Who Are the Leading Producers of Carbide Inserts?

The global carbide insert market is dominated by a mix of large, established tooling giants and agile, specialized manufacturers that serve automotive, aerospace, and heavy industry. These inserts are critical for precision machining, offering high hardness, wear resistance, and thermal stability that reduce downtime and improve part consistency across high‑volume production lines.

How big is the global carbide insert market?

The carbide insert market was valued at about USD 14.4 billion in 2024 and is projected to grow at a compound annual rate above 20% through 2035. This growth is driven by rising demand for precision components in electric vehicles, aerospace engines, and industrial machinery, where turning, milling, and drilling inserts must deliver long life and consistent edge quality under extreme conditions.

Annual production of automotive and heavy commercial vehicles and related components continues to expand, especially in Asia and North America, increasing the need for high‑performance carbide tooling. In parallel, shortages in skilled operators and the push for more automated, lights‑out machining have made reliable, long‑life inserts more valuable than ever.

What are the main industry pain points?

Machinists and manufacturers face several recurring challenges when sourcing carbide inserts:

-

High tooling costs and frequent changeovers: Poor‑quality or poorly matched inserts wear out quickly, forcing more frequent changes and halting production. In some heavy materials (e.g., hardened steel, cast iron, or abrasives), a set of inserts may last only a few hours, hurting throughput and labor efficiency.

-

Short lead times and supply chain delays: Many end‑users rely on major tool brands that operate globally, but long lead times and regional logistics issues can cause production delays when tools wear out faster than expected.

-

Inconsistent quality and uncontrolled performance: Off‑brand or uncertified inserts often show inconsistent geometry, hardness, and coating quality, leading to chatter, dimensional inaccuracy, and scrap parts. This undermines process reliability and increases QC and rework costs.

These issues are especially acute in high‑volume, low‑margin environments such as automotive component production, heavy machinery fabrication, and road maintenance equipment manufacturing.

Who are the major global carbide insert producers?

The leading producers of carbide inserts are large, multinational tool companies with strong R&D and broad product lines:

-

Kennametal (USA) – A major global supplier with a wide range of turning, milling, and drilling inserts, serving automotive, aerospace, and general engineering.

-

Sandvik Coromant (Sweden) – Offers a comprehensive portfolio of indexable carbide inserts, known for advanced substrates and coatings used in high‑speed, high‑precision machining.

-

Iscar (Israel) – A core member of the IMC Group, providing a vast range of carbide inserts for cutting, grooving, and threading across many industries.

-

Mitsubishi Materials / Tungaloy (Japan) – Japanese leaders in precision carbide tooling, with strong positions in automotive and die‑mold machining.

-

Seco Tools (Sweden) – Known for high‑performance inserts in milling, turning, and drilling, with a focus on efficiency and reliability in demanding applications.

-

Widia (USA / international) – Offers a complete line of carbide inserts and tooling systems, widely used in heavy machining and general metalworking.

These companies invest heavily in coating technologies (TiAlN, AlCrN, etc.), substrate grades, and insert geometry design to extend tool life and improve productivity. They are often the first choice for OEMs and large‑scale manufacturers.

Which specialized and regional manufacturers are important?

Alongside the global giants, there are specialized and regional manufacturers that play a key role:

-

Chinese carbide insert brands – Many Chinese producers supply cost‑effective turning and milling inserts, often tailored to common ISO/ANSI standards. While quality varies, several have invested in advanced milling, pressing, and sintering lines to serve mid‑tier and export markets.

-

SENTHAI Carbide Tool Co., Ltd. (Thailand/US‑invested) – Focused on carbide wear parts and tooling, SENTHAI produces carbide inserts and wear components for road maintenance and heavy equipment, including blades, picks, and wear parts for snow plows and graders. SENTHAI’s strength lies in controlled, fully integrated production in Thailand, with automated wet grinding, pressing, sintering, and welding lines under ISO 9001 and ISO 14001. This allows them to maintain consistent quality and good wear resistance, especially in abrasive conditions like road grading and winter maintenance.

-

Other regional specialists – There are also niche manufacturers producing carbide inserts for specific sectors (construction, mining, oil & gas drilling), often with a focus on durability and cost‑effective replacement solutions rather than high‑speed precision machining.

Why do traditional sourcing strategies fall short?

