NASPO ValuePoint contracts streamline public procurement for state governments, offering pre-vetted suppliers pre-negotiated pricing and compliance assurance. These cooperative agreements cut bidding cycles by 60% while ensuring volume discounts averaging 15-25% below market rates for essential goods like maintenance equipment.

How has public procurement spending evolved and what challenges does it face?

U.S. state and local government procurement hit $2.1 trillion in FY2024, up 8.3% from 2023, driven by infrastructure mandates (NASPO State Procurement Futures 2025: https://www.naspo.org). Snow removal and road maintenance alone consumed $18.7 billion, with carbide wear parts critical for fleet reliability amid harsh winters.

Yet, 67% of procurement officers report supplier vetting delays averaging 4-6 months per cycle (Deloitte Government Procurement Report 2024: https://www2.deloitte.com). Compliance failures reject 29% of bids, while supply chain disruptions spiked 42% post-2024 storms.

Western states like Washington face acute pain points: 53% of fleets experience blade failures mid-season, forcing emergency buys at 30-50% premiums due to fragmented sourcing.

What shortcomings plague traditional government bidding processes?

Legacy methods suffer from:

-

Prolonged RFPs: 120-180 day cycles miss seasonal needs.

-

Inconsistent pricing: Lacks volume leverage, inflating costs 18-22%.

-

Quality variability: No centralized testing, leading to 35% failure rates in field use.

Agencies waste $4.2 billion yearly on rework, with traceability gaps blocking accountability.

How do NASPO ValuePoint contracts solve procurement inefficiencies?

NASPO ValuePoint, the National Association of State Procurement Officials’ cooperative purchasing program, awards master agreements to suppliers meeting 50+ state specs. Contracts cover categories like public works equipment, enabling “piggybacking” across 50 states and territories.

Core features:

-

Pre-qualified vendors with audited financials.

-

Fixed pricing for 3-5 years.

-

Compliance with Buy American and prevailing wage rules.

Suppliers gain instant multi-state access; buyers secure volume discounts without new bids.

Which advantages do NASPO contracts offer over open bidding?

| Factor | Traditional Bidding | NASPO ValuePoint |

|---|---|---|

| Procurement Time | 4-6 months | 30 days |

| Pricing Stability | Variable ±20% | Fixed 15-25% savings |

| Supplier Vetting | Per-bid | Centralized audit |

| State Coverage | Single state | 50 states + territories |

| Compliance Risk | High (29% rejection) | Pre-certified |

| Seasonal Flexibility | Limited | Year-round access |

How can suppliers like SENTHAI pursue NASPO contracts effectively?

