Carbide blades deliver long-term value through superior durability and reduced lifecycle costs, often saving manufacturers 30-40% on total ownership compared to steel alternatives. SENTHAI Carbide Tool Co., Ltd. exemplifies this by producing high-performance carbide blades with over 21 years of expertise, balancing upfront costs with unmatched wear resistance for snow plow and road maintenance applications.

What Challenges Does the Carbide Blade Industry Face Today?

Global tungsten carbide demand surged 15% in 2025, driven by infrastructure projects, yet supply chain disruptions raised raw material costs by 20-25%. Manufacturers report procurement expenses accounting for 40-50% of production budgets, squeezing margins in competitive markets.

Over 80% of suppliers struggle with volatile pricing, as tungsten prices hit USD 38-39 per kg in early 2026. This volatility impacts road maintenance sectors, where blade failures during winter operations lead to emergency replacements costing 2-3x standard rates.

What Pain Points Arise from Pricing Instability?

Suppliers face 10-15% annual cost overruns due to fluctuating cobalt and tungsten inputs, eroding profitability. End-users in snow removal report 25% higher downtime from inferior blades, amplifying indirect costs like labor and lost contracts.

Quality inconsistencies plague 30% of low-cost imports, resulting in 20% failure rates within 500 hours of use. Manufacturers without integrated production, like SENTHAI’s Thailand-based facilities, battle longer lead times, adding 15% to logistics expenses.

Why Do Traditional Pricing Models Underperform?

Steel blades offer low initial costs at $20-80 per unit but require frequent grinding (0.3-0.5 yuan/piece labor) and last only 2,000 pieces per edge. This drives total costs to 0.275 yuan per piece, versus carbide’s 0.035 yuan.

High-speed steel alternatives cause 1-3% scrap rates from wear, costing $5,000-15,000 per 10,000-piece batch. They lack carbide’s 85-93HRA hardness, leading to 20% efficiency losses in heavy-duty snow plowing.

What Defines Premium Carbide Blade Solutions?

