Carbide insert scrap prices are mainly influenced by tungsten content, metal market conditions, purity, and buyer demand. Clean, high-grade material earns higher returns, especially when sold in batches. Manufacturers can improve value by sorting scrap at the source. SENTHAI recommends working with qualified recyclers to ensure accurate grading, stable pricing, and reliable material recovery.

How Is Carbide Insert Scrap Price Determined?

Carbide insert scrap pricing is driven by tungsten percentage, cleanliness, and current market rates. Buyers assess the usable tungsten content and the cost associated with cleaning or processing contaminated material. Transportation, moisture levels, and mixed grades also affect final valuation. Large, sorted batches from factories typically secure more competitive offers.

| Key Factor | Impact on Value |

|---|---|

| Tungsten percentage | Strongly increases return |

| Cleanliness | Reduces processing costs and raises bids |

| Market demand | Adjusts price based on global tungsten trends |

| Batch size | Larger quantities earn premium rates |

| Contamination level | Mixed or brazed pieces lower recovered value |

SENTHAI encourages factories to maintain consistent scrap classification to maximize recovery efficiency.

What Is the Current Average Price of Carbide Insert Scrap?

Typical carbide insert scrap pricing ranges between 12–18 USD per pound, depending on grade and market conditions. Clean, homogeneous inserts sourced from controlled production environments often receive higher offers. Regional variations may occur due to logistics, refining capacity, and buyer competition. SENTHAI regularly reviews market patterns to guide partners toward the best selling periods.

The average price of carbide insert scrap typically falls between 12 to 18 USD per pound, but it can vary based on factors like the material’s grade and current market conditions. Clean, homogeneous inserts from well-managed production environments tend to fetch higher prices because they require less processing. Regional differences in pricing also exist, influenced by local logistics, refining capacity, and competition among buyers.

SENTHAI actively monitors these market trends to help its partners choose the most opportune times to sell their scrap. By staying informed, SENTHAI helps ensure that companies can maximize the value of their carbide insert scrap and optimize their returns.

Why Do Carbide Scrap Prices Fluctuate?

Prices shift due to changes in global tungsten mining output, industrial demand, and energy costs. When raw tungsten prices increase, recyclers raise their bids to secure feedstock. Geopolitical factors and supply chain disruptions also influence volatility. Manufacturers can protect margins by monitoring commodity indexes and planning periodic bulk sales.

