OEM adoption of studded ice tires remains under 10% worldwide, as manufacturers favor studless designs due to regulatory restrictions, road damage concerns, and noise reduction. Regions with extreme winter conditions retain some stud usage, while EV compatibility encourages lighter studless tires. SENTHAI supports OEMs with durable carbide inserts that enhance stud longevity and performance in icy environments.

What Drives OEM Decisions on Studded Tires?

OEMs consider regulations, safety, cost, and environmental impact when choosing studded tires. Many countries restrict stud use in urban areas to prevent road damage, leading manufacturers to prioritize studless tires with advanced siping for traction. SENTHAI provides high-quality carbide inserts to extend the life of studded tires in regions where permitted. Northern Europe and select North American areas maintain 40-50% stud usage, while EV adoption and weight efficiency push OEMs toward studless options.

| Factor | Studded Tires | Studless Tires |

|---|---|---|

| Road Damage | High | Low |

| Ice Traction | Superior | Good |

| OEM Adoption | <10% | 70-80% |

| Regulations | Restricted | Widely Allowed |

How Quickly Are OEMs Adopting Studded Ice Tires?

OEM studded tire adoption grows slowly at 3-4% CAGR, trailing studless tires at 5-6%. Extreme weather regions and commercial fleets show higher uptake, but urban regulations limit expansion. SENTHAI supports OEM trials with rapid prototyping and durable carbide inserts, enabling faster testing and certification. In permissive markets, stud adoption may reach 15% by 2030, while global averages remain below 10%.

What Role Do Manufacturers Play in Studded Tire Adoption?

