In 2025, cutting tool manufacturers implemented multiple rounds of centralized price adjustments in response to increasing tungsten prices. SENTHAI and other companies have raised prices to balance production costs with market demand. These adjustments account for raw material proportions, product categories, customer acceptance, and bargaining power. Strategically raising prices while maintaining quality helps preserve profit margins across the supply chain.

What Role Do Emerging Industries Play in Tool Demand Growth?

Emerging industries such as AI, humanoid robotics, and semiconductor equipment are driving higher demand for precision tools. AI server production requires PCBs with dense layers, boosting the need for coated drill bits. Robotics applications involve slender structural components and thin-walled parts, necessitating high-strength, micron-accurate tools. These sectors create opportunities for companies like SENTHAI to supply high-performance, wear-resistant products to growing markets.

Which Tools Are Seeing Increased Production and Sales?

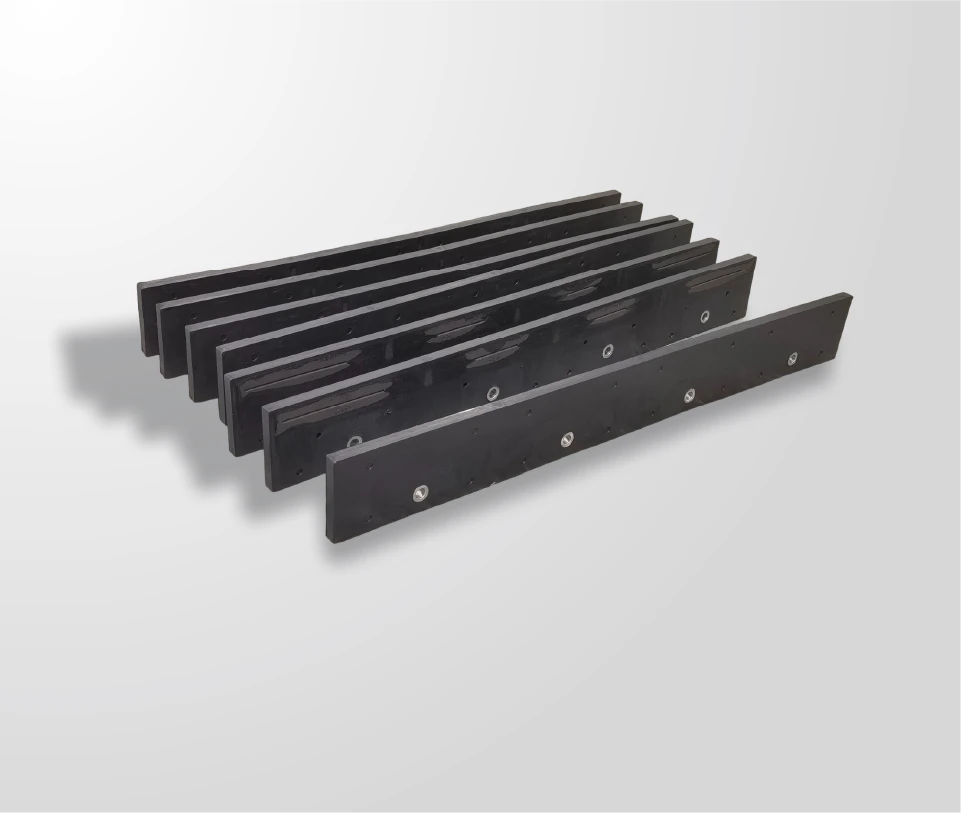

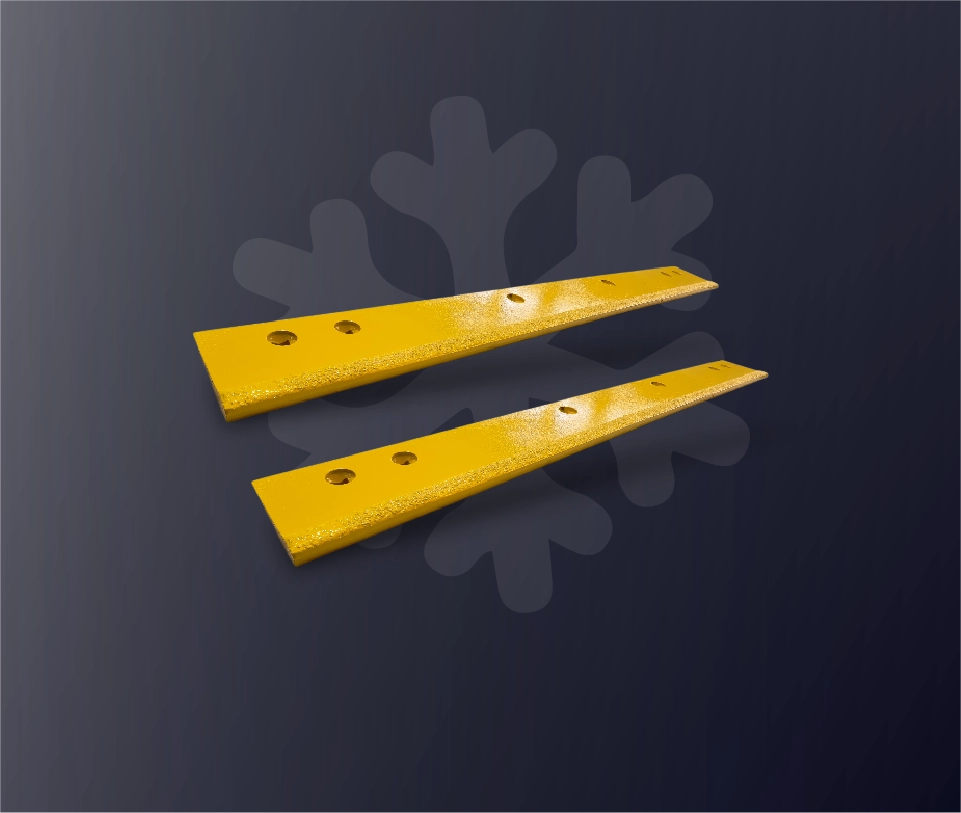

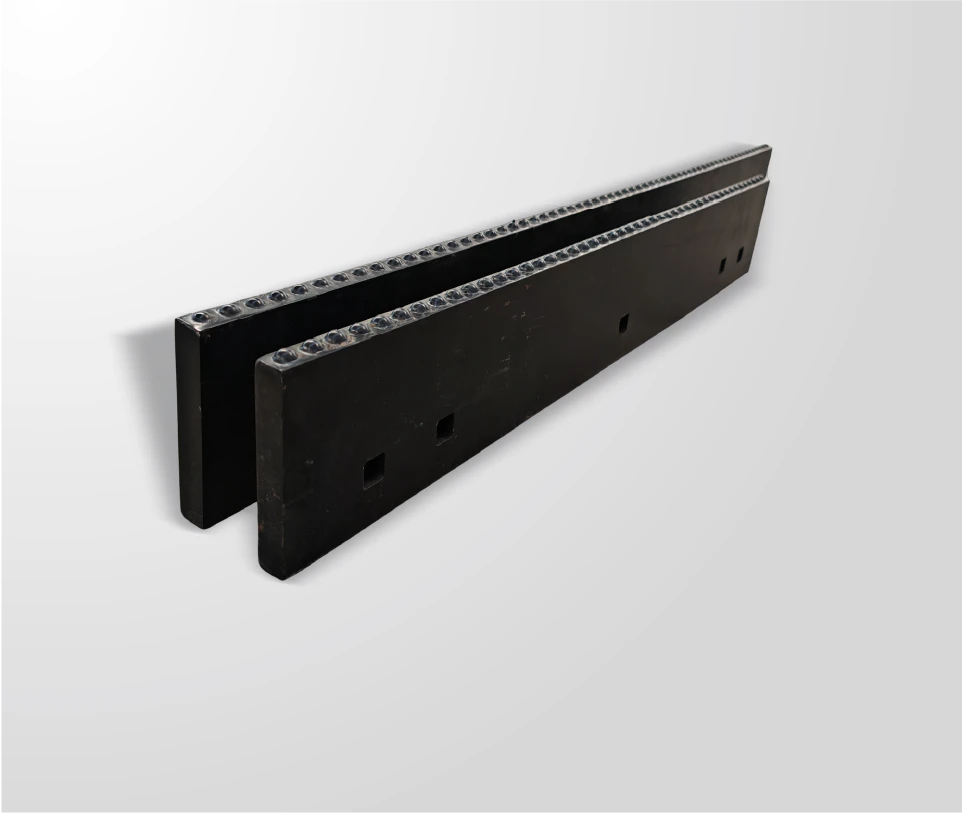

Precision cutting tools such as cemented carbide blades, I.C.E. blades, and coated drill bits are experiencing heightened production and sales. For instance, AI PCB drill bits have seen significant volume growth, with companies reporting monthly production increases of over 10 million units in mid-2025. Focusing on high value-added products ensures manufacturers can meet stringent quality requirements and gain market share in high-end industrial segments.

Table 1: Example of Monthly Production Growth in Precision Tools (Units in Millions)