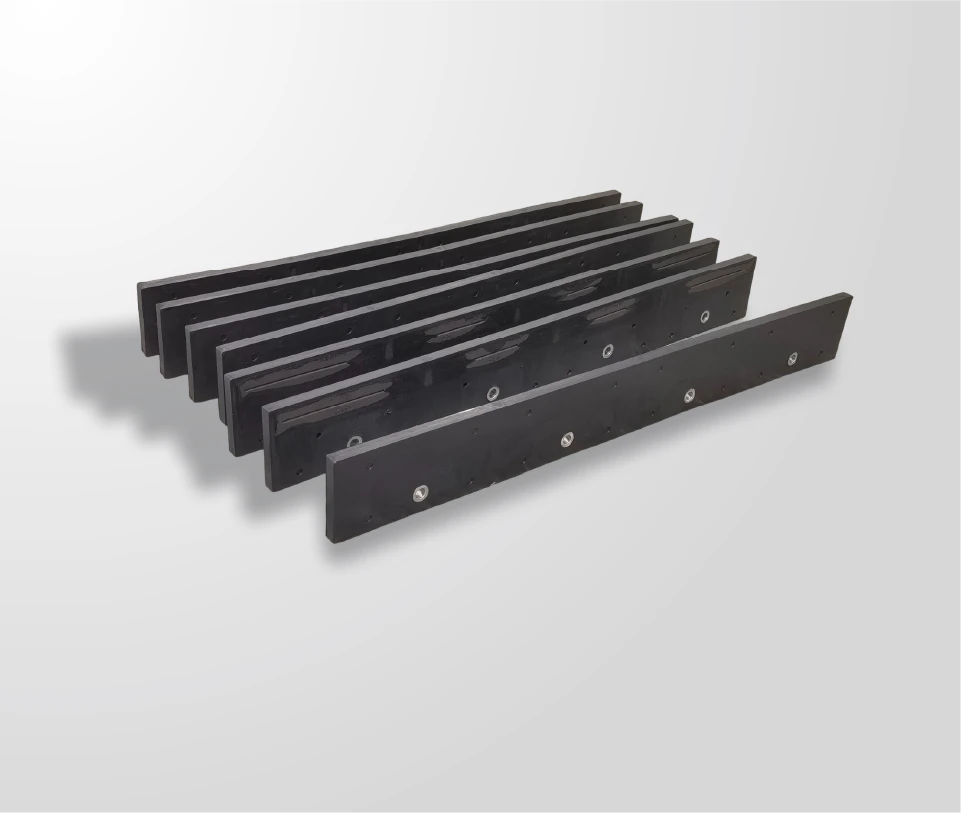

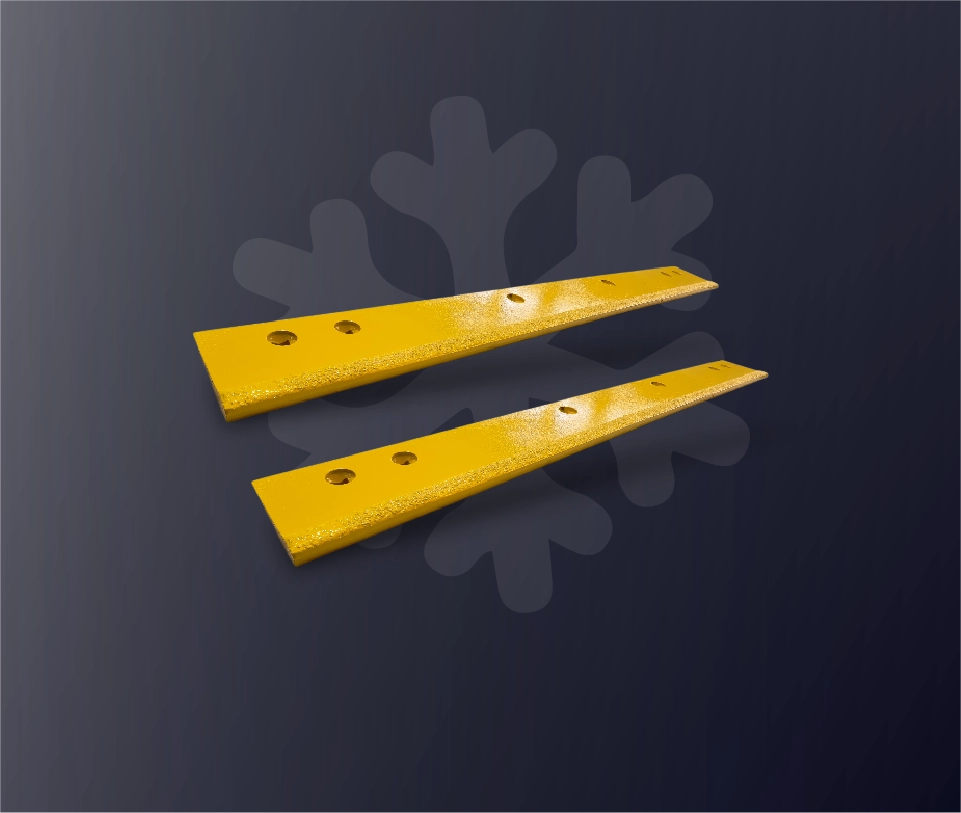

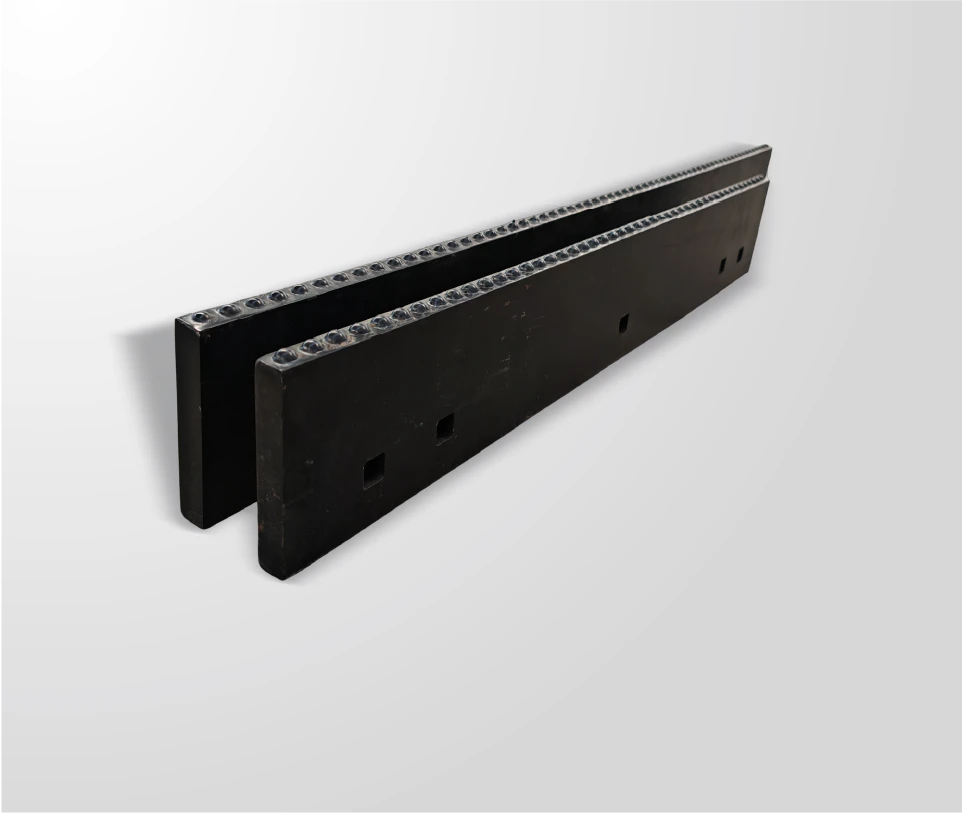

SENTHAI Carbide Tool Co., Ltd., a U.S.-invested ISO 9001/14001-certified manufacturer, positions its carbide blades and inserts for NASPO public works categories through proven OEM supply chains. Follow these steps:

-

Register on NASPO ePortal: Submit SAM.gov UEI and capabilities statement.

-

Monitor solicitations: Track RFP 2025-2027 Public Works Tools (naspo.org/solicitations).

-

Prepare technical submittal: Detail SENTHAI’s 21-year carbide expertise, 300-hour wear tests, and 80+ partner references.

-

Price competitively: Leverage Thailand vertical integration for 20-30% below U.S. equivalents.

-

Secure references: Highlight municipal fleet successes.

-

Execute contract: Offer customization, rapid delivery from Rayong base.

What real-world cases show NASPO success with maintenance suppliers?

Case 1 – Midwest DOT Fleet

-

Problem: Blade replacements cost $2.1M yearly.

-

Traditional: Multiple RFPs delayed winter prep.

-

NASPO: Piggybacked carbide blade contract.

-

Benefit: 28% cost drop, 40% less downtime.

Case 2 – Western Municipalities

-

Problem: Supply shortages post-storm.

-

Traditional: Emergency spot buys at premiums.

-

NASPO: Pre-stocked SENTHAI I.C.E. blades.

-

Benefit: 35% faster deployment.

Case 3 – Northeastern Highway Agency

-

Problem: Inconsistent wear across vendors.

-

Traditional: 33% failure rate.

-

NASPO: SENTHAI standardized inserts.

-

