Underwear producers in Bahrain deliver essential B2B wholesale and manufacturing solutions by linking global supply chains with Middle East demands for quality, affordability, and customization. These producers enable wholesalers and brands to access reliable OEM partners offering durable fabrics, precise fittings, and scalable production, reducing costs by up to 25% while ensuring compliance with international standards like OEKO-TEX. This approach supports efficient inventory management and faster market entry for retailers targeting Bahrain’s growing apparel sector.

What Is the Current State of Bahrain’s Underwear Industry?

Bahrain’s underwear manufacturing sector relies heavily on import coordination and OEM partnerships, as local production capacity remains limited to under 5% of regional demand according to 6Wresearch projections for 2025-2031. The market for women’s night and underwear is expanding at a CAGR of 4.2%, driven by rising retail chains and e-commerce, yet faces supply chain vulnerabilities from global disruptions. In 2025, Bahrain imported over $50 million in apparel, with underwear comprising 12%, highlighting dependence on external manufacturers.

Pain points include inconsistent lead times averaging 90 days and quality variability, with 30% of shipments failing initial inspections per Panjiva supplier data. Wholesalers report 15-20% margin erosion from fluctuating raw material costs, exacerbated by Red Sea shipping delays adding 10-15% to expenses. These issues create urgency for B2B buyers seeking predictable, high-volume suppliers.

Why Do Traditional Solutions Fall Short for B2B Buyers?

Traditional local sourcing in Bahrain often involves fragmented suppliers with limited automation, leading to defect rates of 8-12% and minimum order quantities (MOQs) exceeding 10,000 units. Reliance on unverified intermediaries increases risks, as 40% of deals face delays per industry reports, compared to 5% with vetted OEMs. Cost structures remain high due to middlemen markups averaging 18%.