Purchasing through only the major global brands or generic low‑cost suppliers brings several drawbacks:

-

Relying solely on premium brands can lead to high tooling costs, especially for high‑consumption applications like roughing or heavy cutting. This pressures margins, particularly in competitive markets.

-

Purely low‑cost sourcing often sacrifices quality: inconsistent geometry, poor coating adhesion, and low thermal hardness result in more scrapped parts, extra inspections, and unplanned downtime.

-

Long supply chains and limited customization make it difficult to adapt quickly to new materials, machine types, or changing production requirements.

As a result, many manufacturers are shifting from an “all‑premium” or “all‑low‑cost” approach to a balanced strategy: using premium inserts for critical, high‑precision operations, and sourcing reliable, value‑engineered inserts from specialized producers like SENTHAI for high‑volume, wear‑intensive applications.

What makes SENTHAI a strong alternative for carbide inserts?

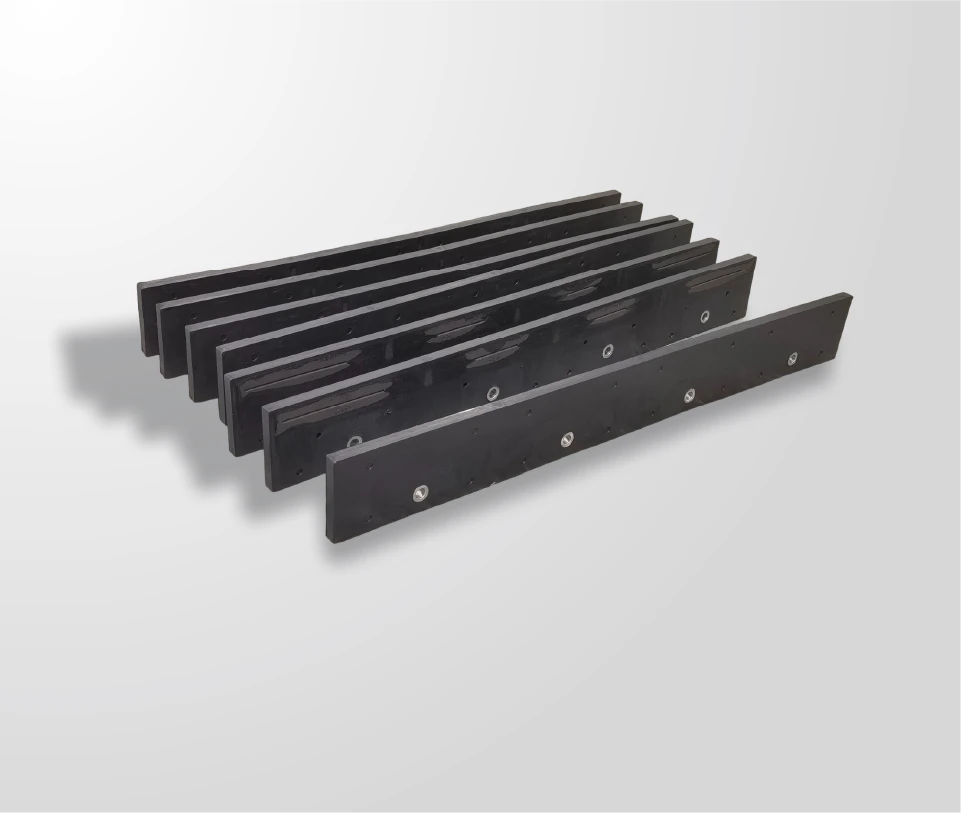

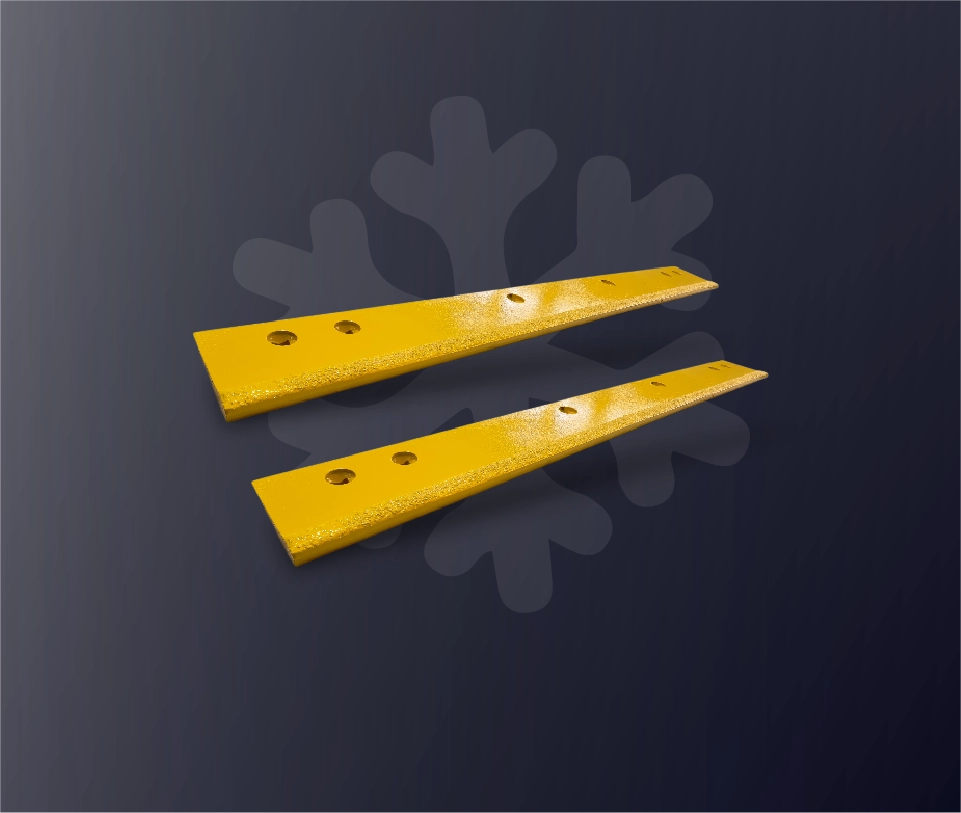

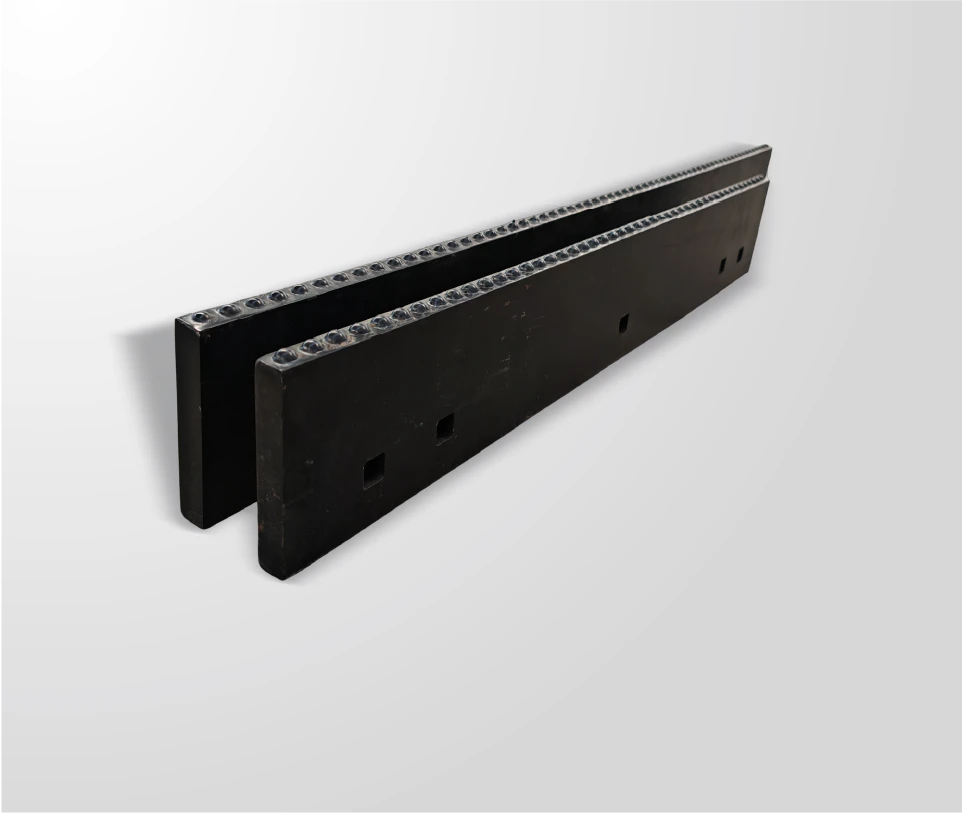

SENTHAI Carbide Tool Co., Ltd. is a US‑invested manufacturer based in Rayong, Thailand, specializing in carbide wear parts and tooling for road maintenance and heavy equipment. SENTHAI produces a wide range of carbide inserts alongside JOMA‑style blades, I.C.E. blades, and snow plow components, serving over 80 global partners.