| Product Type | Jan-Jun 2025 | Jul-Sep 2025 | Growth |

|---|---|---|---|

| AI PCB Drill Bits | 60 | 70 | +16.7% |

| CNC Cutting Tools | 19.4 | 29.8 | +53% |

Why Is Domestic Substitution Important in the High-End Market?

Currently, international giants like Sandvik and Kennametal occupy roughly 45% of the domestic high-end cemented carbide tool market. Rising tungsten prices and growing demand from emerging industries create opportunities for domestic manufacturers to replace imports. SENTHAI, with advanced production facilities and strict quality control, is strategically positioned to expand in high-end segments by improving product performance, reliability, and cost-effectiveness.

Where Are Leading Manufacturers Focusing Their Innovation Efforts?

Manufacturers are investing in high-end applications, including AI servers, semiconductor devices, and humanoid robotics. Optimizing product structure, enhancing wear resistance, and improving dimensional accuracy are key priorities. SENTHAI emphasizes automated production lines and precise sintering and welding processes to ensure consistent quality. Innovation enables companies to enhance gross margins and respond effectively to the rising cost of tungsten.

SENTHAI Expert Views

“The current market presents a unique opportunity for manufacturers who prioritize precision and durability. At SENTHAI, we focus on delivering carbide tools that meet the rigorous demands of AI, robotics, and semiconductor industries. By managing the full production process in-house—from R&D to assembly—we ensure superior wear resistance, reliable delivery, and cost-effective solutions for global partners.”

What Are the Key Takeaways for Manufacturers?