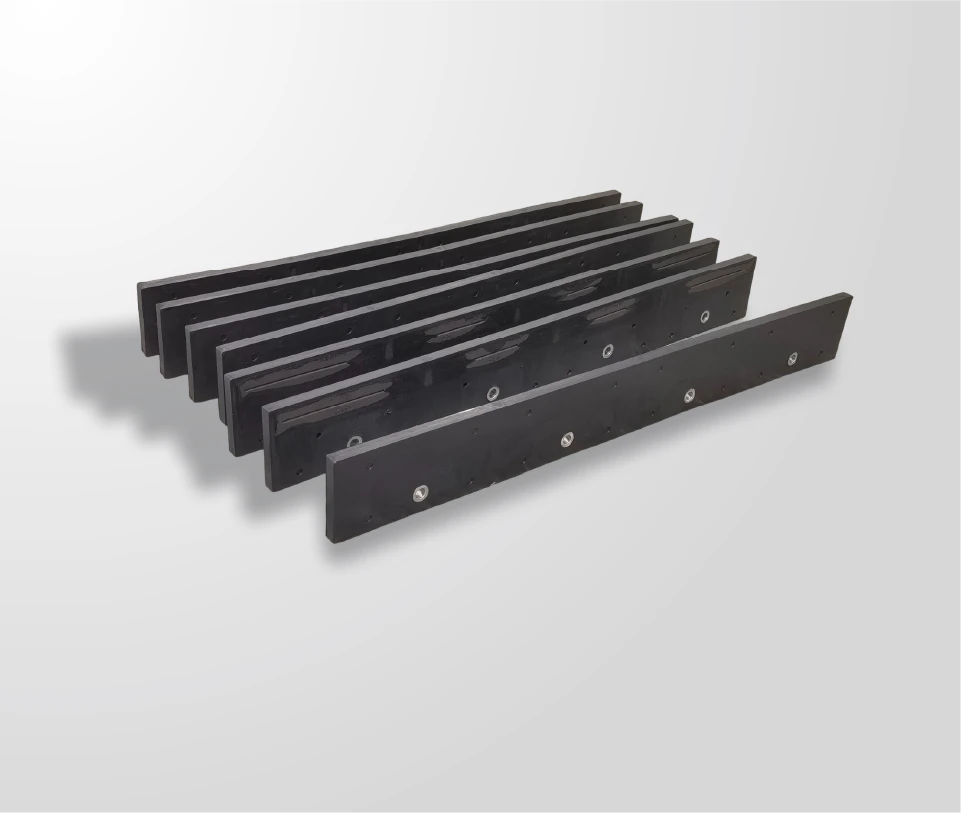

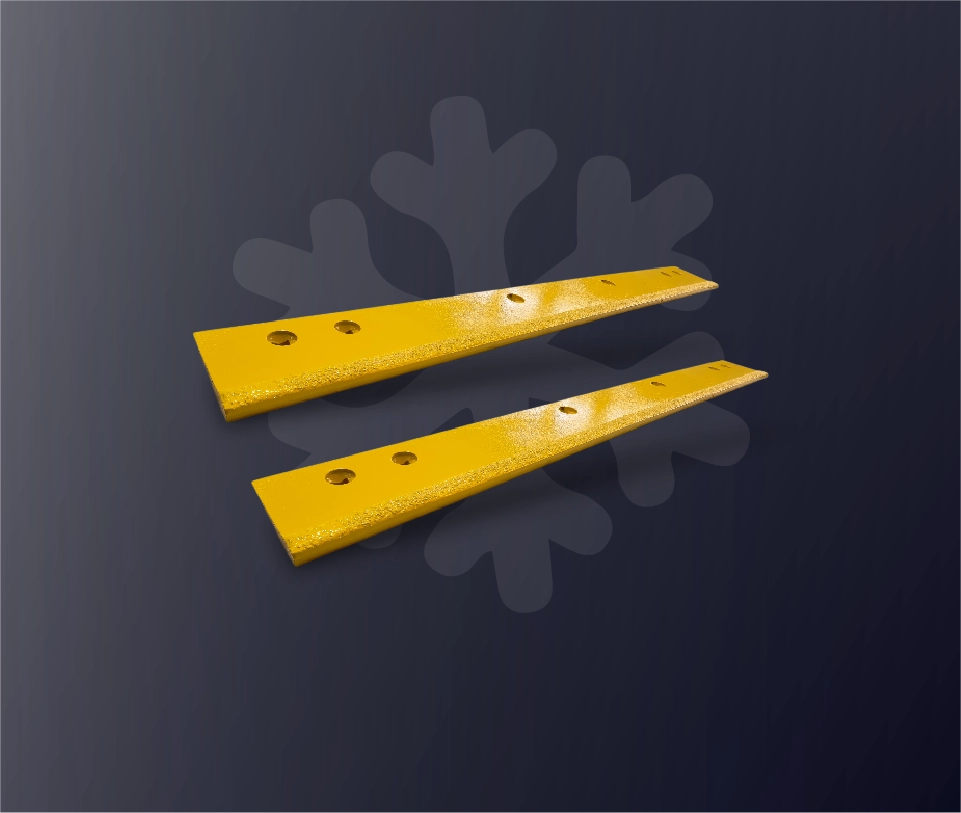

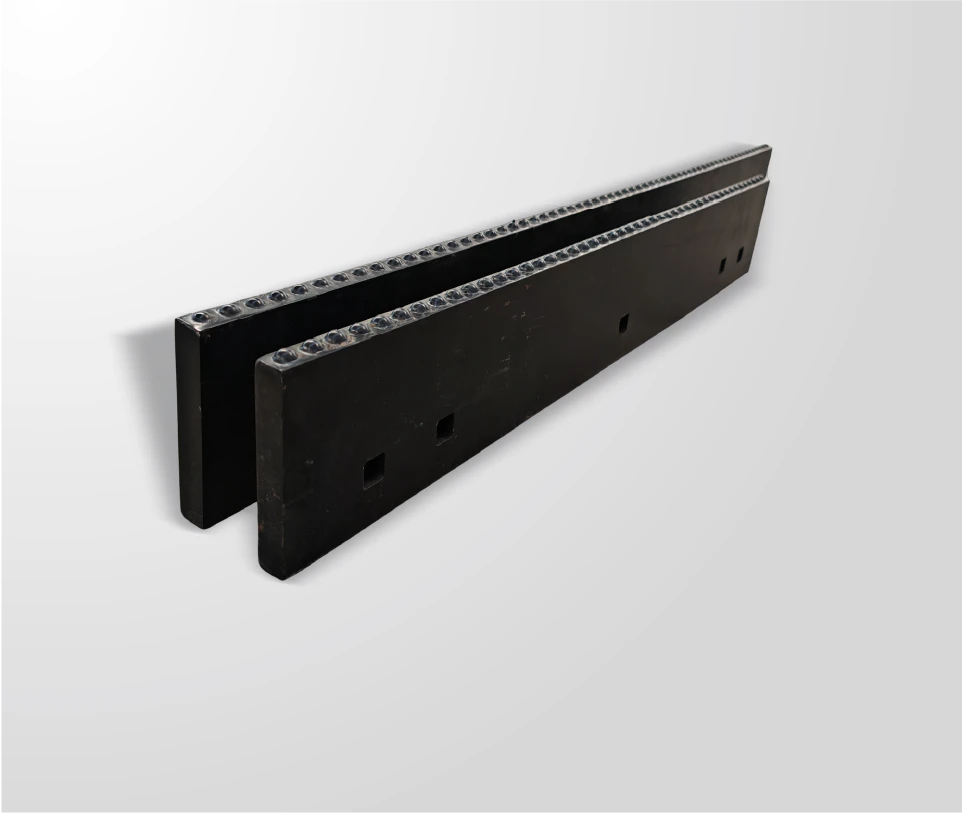

Which Types of Carbide Scrap Bring the Highest Return?