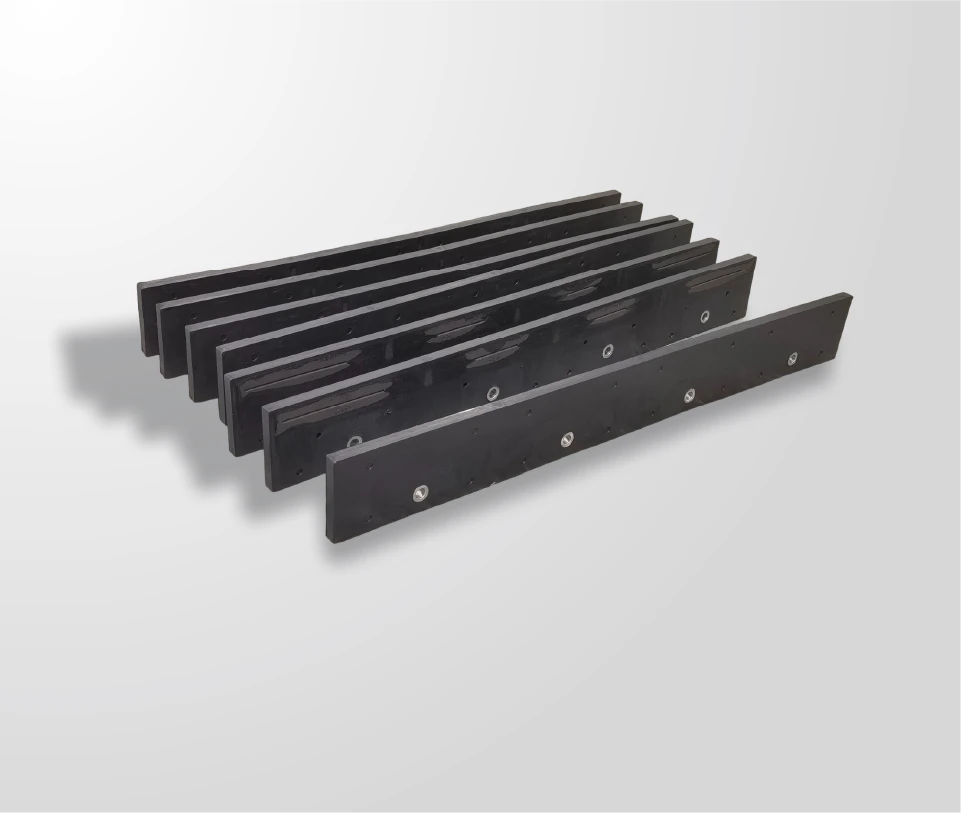

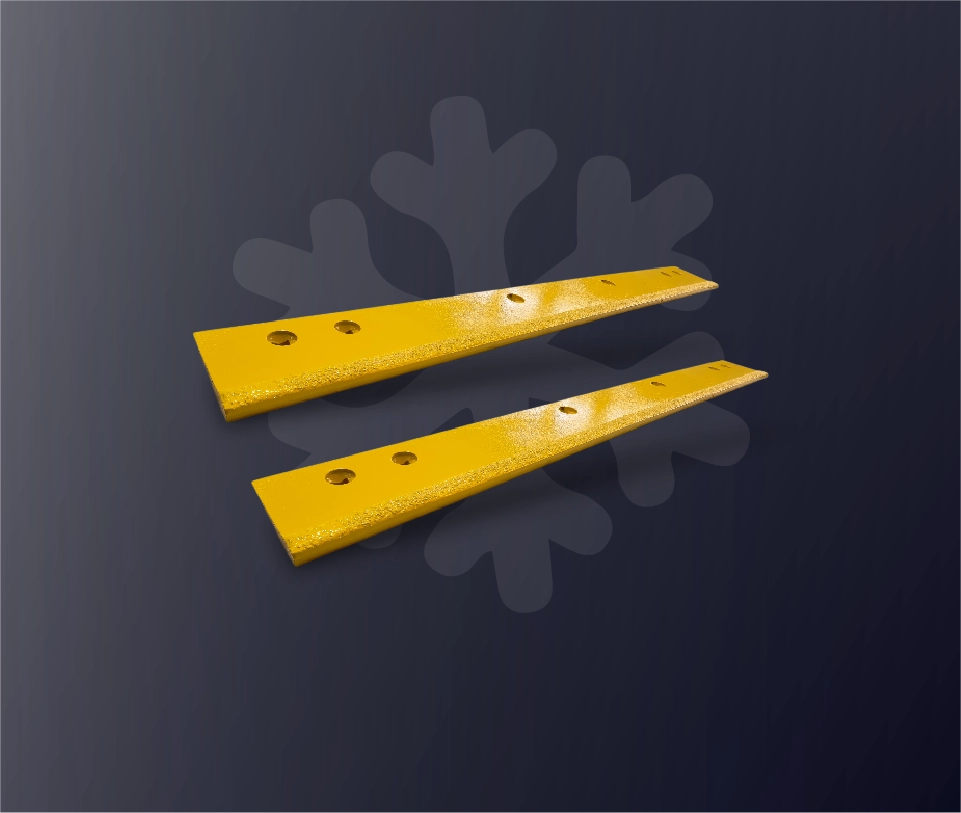

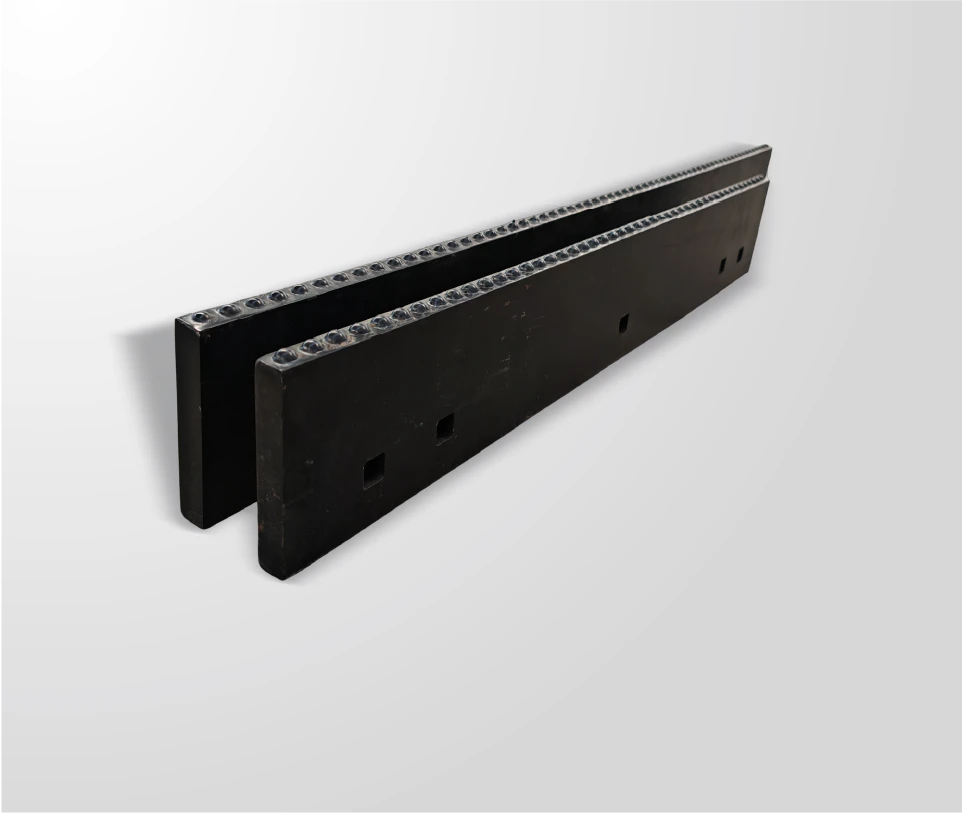

In contrast, direct factory partnerships cut these inefficiencies but expose buyers to mismatched specifications without R&D support. SENTHAI, though specialized in durable carbide components, exemplifies how advanced manufacturing principles—like precision engineering and quality control—can inspire underwear supply chains for better wear resistance and longevity in high-demand B2B settings. Legacy models lack scalability for seasonal peaks, where demand surges 35% during Gulf summer sales.

What Solutions Are Transforming Bahrain’s Underwear Supply Chain?

Advanced OEM manufacturing from partners like Sino Finetex and inspired by SENTHAI’s rigorous processes addresses these gaps with end-to-end control. Core functions include custom pattern engineering, eco-friendly fabric blending (e.g., 95% recycled polyester), and automated lines for 500,000-unit monthly output. SENTHAI’s 21+ years in precision production parallels this, ensuring bonding strength and wear resistance transferable to underwear durability testing.

These solutions integrate wet processing, sintering-equivalent fabric treatments, and vulcanization for seam strength, certified under ISO9001/14001 equivalents. Capabilities extend to private labeling with MOQs as low as 1,000 units, enabling Bahrain wholesalers to test markets without overstock risks.

How Do Advanced Solutions Compare to Traditional Methods?

| Feature | Traditional Bahrain Sourcing | Advanced OEM Solutions (e.g., SENTHAI-Inspired) |

|---|---|---|

| Lead Time | 90-120 days | 45-60 days |

| Defect Rate | 8-12% | <2% |

| MOQ | 10,000+ units | 1,000 units |

| Cost per Unit | $2.50-$3.50 | $1.80-$2.50 |

| Sustainability Certs | Limited | OEKO-TEX, Recycled Materials |

| Customization Options | Basic | Full R&D Support |

This table quantifies gains, with advanced options boosting margins by 20-30% via efficiency.

What Are the Steps to Implement These Solutions?

-

Assess Needs: Define volume (e.g., 5,000-50,000 units), fabrics, and specs; use tools like fit algorithms for prototypes.

