Regional demand is fueled by prolonged ice coverage, commercial operations, and the need for safe winter driving. Fleets in trucking, snow plowing, and logistics prioritize carbide studs for reliability, reducing downtime and accidents. SENTHAI supports this demand with high-wear-resistant tungsten carbide studs, tailored for OEM snow removal vehicles. Growth is projected at a 4.2% CAGR through 2033, particularly where extreme winter conditions prevail. Factories optimize bonding strength and scale production to meet B2B requirements while navigating regional regulations.

Which Regions Show Highest Commercial Demand?

Northern North America and Nordic Europe dominate, representing 70% of global commercial demand. Canada and northern U.S. states lead due to harsh winters, while Norway, Sweden, and Finland follow for fleet reliability. SENTHAI supplies OEM factories with carbide inserts tailored for these zones, supporting wholesale stockpiling before winter.

| Region | Key Demand Drivers | Commercial Share | Growth Projection |

|---|---|---|---|

| Canada | Ice storms, trucking fleets | 35% | 5% CAGR |

| Nordic Countries | Prolonged snow, public works | 25% | Steady |

| Northern U.S. | Highway maintenance | 20% | Rising |

| Russia/Eastern Europe | Harsh terrains | 15% | Emerging |

Asia Pacific sees growth potential, but commercial adoption lags due to stud restrictions, prompting suppliers to explore studless alternatives where needed.

How Do Commercial Fleets Influence Carbide Stud Demand?

Commercial fleets account for 60% of demand, requiring uninterrupted winter operations. Tungsten carbide studs enhance ice grip, reduce accident risk, and extend tire life for high-mileage vehicles. OEM manufacturers integrate SENTHAI carbide studs to ensure consistent wear resistance, while wholesale buyers benefit from bulk orders and custom alloy options. Seasonal preparation drives peak demand, and forecasting fleet expansions enables B2B partners to maintain supply chain stability.

What Role Does Tungsten Carbide Play in Ice Tire Demand?