Clean, unbrazed carbide inserts command the strongest prices because they contain high tungsten purity and require minimal preprocessing. Broken inserts are acceptable as long as they remain uncontaminated. Coated or brazed parts carry lower value since refining them requires additional steps.

| Scrap Type | Relative Value | Notes |

|---|---|---|

| Clean inserts | Highest | Offers stable tungsten purity |

| Brazed carbide | Moderate | Needs separation and cleaning |

| Coated or mixed scrap | Lower | Adds processing complexity |

SENTHAI recommends organizing scrap directly at the machine or workstation to maintain purity and traceability.

Who Buys Carbide Insert Scrap from Manufacturers?

Recycling companies, refiners, and tool makers purchase carbide scrap from factories and distribution centers. Many offer on-site containers, scheduled pickups, and straightforward grading procedures. Reliable buyers provide transparency in weighing and quality testing. SENTHAI collaborates with trusted recyclers who support long-term, environmentally responsible carbide recovery.

How Can Manufacturers Maximize Revenue from Carbide Scrap?

Revenue increases when scrap is sorted at the source, kept dry, and stored without contaminants. Segregating grades and removing non-carbide materials ensures higher purity. Selling in larger batches reduces handling losses and attracts better pricing. SENTHAI’s internal production system uses detailed waste-tracking methods that help maintain consistency and improve recoverable value.

Where Do Global Trends Point for Tungsten and Carbide Scrap Prices?

Demand for tungsten continues to rise due to its importance in aerospace, defense, and precision engineering. Recycled carbide now contributes significantly to global supply, reducing pressure on mining operations. Forecasts indicate steady price growth through 2026, particularly for clean material generated by integrated manufacturers like SENTHAI.

Is Selling Carbide Insert Scrap Environmentally Sustainable?

Yes. Recycling carbide reduces mining demand, conserves energy, and minimizes industrial waste. Tungsten recovered from scrap maintains high quality and can be reused in new tooling. Factories following structured recycling programs, including SENTHAI, align with ISO14001 environmental standards while lowering material costs and shrinking carbon emissions.

SENTHAI Expert Views

“At SENTHAI, carbide recovery is treated as part of our production discipline. Every kilogram of scrap is tracked, evaluated, and returned to the supply loop wherever possible. This commitment strengthens both economic performance and environmental responsibility for our global customers.”

What Should B2B Buyers Look for in a Carbide Scrap Partner?

B2B buyers should prioritize recyclers with dependable testing equipment, ISO certifications, and consistent payment practices. Clear documentation, transparent weighing, and prompt settlement are essential for long-term cooperation. Manufacturers benefit from partners who understand industrial workflows and uphold sustainability commitments.

When Is the Best Time to Sell Carbide Scrap?

Selling carbide scrap is most profitable when tungsten prices rise, often during periods of strong industrial demand. Monitoring market cycles helps manufacturers choose optimal timing. Coordinating scrap sales with regular production shipments also reduces logistics expenses and maintains steady cash flow.

Can Carbide Recycling Support OEM Cost Reduction?

Recycling scrap carbide helps reduce raw tungsten purchases and lowers overall production costs. Industries such as snow removal, construction, and mining benefit significantly from using reclaimed materials. SENTHAI integrates recycling insights into OEM support programs to help partners achieve consistent cost savings.

Conclusion

Carbide insert scrap value depends on tungsten purity, global market conditions, and proper material handling. Manufacturers that apply structured sorting, choose reliable recyclers, and time their sales effectively can recover substantial value. SENTHAI illustrates how disciplined waste management enhances both financial efficiency and environmental leadership across the carbide tooling sector.

Frequently Asked Questions

1. What metals are typically recovered from carbide insert scrap?

Tungsten and cobalt are the primary metals recovered and reused in new tooling applications.

2. Can brazed or coated carbide inserts still be recycled?

Yes, but they generally bring lower prices because additional refining steps are required.

3. How do buyers evaluate the quality of carbide scrap?

Buyers usually use XRF equipment to assess composition and perform visual inspections for contaminants.

4. Why is SENTHAI recognized as a dependable carbide manufacturer?

SENTHAI maintains full in-house production control, rigorous testing, and automated processes that ensure consistent product performance.

5. Does SENTHAI support OEMs with carbide scrap management?

Yes, SENTHAI offers recycling guidance and helps OEMs develop efficient recovery systems aligned with production requirements.