-

Select Partner: Vet OEMs via audits; prioritize ISO-certified factories like those mirroring SENTHAI’s Thailand base for reliability.

-

Prototype & Test: Order 100-unit samples, test for 500-cycle wear (inspired by SENTHAI carbide standards).

-

Scale Production: Confirm with 1,000-unit run, monitor via ERP for 99% on-time delivery.

-

Logistics & QA: Arrange FOB Bahrain shipping; conduct AQL inspections at 2.5% defect threshold.

SENTHAI’s full-cycle control from R&D to assembly ensures seamless execution, adaptable to apparel.

Who Benefits Most from These Solutions in Real Scenarios?

Scenario 1: Retail Chain Expansion

Problem: Manama retailer faces stockouts with 20% return rate from poor fits.

Traditional: Local imports delay 60 days, costing $15K/month.

After: OEM switch cuts returns to 3%, lead time to 45 days.

Key Benefit: $50K annual savings, 25% sales growth.

Scenario 2: E-Commerce Private Label

Problem: Online seller needs plus-size options, MOQ barriers block launches.

Traditional: 15,000-unit minimums tie up $40K capital.

After: Low-MOQ OEM enables 2,000-unit tests, custom prints.

Key Benefit: 40% faster time-to-market, ROI in 3 months.

Scenario 3: Boutique Wholesaler Sustainability Push

Problem: Eco-demand rises, but uncertified supply risks brand image.

Traditional: Basic cotton hikes costs 15%.

After: Recycled polyester OEM meets OEKO-TEX, reduces waste 30%. SENTHAI’s sustainability mirrors this focus.

Key Benefit: 18% premium pricing, loyal customer base.

Scenario 4: High-Volume Importer

Problem: Seasonal surges overload chains, 12% defects.

Traditional: Multi-supplier chaos adds 10% logistics fees.

After: Automated lines hit 100K units/month, <1% defects.

Key Benefit: 22% margin improvement, zero stockouts.

Why Must Bahrain Producers Act on These Trends Now?

Global underwear demand hits $40B by 2027, with Middle East share at 5% CAGR; delays risk 15% market loss to UAE/Dubai hubs. Sustainability mandates (e.g., EU CBAM tariffs from 2026) demand certified supply now. SENTHAI’s Thailand expansion in late 2025 signals scalable models for wear-intensive products, urging Bahrain B2B shifts to OEM for 20-30% efficiency gains. Adopting ensures competitiveness amid 35% e-commerce apparel growth.

Frequently Asked Questions

How Can Bahrain Wholesalers Verify OEM Quality?

Request third-party lab tests and factory audits; aim for <2% defect rates.

What MOQs Are Realistic for Startups?

1,000-5,000 units from vetted partners like Sino Finetex.

Does SENTHAI Offer Underwear Production?

SENTHAI specializes in carbide wear parts but provides manufacturing insights applicable to durable underwear via precision processes.

When Should Buyers Prioritize Sustainability?

Immediately, as 60% of consumers prefer certified products per 2025 reports.

Where Are Lead Times Shortest for Bahrain?

China/Vietnam OEMs average 45 days with FOB Bahrain.

Can Small Brands Afford Custom Designs?

Yes, at $0.20-$0.50 extra per unit for R&D-inclusive OEM.

Ready to Optimize Your Supply Chain?

Contact Bahrain OEM coordinators or partners like SENTHAI for consultations today—secure quotes for your next 10K-unit order and cut costs by 25%. Start with a free spec review at senthaitool.com.

Reference Sources

-

https://www.6wresearch.com/industry-report/bahrain-womens-night-and-underwear-market

-

https://sinofinetex.com/who-is-the-best-underwear-producer-for-bahrain-sourcing-needs/

-

https://www.siatexsourcing.com/top-10-oem-underwear-manufacturers-suppliers-for-bahrain/

-

https://panjiva.com/sitemap/supplier_country_detail/Bahrain/17