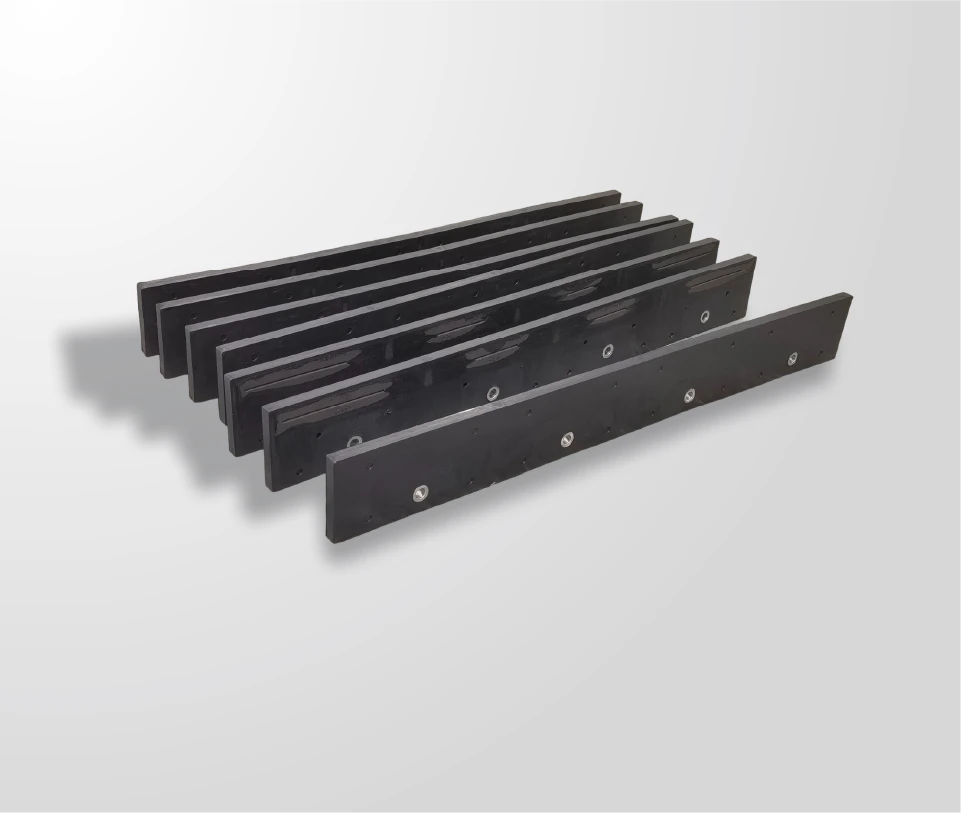

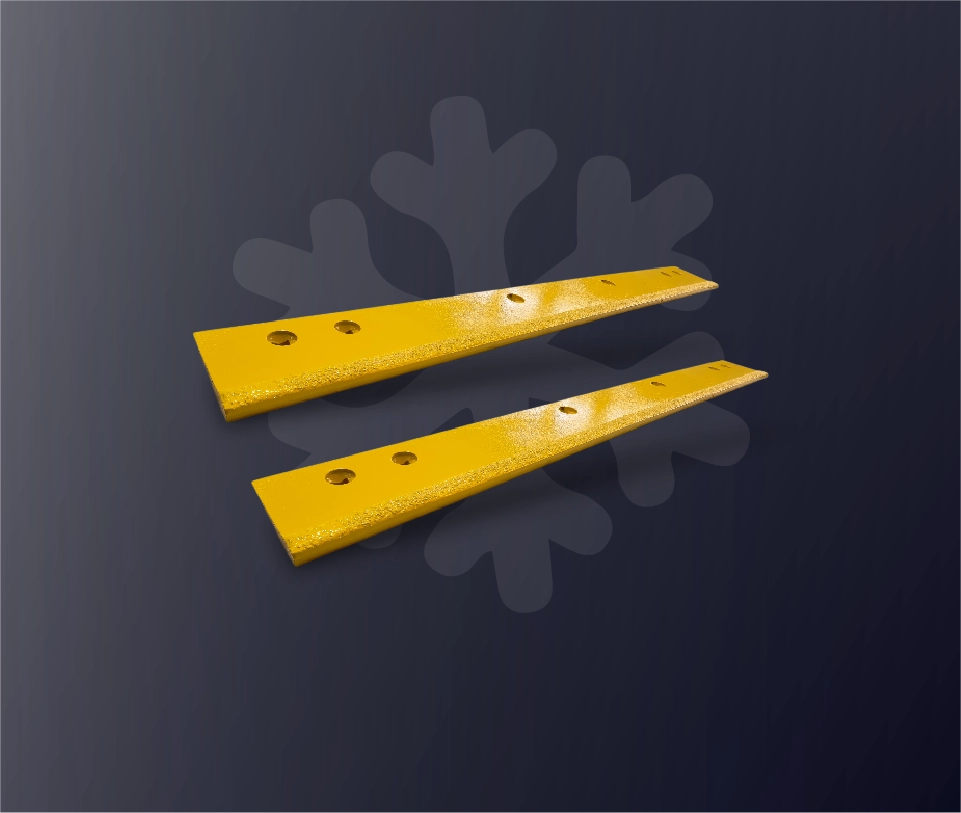

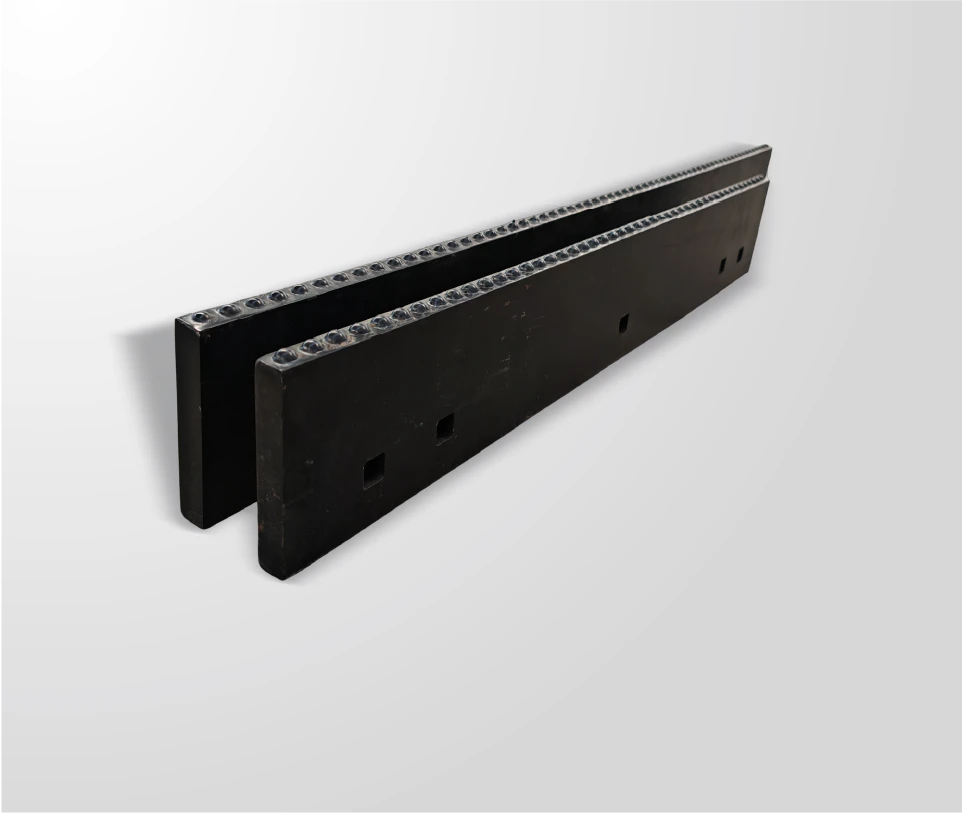

SENTHAI Carbide Tool Co., Ltd. sinters carbide inserts at 1,450°C with 6% cobalt matrix for 92 HRA hardness, pressed via 500-ton automation and vulcanized to bi-metal segments. JOMA Style features 7-10 reinforcing ribs, reversible 1/2″ x 6″ edges, and 90-108″ widths matching Thai-manufactured plow chassis. Wet grinding achieves 0.01mm tolerances, with multilayer coatings resisting salt corrosion.