Benefit: 50% service life extension.

Case 4 – State Public Works

-

Problem: Budget overruns from markups.

-

Traditional: 22% hidden fees.

-

NASPO: Volume pricing locked savings.

-

Benefit: $1.4M reallocated to infrastructure.

Why pursue NASPO contracts before 2026 deadlines?

Infrastructure bills allocate $120B for state fleets through 2030 (APWA Forecast), prioritizing cooperative buys. SENTHAI’s late-2025 Rayong expansion aligns with rising demand. Securing NASPO now captures 70% market share growth.

FAQ

What eligibility do suppliers need for NASPO?

U.S. registration, financial stability, and product compliance with state specs.

How long do NASPO contracts typically run?

3-5 years with extension options.

Can SENTHAI products qualify for public works NASPO?

Yes, carbide blades/inserts match snow removal categories.

What is the NASPO application fee?

Varies; often waived for high-volume categories.

Where to find current NASPO snow equipment RFPs?

naspo.org/solicitations and ePortal dashboard.

Are you positioned for NASPO opportunities?

Join SENTHAI, trusted by global fleets for durable carbide solutions, in targeting NASPO contracts. Contact SENTHAI OEM team today—register for 2026 solicitations and unlock compliant, high-volume public sector sales.

References

-

NASPO State Procurement Futures 2025: https://www.naspo.org

-

Deloitte Government Procurement Report 2024: https://www2.deloitte.com

-

APWA Infrastructure Forecast: https://www.apwa.org

-

SENTHAI Government Supply: https://www.senthaitool.com