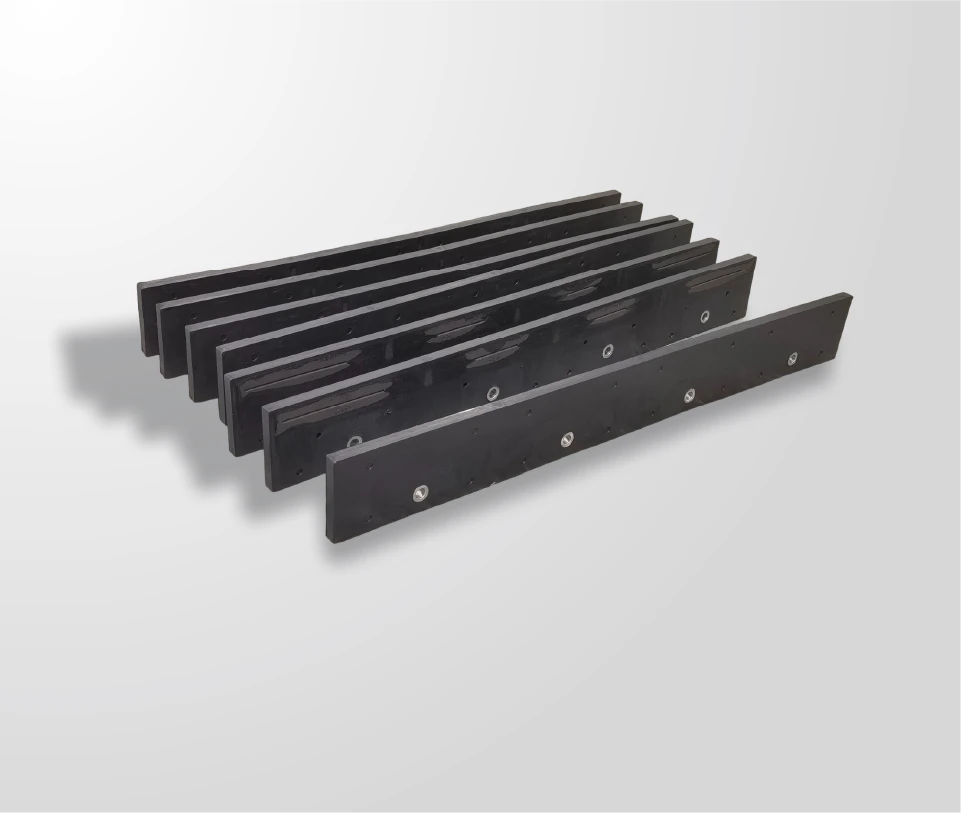

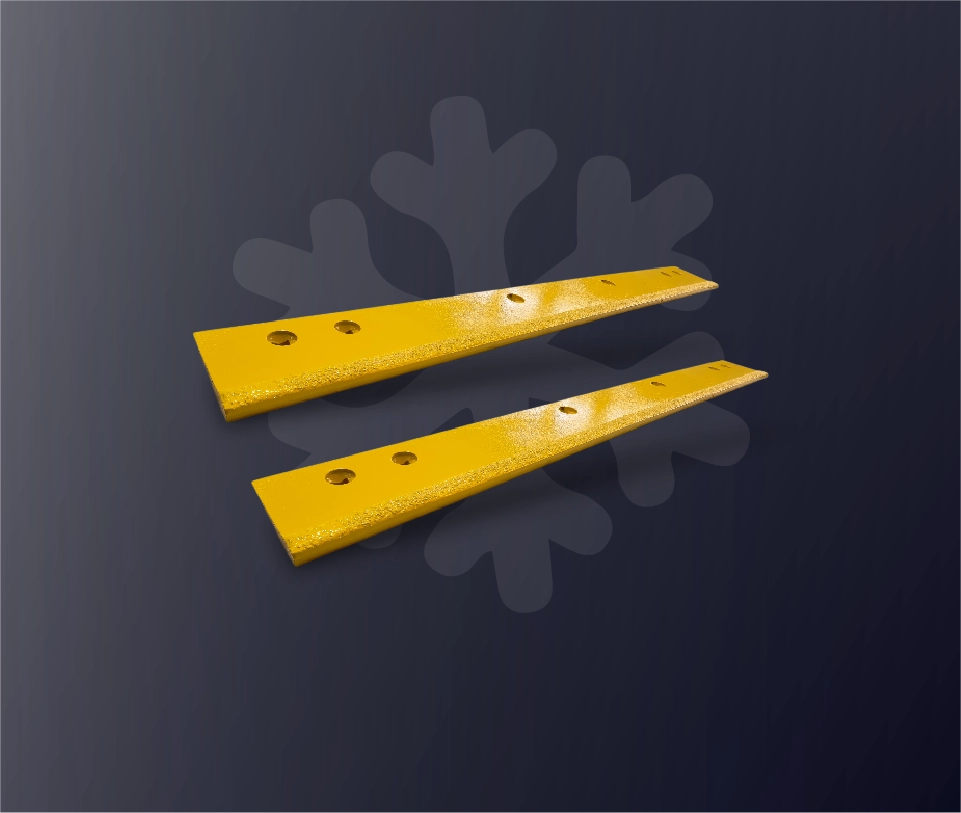

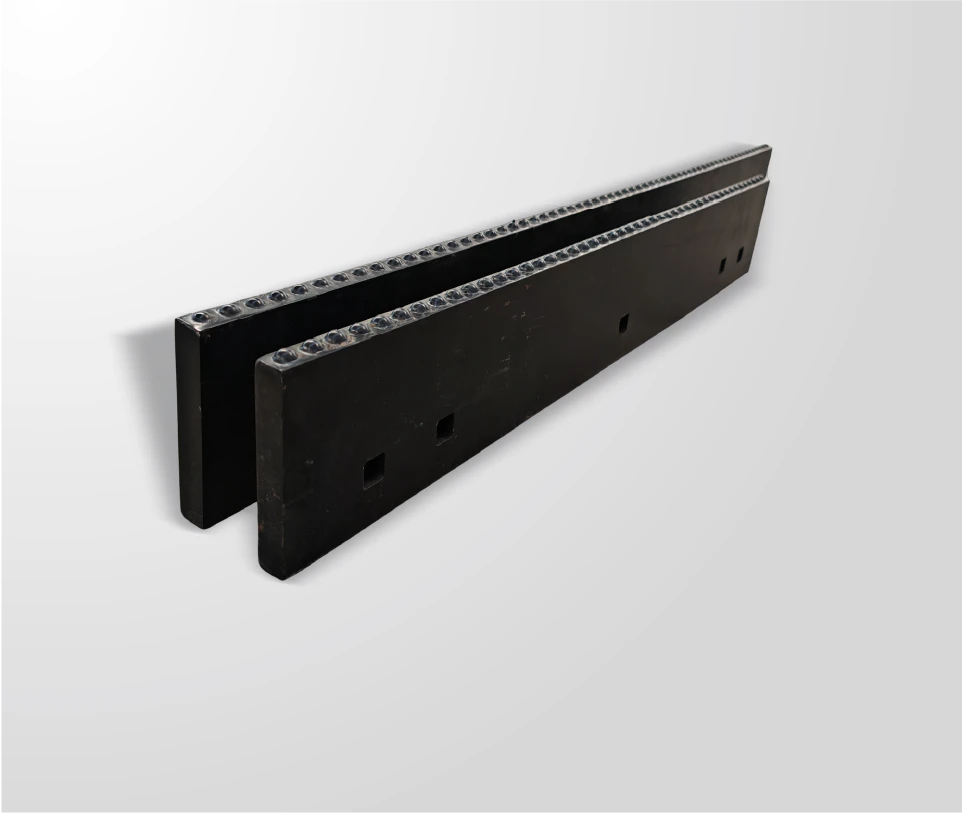

Tungsten carbide provides superior hardness and longevity compared with steel, offering better traction on ice and resistance to commercial wear. SENTHAI manufactures carbide inserts with precision wet grinding, sintering, and vulcanization processes to meet OEM standards. Adoption grows as manufacturers invest in alloy technology to meet Nordic and Canadian specifications, driving regional growth of 4–5%.

Why Are Regulations Shaping Carbide Studded Tire Markets?

Regulations influence market access and demand. Nordic countries often mandate studs for safety, while Canada and U.S. states allow seasonal use, supporting commercial uptake. In milder climates, bans limit stud use, prompting alternative tire solutions. SENTHAI develops low-wear carbide studs compliant with regional laws, enabling B2B partners to expand their market presence safely and sustainably.

How Can Manufacturers Tailor Strategies to Rising Demand?

Manufacturers should scale production in peak seasons, partner with OEMs for custom studs, and use predictive analytics for demand forecasting. SENTHAI leverages Thailand-based manufacturing to efficiently produce high-quality carbide studs.

-

Bulk supply to Nordic fleets before winter

-

Customize inserts for U.S. trucking tires

-

Invest in sintering technology for durability

-

Offer B2B solutions for volume orders

Monitoring weather trends and local regulations ensures proactive scaling and optimized margins.

SENTHAI Expert Views

“Rising demand for carbide studded ice tires highlights the need for reliable winter performance. At SENTHAI Carbide Tool Co., Ltd., our 21+ years of expertise in carbide wear parts allow us to supply OEM factories with tungsten carbide inserts optimized for ice traction. Automated lines in Rayong ensure superior bonding and wear resistance. Our ISO-certified processes provide B2B partners with cost-effective, high-quality solutions, particularly for Nordic and Canadian fleets, which account for the majority of commercial demand.”

— SENTHAI Engineering Director