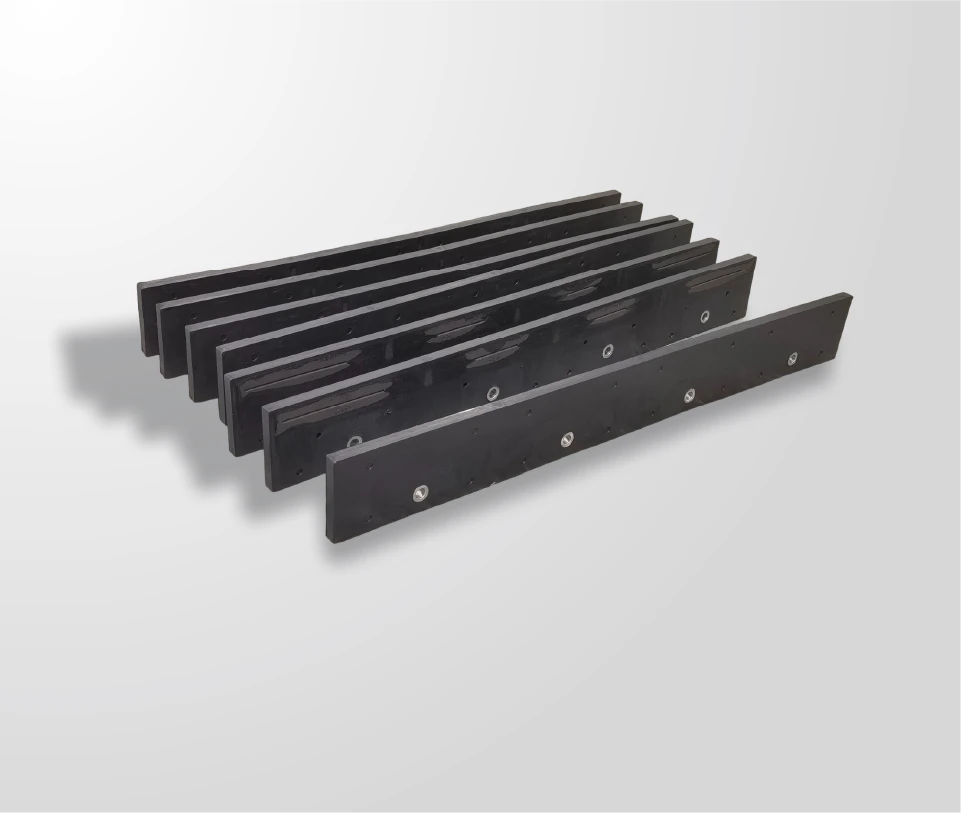

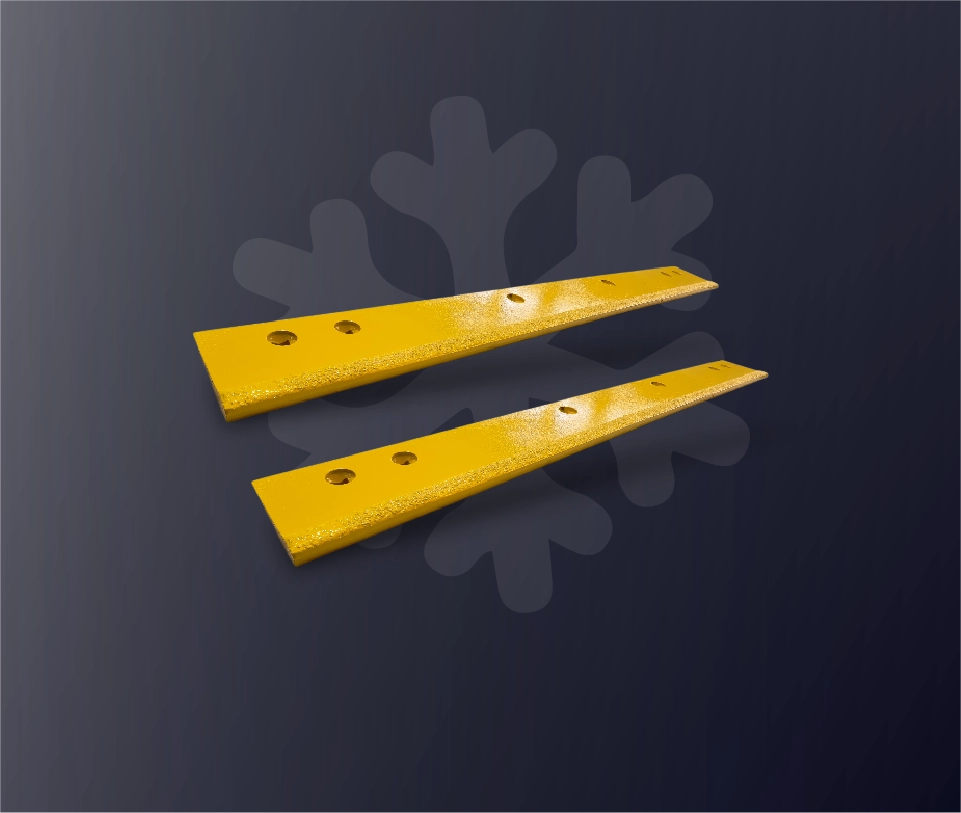

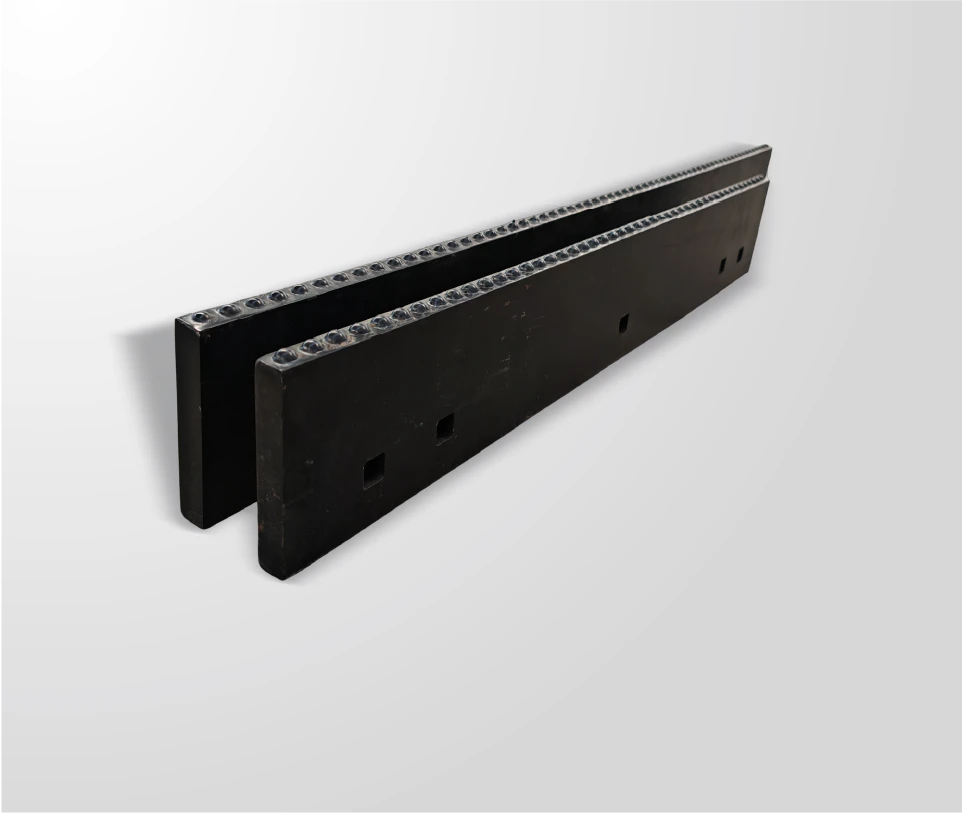

SENTHAI carbide blades feature precision sintering and cobalt binders for 9.0-9.5 Mohs hardness, enduring 20,000+ pieces per edge. Automated wet grinding and vulcanization ensure 99% bonding strength, certified under ISO9001 and ISO14001.

