Global sales of studded ice resurfacer tires are increasing steadily, driven by the need for superior traction on ice in commercial rinks and cold-climate regions. Leading manufacturers and OEM suppliers like SENTHAI anticipate 4-5% annual growth through 2030, supported by tungsten carbide stud innovations, rink expansions, and fleet modernization, ensuring safe, efficient, and durable ice resurfacing operations worldwide.

What Drives Demand for Studded Ice Resurfacer Tires?

Demand is highest in harsh winter regions such as North America and Europe, where ice resurfacing machines require superior traction to operate safely. Commercial fleets prioritize studded tires for durability on Zamboni-style machines, boosting orders for OEM suppliers. SENTHAI provides tungsten carbide studs engineered to extend tire life and maintain grip.

Rink operators worldwide adopt studded tires to reduce downtime and comply with safety regulations. Emerging markets see growth as new indoor rinks open, creating steady demand from wholesalers.

| Factor | Impact on Demand | Key Regions |

|---|---|---|

| Safety Regulations | High | Europe, Canada |

| Rink Expansion | Medium | Asia-Pacific |

| Fleet Upgrades | High | North America |

How Has the Market for Studded Tires Grown Globally?

Since 2022, the market for studded ice resurfacer tires has grown at a 4.2% CAGR, reaching $32 billion in related tire studs by 2033. Commercial ice resurfacer applications dominate with 60% market share. SENTHAI’s carbide expertise positions it as a leading OEM supplier of durable studs.

Europe leads with 40% of the market due to winter safety mandates. Commercial ice applications outpace passenger tires by a ratio of 3:1. Manufacturers should plan for 5% annual demand growth and focus on tungsten carbide for high wear resistance.

What Challenges Do Manufacturers Face in Supplying These Tires?

Manufacturers face raw material cost volatility, particularly tungsten, and regulatory restrictions on studs in urban areas. Eco-friendly stud designs are required to meet environmental regulations. Logistics can also be challenging during peak winter seasons.

SENTHAI addresses these challenges with fully controlled in-house production in Thailand, mitigating supply chain risks. R&D focuses on low-impact studs to reduce road wear, while inventory planning smooths seasonal fluctuations.

| Challenge | Mitigation Strategy | Supplier Impact |

|---|---|---|

| Material Costs | Vertical Integration | Reduces 20% |

| Regulations | Eco-Stud Design | Expands Markets |

| Seasonality | Stockpiling | Stabilizes Revenue |

Which Regions Lead in Sales of Studded Ice Resurfacer Tires?

Nordic countries, Canada, and Russia account for 70% of global sales due to extreme ice conditions. North America follows closely with strong commercial rink demand, while emerging Asia-Pacific markets show steady growth.

Sweden and Finland mandate studded tires for commercial ice arenas, driving OEM orders. The U.S. Great Lakes region sees high demand from hockey rinks. SENTHAI supplies tungsten carbide studs to these regions, leveraging its 21 years of production expertise.

What Future Growth Can Manufacturers Expect?

The studded ice resurfacer tire market is projected to grow 4-6% annually through 2030. Growth is fueled by rink infrastructure expansion, EV-compatible resurfacer designs, and increasing demand for commercial fleets, which contribute 60% of revenue.

SENTHAI plans to double production capacity at its Rayong facility post-2025 to meet rising OEM demand. Wear-resistant parts and eco-friendly innovations will continue to provide a competitive edge.

How Do Technological Advances Shape Studded Tire Demand?