Which Emerging Markets Offer Growth for Suppliers?

Emerging opportunities exist in Asia Pacific and Eastern Europe, with 3–4% CAGR driven by growing fleets and infrastructure. SENTHAI positions as an OEM supplier with scalable production, entering new markets through pilot contracts and flexible B2B agreements. Safety awareness and fleet expansion accelerate commercial adoption in these regions.

| Market | Challenges | Opportunities |

|---|---|---|

| Asia Pacific | Regulations | Urban fleets |

| Eastern Europe | Costs | Infrastructure expansion |

Why Partner with Carbide Factories Like SENTHAI?

SENTHAI provides reliable B2B supply with full control from R&D to assembly, ensuring consistent quality for studded ice tires. ISO-certified manufacturing, in-house production, and over 21 years of experience make SENTHAI a trusted partner for OEM and commercial applications.

Conclusion

Carbide studded ice tire demand is strongest in cold, regulated regions such as Canada and Nordic countries. Commercial fleets drive growth, emphasizing durability, safety, and consistent performance. Tungsten carbide is key to superior traction and wear resistance. Partnering with SENTHAI ensures reliable OEM customization, scalable B2B supply, and compliance with local regulations—critical strategies for success in winter tire markets.

FAQs

What makes carbide studs ideal for commercial ice tires?

Tungsten carbide provides superior ice traction and durability, essential for fleet safety and performance. SENTHAI studs excel in wear resistance for heavy-duty use.

Which region has the fastest demand growth?

Canada leads due to severe winters, with a projected 5% CAGR in commercial tire applications.

How do regulations affect studded tire markets?

Permissive regulations drive demand, while bans in mild regions limit market size, focusing adoption in compliant zones.

Can SENTHAI customize studs for OEM requirements?

Yes, SENTHAI tailors carbide inserts to specific tire and regional specifications from their Thailand facilities.

When does commercial demand peak?

Peak demand occurs in fall, as fleets place bulk orders for pre-winter deployment.