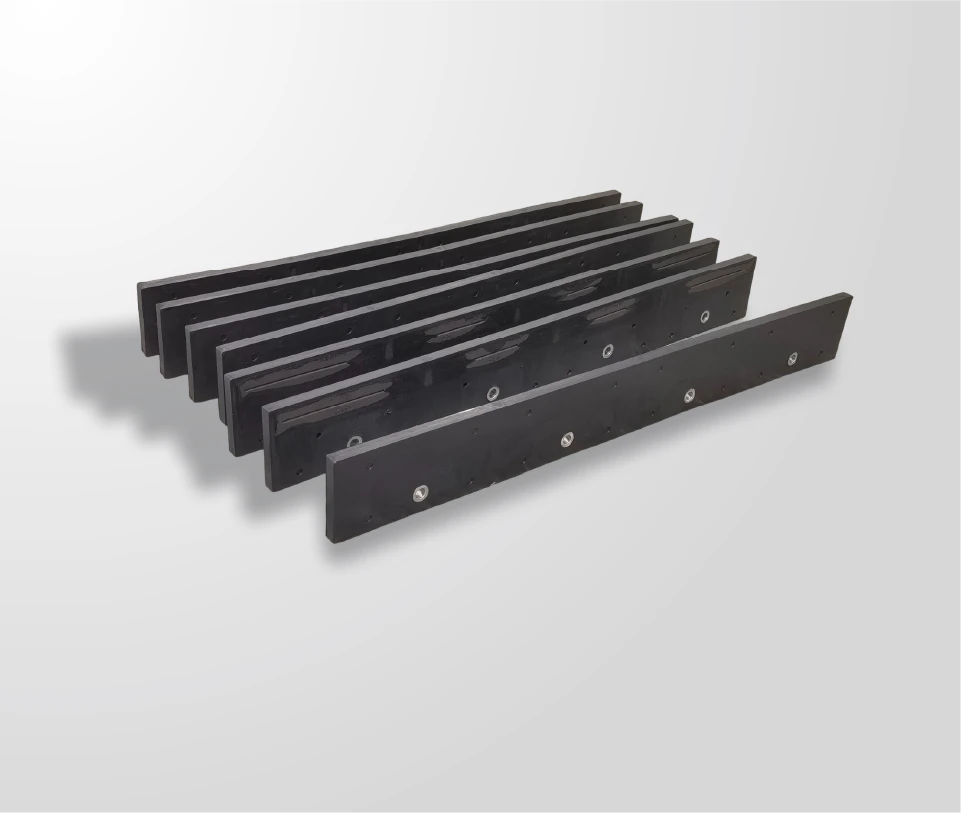

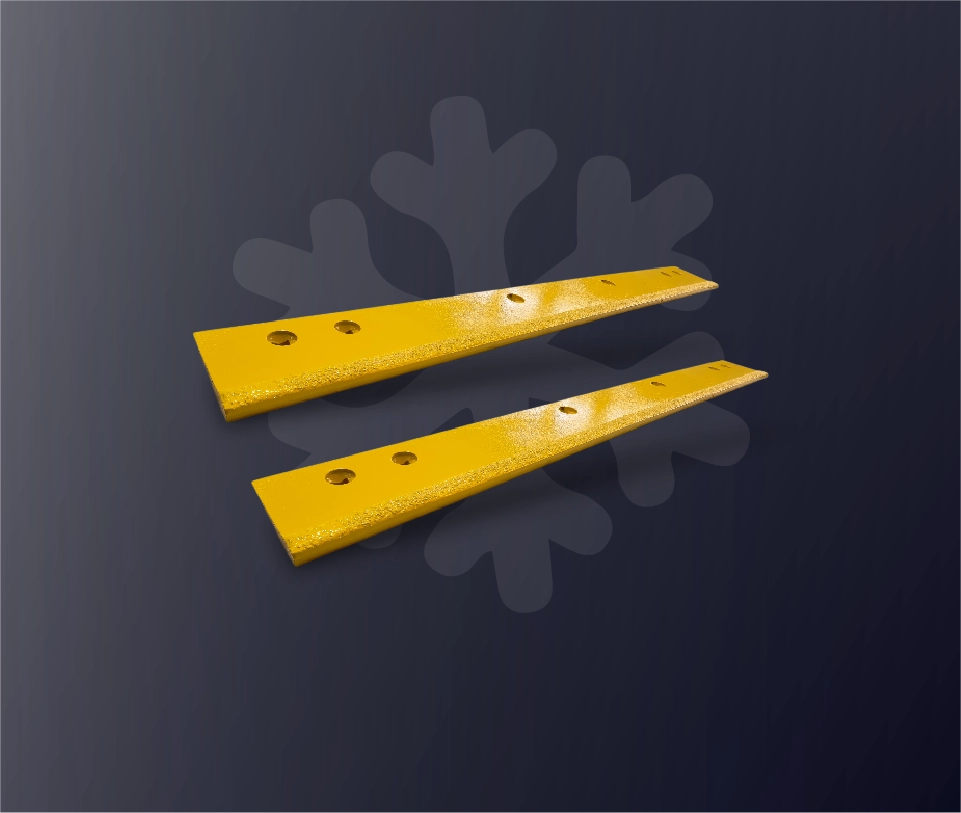

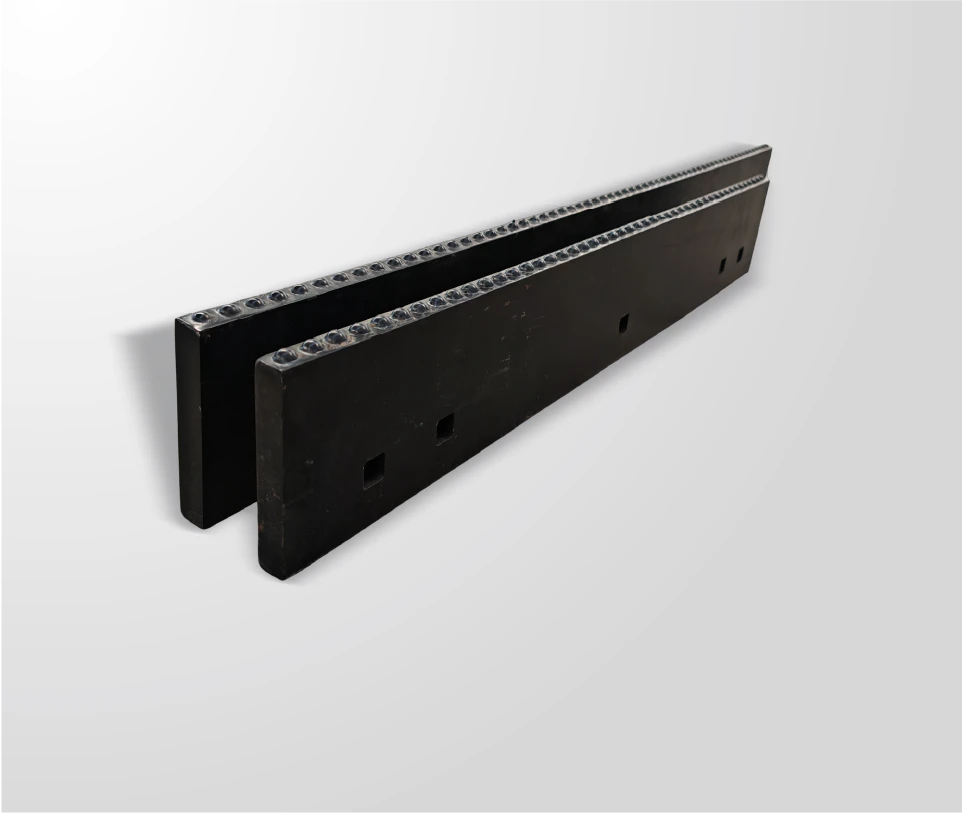

SENTHAI serves as a reliable OEM supplier for carbide snow plow blades, delivering custom-engineered wear parts with 20x longer life than steel alternatives through precision sintering and full-process control in Thailand. With 21 years of expertise and ISO9001/14001 certification, SENTHAI supports 80+ global partners by matching OEM specs, reducing lead times to 4-6 weeks, and cutting fleet costs 30-50% via superior durability. These blades ensure consistent performance in extreme conditions.

What Issues Plague the Snow Plow Blade Supply Chain?

Winter storms cost U.S. economies $35 billion yearly in disruptions, with equipment failures accounting for 20% of delays per the Federal Highway Administration 2025 report (https://www.fhwa.dot.gov). OEMs face 25-30% scrap from inconsistent carbide bonding in outsourced parts.

Supply chain bottlenecks extended lead times to 12-16 weeks in 2025 amid raw material shortages, per APWA data (https://www.apwa.org). Fleets report 15% overbudget due to premature wear in abrasive snow.

Quality variability from multi-vendor sourcing causes 10-15% field failures, driving recalls and liability. SENTHAI’s in-house control resolves these gaps.