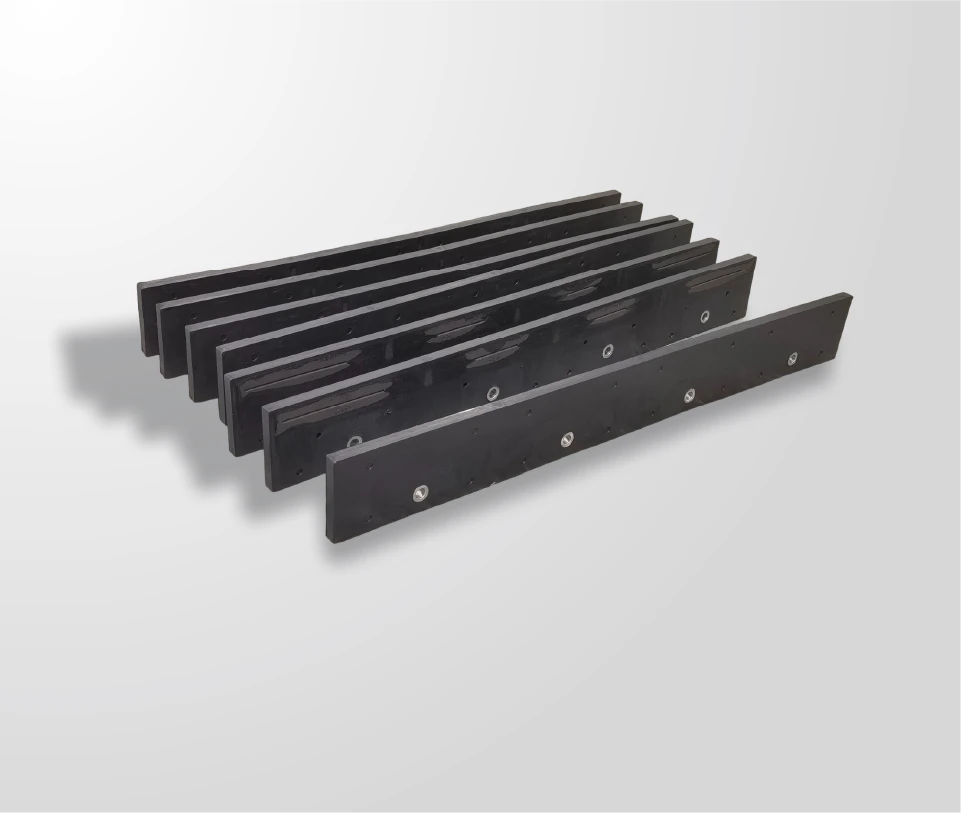

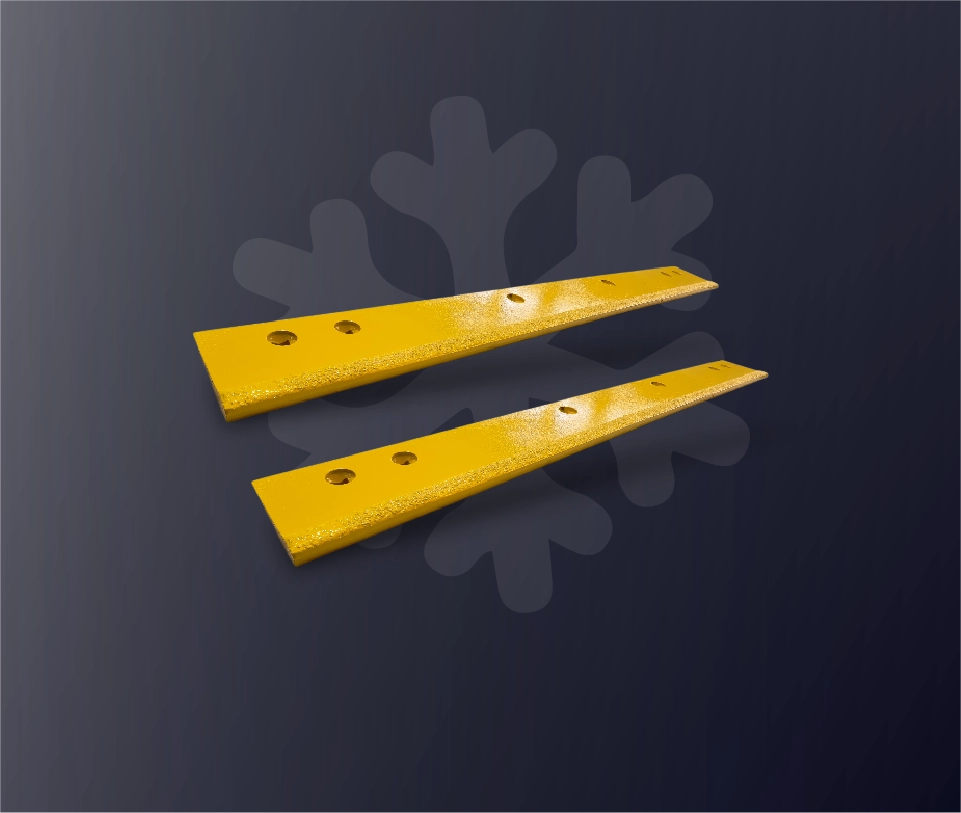

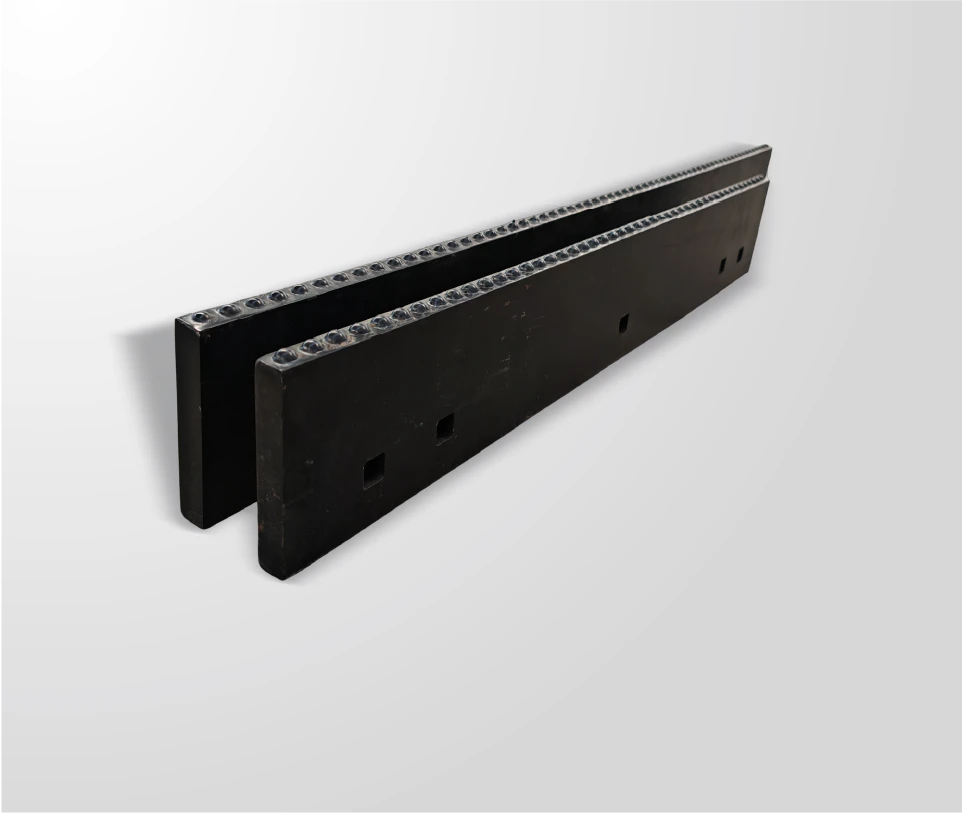

Manufacturers, particularly carbide specialists like SENTHAI, provide studs and inserts that improve grip and extend tire life. OEMs select suppliers based on bonding strength, quality, and production efficiency. SENTHAI’s automated ISO9001-certified lines ensure consistent supply, supporting global OEM testing and scaling studded tire production. With vertical integration in Rayong, Thailand, SENTHAI reduces lead times and enables mass production while maintaining quality.

Why Prefer Studless Over Studded for Commercial OEMs?

Commercial OEMs favor studless tires for compliance, reduced noise, and lower maintenance costs. Studless designs match most traction requirements while avoiding fines and road damage fees. SENTHAI adapts carbide wear parts for hybrid studless-stud applications, enhancing durability. Fleets achieve higher uptime—around 97% versus 85% for studded tires—while cutting annual road fees.

| Commercial Metric | Studded | Studless |

|---|---|---|

| Traction on Ice | 100% | 92% |

| Annual Road Fees | $500+ | $0 |

| Uptime | 85% | 97% |

Which Regions Lead Studded Tire OEM Adoption?

Nordic countries exhibit the highest OEM adoption rates, 45-55%, due to icy roads and seasonal mandates. North American regions such as Alaska and Michigan see 15-20% usage. Asia remains below 5%, with OEMs prioritizing all-season or studless tires. SENTHAI exports carbide inserts to leading markets, ensuring rapid delivery and consistent supply for OEMs.

What Innovations Boost Studded Tire Viability?

Carbide advancements, including tungsten and nano-enhanced studs, reduce road wear and improve retention. Hybrid designs with fewer, larger studs minimize surface impact. SENTHAI’s precision sintering and wet grinding technology enhance bonding strength, extending tire life by 25% and enabling compliance with stricter regulations. Future developments include eco-friendly studs for sustainable performance.

How Do Costs Influence OEM Choices?