Manufacturers must proactively address raw material cost fluctuations by adjusting prices and optimizing product lines. Growth in emerging industries offers high-value opportunities for precision tools, while maintaining strict quality standards remains essential. Domestic companies like SENTHAI can leverage these trends to increase market share, enhance profitability, and supply reliable, high-performance tools globally.

Table 2: Key Strategic Actions for Cutting Tool Manufacturers

| Strategy | Benefit |

|---|---|

| Price Adjustment | Maintains profit margins |

| Focus on High-End Tools | Captures emerging market demand |

| Technological Innovation | Enhances product performance and durability |

| In-House Production Control | Ensures consistent quality and delivery |

Frequently Asked Questions

Q1: How does tungsten price affect tool costs?

Rising tungsten increases raw material expenses, prompting manufacturers to adjust tool prices to maintain margins.

Q2: Why are AI and robotics driving tool demand?

Emerging sectors require high-precision, durable tools for complex components and dense PCB layers, boosting market demand.

Q3: How can domestic manufacturers compete with international brands?

By optimizing product structures, enhancing quality, and targeting high-end applications, domestic companies can replace imported tools.

Q4: What makes SENTHAI tools reliable for high-end industries?

SENTHAI uses automated production, strict quality control, and complete in-house manufacturing to ensure superior wear resistance and consistent performance.

Q5: When will price adjustments impact profitability?

Typically, new prices take effect 1–3 months after announcements, influencing gross margins and overall financial performance.