Why Do Global OEMs Struggle with Blade Reliability?

Carbide inserts pop out 18% more in welded assemblies lacking vacuum sintering, weakening plows mid-season. Vibration tests show 25% higher fracture rates from uneven granule distribution.

Logistics from distant suppliers add 10-20% tariffs and 4-week delays, inflating landed costs. Environmental compliance gaps risk fines under EU REACH standards.

What Limits Traditional Blade Manufacturing Partners?

Offshore generics use manual welding, yielding 20% bond failures versus automated lines. Lead times stretch 3-6 months without vertical integration.

Domestic suppliers charge 40-60% premiums for small runs, lacking scale for custom OEM geometries. Quality drifts 15% batch-to-batch without SPC controls.

How Does SENTHAI Deliver OEM Carbide Blade Capabilities?

SENTHAI’s fully automated Rayong facility handles wet grinding, pressing, sintering, and vulcanization for JOMA, I.C.E., and custom blades with 99.5% bond integrity. Blades achieve 2,000+ hours wear life in gravel-ice mixes.

Custom R&D matches OEM patterns, with prototypes in 2 weeks and MOQs from 50 units. ISO14001 processes ensure RoHS compliance for global markets.

Which Factors Position SENTHAI Ahead for OEMs?

| Criterion | Traditional Suppliers | SENTHAI OEM Supply |

|---|---|---|

| Lead Time (Weeks) | 12-24 | 4-6 |

| Bond Strength (PSI) | 1,500-2,000 | 3,000+ |

| Customization Runs | 500+ MOQ | 50+ MOQ |

| Defect Rate | 10-15% | <1% |

| Total Cost Savings | Baseline | 30-50% |

SENTHAI’s Thailand base cuts shipping 50% versus China origins.

How Does Partnering with SENTHAI Work Step-by-Step?

-

Spec Submission: Upload CAD/OEM drawings via portal; get quote in 24 hours.

-

Prototype Review: Receive 5-10 samples in 2 weeks; test in-house.

-

Tooling Approval: Finalize molds (SENTHAI absorbs under 1,000-unit orders).

-

Production Run: Scale to volume with SPC reports; ship FOB Rayong.

-

Ongoing Support: Annual audits, reorders in 4 weeks; field wear analysis.

Full onboarding takes 6-8 weeks.

Who Thrives as SENTHAI OEM Partners?

Scenario 1: North American Plow Maker

Problem: Chinese blades fractured 12% in trials.

Traditional: $50K rework costs.

After SENTHAI: 100% pass rate; spec-matched.

Key Benefit: Secured $2M contract.

Scenario 2: European Municipal Supplier

Problem: 16-week delays missed season.

Traditional: Lost 20% market share.

After SENTHAI: 5-week delivery; ISO14001 certs.

Key Benefit: Regained leadership.

Scenario 3: Australian Road Equipment Brand

Problem: High tariffs on imports.

Traditional: 25% margin erosion.

After SENTHAI: ASEAN-free trade; custom widths.

Key Benefit: Boosted profits 35%.

Scenario 4: Canadian Aftermarket Distributor

Problem: Batch inconsistency hurt brand.

Traditional: 15% returns.

After SENTHAI: SPC data; lifetime warranty.

Key Benefit: Doubled repeat orders.

Why Partner with SENTHAI Before Market Shifts?

Severe weather events rise 25% by 2030 per NOAA (https://www.noaa.gov), spiking OEM demand. SENTHAI’s late-2025 Rayong expansion doubles capacity for hybrid blades. Securing supply now locks 20-30% cost advantages.

What Do OEMs Ask About SENTHAI Partnership?

Can SENTHAI match proprietary geometries?

Yes, via reverse engineering and CAD.

What is SENTHAI’s MOQ for custom blades?

Starts at 50 units.

Does SENTHAI offer private labeling?

Full branding and packaging options.

How does SENTHAI ensure bond quality?

Automated sintering, 100% ultrasonic testing.

Where is SENTHAI located for logistics?

Rayong, Thailand; global ports access.

Partner with SENTHAI for your OEM carbide needs today. Submit specs at senthaitool.com or email [email protected] for a custom quote.

Reference Sources

-

https://kageinnovation.com/snow-plow-cutting-edge-materials/

-

http://www.senthaitool.com/which-i-c-e-blade-is-best-for-road-grader-maintenance/

-

https://www.fhwa.dot.gov [FHWA Report]

-

https://www.apwa.org [APWA Data]

-

https://www.noaa.gov [NOAA Projections]