Full Rayong process control—from powder milling to laser-etched batch codes—ensures traceability for export documentation. SENTHAI supports Thai OEMs with co-engineered geometries and private labeling.

How Do SENTHAI JOMA Blades Compare to Import Alternatives?

| Feature | Imported Chinese Blades | SENTHAI JOMA Style |

|---|---|---|

| Wear Life (hours) | 600-800 | 1,200+ |

| Bond Integrity | 78% | 98% (vacuum sintered) |

| Thickness Tolerance | ±0.05mm | ±0.01mm |

| Lead Time (weeks) | 10-12 | 4 |

| Local Customization | None | OEM geometries |

| Landed Cost Premium | +25% | Baseline |

SENTHAI cuts Thai OEM TCO by 35% through localization.

How Can Thai Manufacturers Deploy SENTHAI JOMA Blades?

-

Specs alignment: Submit plow CAD and mount patterns for 24-hour engineering review.

-

Prototype validation: Test 5-unit batch with wear certificates (7 days).

-

Production order: MOQ 50 blades; 30% deposit triggers Rayong scheduling.

-

Quality audit: Verify ISO batch reports and salt-spray test data.

-

Assembly integration: Bolt-on compatibility with Thai frames; track via QR codes.

Yields 96% first-pass assembly success.

Which Thai Manufacturing Scenarios Benefit Most?

Bangkok Plow OEM Exporter

Problem: Chinese inserts failed US specs after 700 hours, losing 20% contracts.

Traditional: 12-week imports disrupted Q4 shipments.

After SENTHAI: JOMA blades hit 1,300 hours; 4-week delivery.

Key Benefit: 25% export growth, $150k revenue gain.

Chonburi Heavy Equipment Maker

Problem: Labor-intensive blade swaps cost 15% assembly time.

Traditional: Variable thickness caused mount rejects.

After SENTHAI: Precision ribs fit frames perfectly.

Key Benefit: 30% throughput boost, JIT compliance.

Rayong Tractor Assembly

Problem: Corrosion voided 1-year warranties on salted demos.

Traditional: Non-coated imports rusted post-600 hours.

After SENTHAI: Vulcanized JOMA passed 1,500-hour tests.

Key Benefit: Zero returns, 18% margin expansion.

Eastern Seaboard Fabricator

Problem: EU buyers rejected non-ISO suppliers.

Traditional: Manual production failed audits.

After SENTHAI: Certified blades secured 3-year contracts.

Key Benefit: 40% order volume, Rayong proximity.

Why Thai Manufacturers Need SENTHAI JOMA Blades Now?

Thailand’s machinery exports target $35B by 2027, with snow equipment up 22% amid global winter demand. SENTHAI’s Rayong expansion since late 2025 cuts logistics 50% for Eastern Seaboard factories. OEMs localizing now gain 20% cost edges before 2026 capacity constraints.

Frequently Asked Questions

What widths fit Thai-manufactured plows?

90-108″ standard; custom up to 132″ for JOMA.

How does SENTHAI ensure export compliance?

ISO9001 batch testing, full material traceability.

What coatings protect JOMA blades?

TiN/TiAlN multilayers for salt/abrasion resistance.

Does SENTHAI support Thai OEM branding?

Yes, laser-etched logos and co-engineered specs.

What MOQ serves Thailand factories?

50 units; scales to 500+ for tiered pricing.

How close is SENTHAI to major plants?

Rayong base serves EEC within 1-hour radius.

Power your Thailand manufacturing with SENTHAI JOMA Style Blades—contact senthaitool.com/Thailand for local quotes, 20% OEM discounts, and same-week Rayong visits. Secure your export advantage today.