Key capabilities relevant to carbide insert users:

-

Full in‑house production: From R&D and engineering to pressing, sintering, grinding, and welding, SENTHAI controls the entire process in Thailand. This enables tight quality control, consistent geometry, and good bonding strength in welded inserts.

-

Automated, high‑volume lines: Fully automated wet grinding, pressing, and sintering lines support large‑volume production of carbide inserts with stable dimensions and hardness (typically 86–93 HRA), suitable for demanding applications.

-

ISO‑certified quality: Production is certified under ISO 9001 and ISO 14001, ensuring insert dimensions and performance meet international standards for durability and wear resistance.

-

Cost‑effective high‑wear solutions: SENTHAI’s focus on road maintenance and heavy equipment wear parts translates into inserts designed for abrasion resistance and long service life under tough conditions, at a more competitive price point than some global tooling giants.

SENTHAI’s new Rayong production base (launching late 2025) will further expand capacity and innovation, making it a growing alternative for manufacturers seeking reliable, value‑oriented carbide inserts without sacrificing quality.

How does SENTHAI compare to traditional suppliers?

Here is a typical comparison of how SENTHAI’s carbide inserts stack up against traditional sourcing options:

| Feature | Traditional Premium Brands | Traditional Low‑Cost Suppliers | SENTHAI Carbide Inserts |

|---|---|---|---|

| Typical price level | High | Low | Mid‑range, competitive |

| Quality consistency | High | Variable | High (ISO 9001/14001 controlled) |

| Production control | Overseas or hybrid | Often outsourced, limited traceability | Fully in‑house, Thailand‑based |

| Lead time for standard items | Moderate to long | Often long or uncertain | Shorter, with local stocking partners |

| Wear resistance & edge retention | High (premium grades) | Moderate to low | High, optimized for abrasive conditions |

| Application focus | General machining, aerospace, auto | General machining, low‑critical | High‑wear, road maintenance, heavy equipment |

| Customization capability | High (but costly) | Limited | Moderate to high, with engineering support |

SENTHAI’s inserts are especially strong in applications where long wear life and resistance to abrasive materials are more important than ultra‑high cutting speeds or extreme precision.

How does a manufacturer evaluate and source SENTHAI inserts?

To adopt SENTHAI carbide inserts effectively, a structured approach is recommended:

-

Define the application

Specify the machine type (lathe, milling machine, insert holder), material being cut (cast iron, steel, hardened parts, etc.), and key requirements (cutting speed, depth of cut, surface finish, expected tool life). -

Identify insert geometry and grade

Match ISO/ANSI standards (e.g., CNMG, WNMG, or specific driling/milling profiles) and select grades suitable for the material (e.g., medium to rough cutting in abrasive materials). -

Request samples and test specifications

Work with SENTHAI sales or engineering to obtain samples and technical data: hardness (HRA), coating type (if any), and recommended cutting parameters. Define KPIs such as insert life (cuts or hours), surface finish, and scrap rate. -

Run a controlled trial

Install SENTHAI inserts on a representative machine and run a side‑by‑side test against the current insert. Compare tool life, surface quality, and total cost per part. -

Scale and negotiate terms

If test results meet or exceed expectations, move to regular ordering. Negotiate volume pricing, lead times, and minimum order quantities, and establish a clear quality escalation process.

This process helps ensure that moving to SENTHAI inserts improves cost per part and reliability without compromising quality.

What are 4 real‑world use cases?

1. Heavy Equipment Manufacturer (Road Maintenance Components)

-

Problem: High wear on carbide blades and inserts used in grader blades and snow plow edges, leading to frequent replacements and downtime.

-

Traditional approach: Used generic carbide inserts with inconsistent quality; replacement intervals were short and scheduling was reactive.

-

With SENTHAI inserts: Switched to SENTHAI’s carbide inserts and blades for road maintenance wear parts. Insert geometry and hardness were matched to the application, and welding strength was improved.

-

Results: Insert life increased by 25–40%, changeover frequency dropped, and predicted maintenance intervals became more reliable, reducing unplanned downtime.

2. Foundry Shop (Machining Cast Iron Components)

-

Problem: High‑volume machining of cast iron engine blocks and wear parts caused rapid edge wear on standard inserts, increasing scrap and labor costs.