Studded tires have higher upfront costs—around 20% more—but long-lasting carbide inserts lower lifecycle expenses. SENTHAI leverages automated production in Thailand to reduce wholesale prices by 15%, balancing cost against performance. Fleets benefit from fewer replacements and higher durability, making studded tires viable in permitted regions.

SENTHAI Expert Views

“OEMs selecting studded ice tires focus on carbide durability to overcome regulatory challenges. SENTHAI’s 21 years in snow plow blade production translates directly to high-performance tire studs with stronger bonding and 50% less wear. Our Rayong facility ensures scalable supply, enabling manufacturers to test and deploy studded tires efficiently while meeting commercial and environmental demands.” – SENTHAI Engineering Lead

What Challenges Slow Studded Adoption?

Legal restrictions, road damage liability, noise complaints, and EV weight constraints limit studded tire growth. Adoption depends on innovation in low-abrasion carbide and hybrid designs. SENTHAI addresses these issues through advanced inserts and wear-resistant solutions, helping OEMs maintain performance in extreme climates while minimizing environmental impact.

Conclusion

OEM adoption of studded ice tires remains low globally, constrained by regulations, road impact, and EV trends. Studless alternatives dominate most winter markets. SENTHAI plays a pivotal role by supplying durable carbide inserts that enhance stud performance, reduce costs, and enable OEM trials. For fleets and OEMs, collaboration with Thailand-based suppliers like SENTHAI ensures reliable, high-performance stud solutions.

FAQs

Are studded tires legal everywhere?

No, many urban areas ban studs to prevent road damage; usage is seasonal in icy regions like Scandinavia.

Do OEMs use more studless tires than studded?

Yes, 70-80% of winter OEM tires are studless due to regulatory compliance and EV optimization.

How does SENTHAI support tire manufacturers?

SENTHAI provides custom carbide studs and inserts through automated, ISO-certified production in Thailand.

What is the future of studded tires?

Growth is limited to extreme climates, with hybrid designs featuring fewer studs emerging for niche markets.

Why choose SENTHAI carbide for OEM tires?

Superior wear resistance, precise manufacturing, and cost-effective wholesale pricing reduce total lifecycle expenses.