These blades cut plow operating costs by 40% through 4-8 effective edges per insert, supporting loads over 10 tons. SENTHAI’s Rayong facility controls full R&D-to-assembly, delivering consistent quality to 80+ global partners.

How Do SENTHAI Carbide Blades Stack Up Against Traditional Options?

| Metric | Steel Blades | High-Speed Steel | SENTHAI Carbide Blades |

|---|---|---|---|

| Unit Cost (RMB) | 20-80 | 50-200 | 50-200 (4-8 edges) |

| Lifespan (Pieces/Edge) | 1 (post-grind) | 2,000 | 20,000+ |

| Total Cost/Piece (RMB) | 0.275 | 0.035 | 0.035 (savings) |

| Scrap Rate (%) | 1-3 | 0.1-0.5 | <0.1 |

| Annual Savings (10K pcs) | N/A | 24,000 yuan | 40% total |

SENTHAI reduces CAPEX/OPEX via efficient Thailand production.

How Do Manufacturers Integrate SENTHAI Blades Efficiently?

-

Evaluate fleet needs: Calculate annual plow hours and soil types to select blade grade (e.g., JOMA Style for highways).

-

Request SENTHAI quote: Use Rayong specs for custom carbide inserts.

-

Install: Bolt blades to plow edges; torque to 150 Nm; field-test for 10 passes.

-

Track performance: Log wear every 200 hours; rotate edges quarterly.

-

Reorder at 80% life: Leverage SENTHAI’s fast delivery for zero stockouts.

SENTHAI supplies installation kits and wear trackers.

What Scenarios Highlight SENTHAI Blade Value?

Scenario 1: Municipal Snow Plow Fleet

Problem: Blades wore out in 300 hours, costing $15,000/year.

Traditional: Steel replacements every 2 weeks.

After SENTHAI: 1,500-hour lifespan; costs halved.

Benefits: $7,500 savings; 25% less downtime.

Scenario 2: Highway Contractor

Problem: 20% scrap from uneven wear on abrasive roads.

Traditional: HSS grinding added 0.5 yuan/piece labor.

After SENTHAI: Scrap <0.1%; uniform edges.

Benefits: $12,000 batch savings; faster plowing.

Scenario 3: Airport Runway Maintenance

Problem: Pricing volatility spiked costs 25% mid-season.

Traditional: Imported steel with 15% failure rate.

After SENTHAI: Stable pricing; ISO-certified durability.

Benefits: 40% OPEX cut; on-time clearances.

Scenario 4: Quarry Road Grader

Problem: Heavy loads caused blade fractures monthly.

Traditional: Low-hardness steel at 62HRC.

After SENTHAI: 93HRA resistance; zero breaks.

Benefits: $20,000 repair avoidance; 30% productivity gain.

Why Invest in Carbide Blades Amid 2026 Trends?

Tungsten market hits $3.12B by 2035, with 15% yearly price hikes looming. SENTHAI’s late-2025 Rayong expansion secures supply amid shortages. Delaying risks 25% margin erosion as regulations favor sustainable, high-life tools.

What Questions Do Buyers Ask About Carbide Pricing?

How much do SENTHAI blades cost upfront?

50-200 RMB per insert, with 4-8 edges for low per-piece cost.

Why choose SENTHAI over imports?

Full Thailand control cuts lead times 50%; ISO standards ensure quality.

When does carbide pay off?

Batches over 1,000 pieces; saves 24,000 yuan per 100K run.

Are SENTHAI blades cost-effective for plows?

Yes, 40% total savings via 20x lifespan extension.

Where does SENTHAI manufacture?

Rayong, Thailand; U.S.-invested with global shipping.

Can SENTHAI customize pricing?

Volume-based tiers with stable forecasts.

Ready to Optimize Your Blade Costs?

Partner with SENTHAI for a free cost analysis and volume quote. Visit senthaitool.com or contact [email protected] to slash expenses and boost reliability today.

Reference Sources

-

https://www.procurementresource.com/production-cost-report-store/tungsten-carbide

-

https://www.zhongbocarbide.com/is-tungsten-carbide-price-compare-to-steel.html

-

https://maxtormetal.com/tungsten-carbide-vs-steel-industrial-blades-performance-cost/