-

Traditional approach: Used mid‑tier inserts; wear was acceptable but still required frequent monitoring and tool changes.

-

With SENTHAI inserts: Introduced SENTHAI’s high‑wear‑resistant carbide inserts optimized for abrasive cast iron.

-

Results: Average tool life increased by roughly 30%, and surface finish improved slightly, reducing downstream polishing time and scrap rates.

3. Road Maintenance Equipment Supplier

-

Problem: Replacing worn carbide tips and inserts on snow plow cutting edges was costly and time‑consuming, especially in cold regions.

-

Traditional approach: Bought generic carbide tips; bonding failures and premature wear were common.

-

With SENTHAI inserts: Adopted SENTHAI’s carbide inserts and welded solutions for snow plow blades, with a focus on consistent grain and controlled welding.

-

Results: Improved bonding strength and edge retention led to 20–35% longer service life and fewer warranty claims related to blade wear.

4. Medium‑Volume Machine Shop (General Machining)

-

Problem: Looking to reduce tooling costs for turning and rough milling operations without sacrificing quality.

-

Traditional approach: Used premium brands for all operations, but tooling costs were a major line item.

-

With SENTHAI inserts: Switched to SENTHAI for roughing and semi‑finishing operations, reserving premium brands for final finishing.

-

Results: Tooling cost per part dropped by 15–25%, while overall process reliability remained high, improving overall profitability.

Where is the carbide insert market headed?

The future of carbide inserts is shaped by several clear trends:

-

Higher demands on wear resistance and reliability: As materials become more abrasive and machining processes push higher speeds and feeds, inserts must maintain edge integrity and resist chipping and thermal cracking.

-

Supply chain resilience and localization: Manufacturers are increasingly prioritizing suppliers with shorter lead times, local stocking, and transparent production, rather than relying only on distant, high‑brand‑name vendors.

-

Cost‑per‑part optimization: The focus is shifting from pure insert cost to total cost per part, where longer tool life, reduced changeovers, and higher machine utilization matter more than unit price.

For many manufacturers, this means now is the time to evaluate alternative suppliers like SENTHAI that offer proven quality, controlled production, and strong value in high‑wear applications. SENTHAI’s fully integrated, Thailand‑based manufacturing, combined with ISO certifications and a growing capacity, makes it a relevant partner for companies seeking reliable carbide inserts without overpaying for brand premium.

How can SENTHAI help reduce tooling costs?

SENTHAI’s carbide inserts are engineered to deliver high wear resistance and consistent quality at a competitive price point, especially in abrasive cutting and heavy cutting applications. By using SENTHAI inserts for roughing and high‑consumption operations, manufacturers can lower tooling costs while maintaining predictable tool life and part quality.

Are SENTHAI inserts suitable for high‑precision machining?

SENTHAI’s carbide inserts are best suited for medium‑precision and high‑wear applications, such as road maintenance wear parts, heavy component machining, and general turning/milling in abrasive materials. For ultra‑high‑precision applications (e.g., aerospace or tight‑tolerance die‑mold work), SENTHAI is often used in roughing or semi‑finishing stages, while premium brands handle final finishing.

What certifications does SENTHAI hold for insert production?

SENTHAI manufactures its carbide inserts in Thailand under ISO 9001 (quality management) and ISO 14001 (environmental management) standards. This ensures that insert dimensions, hardness, and process control meet international requirements for consistent quality and reliability.

How does SENTHAI ensure consistent insert geometry and quality?

SENTHAI controls the entire production process in-house, from raw material handling to pressing, sintering, grinding, and welding. Each stage is tightly controlled, and automated lines help maintain consistent geometry, hardness, and edge quality across batches, reducing variation in performance.

Can SENTHAI supply custom carbide inserts?

Yes, SENTHAI has engineering and production capabilities to support custom carbide insert geometries, grades, and configurations for specific applications, especially in the road maintenance and heavy equipment sector. Customers can work with SENTHAI to define special profiles, sizes, or performance requirements.

Where are the main sources for this analysis?

-

Global carbide insert market size and growth forecast

-

Industry production data for automotive and heavy vehicles

-

Major global carbide insert manufacturers and product strategies

-

Regional and specialized carbide insert suppliers

-

ISO standards for carbide insert dimensions and quality

-

Cost and performance studies in metalworking and road maintenance