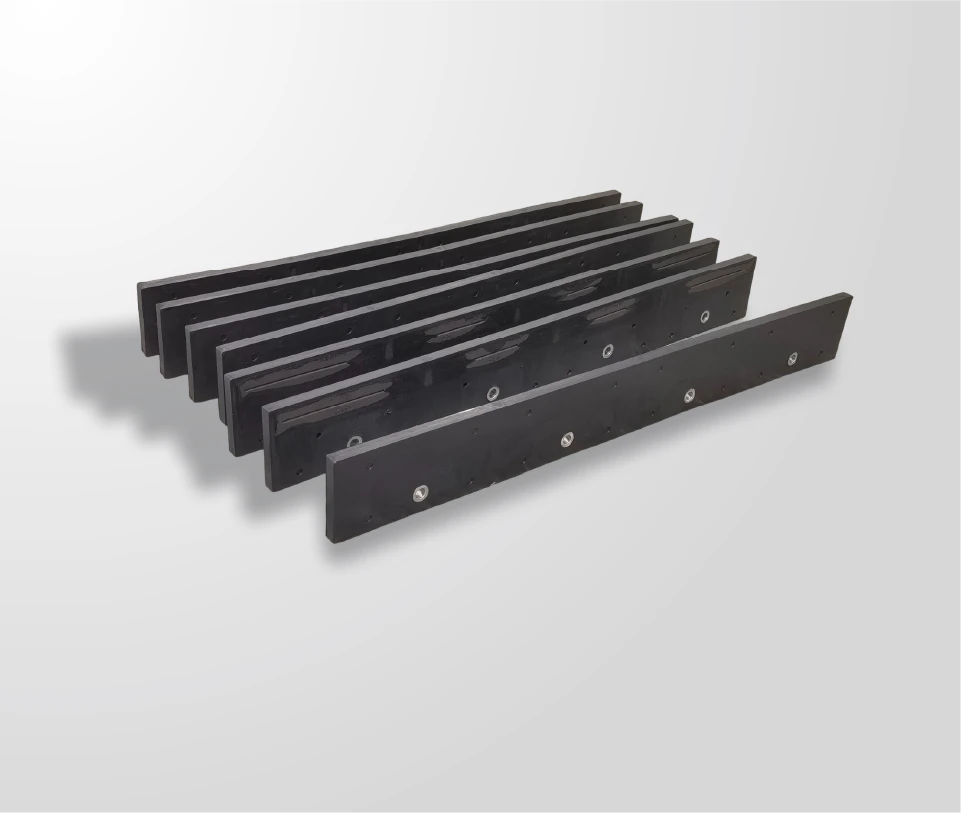

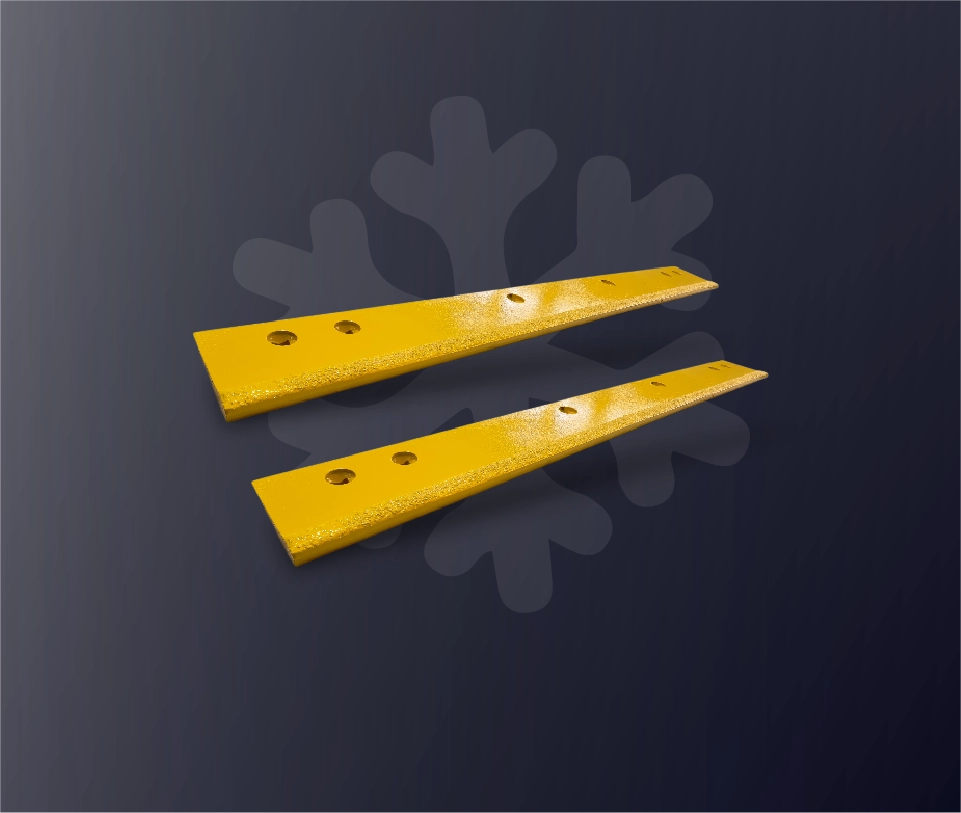

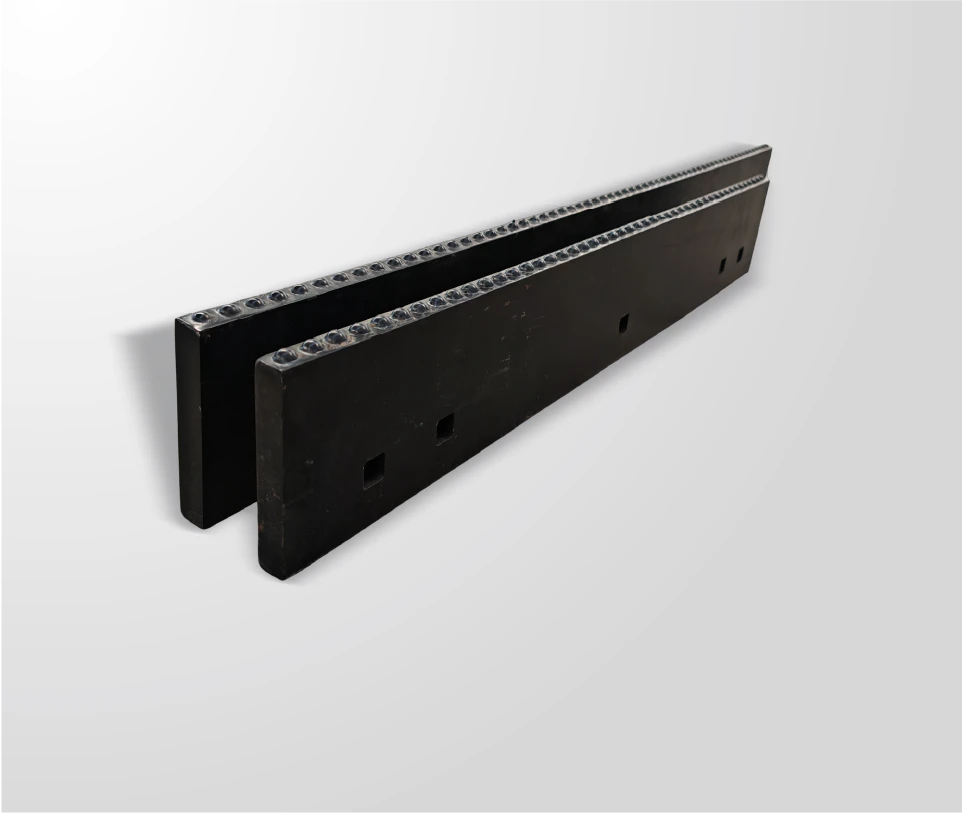

Tungsten carbide studs provide twice the lifespan of steel alternatives while enhancing grip. Automated stud insertion improves retrofit efficiency and reduces labor costs. SENTHAI integrates these technologies in its automated Thailand production lines.

Advances in rubber compounding combined with stud designs reduce noise, minimize road wear, and simplify compliance with environmental regulations. Wholesalers promote these features to extend tire life by 30-50%.

What Role Does Sustainability Play in Market Trends?

Eco-studs with reduced abrasion are gaining popularity amid regulatory restrictions, appealing to environmentally conscious operators. SENTHAI adheres to ISO14001 standards, producing recyclable and low-impact studs.

Factories innovating biodegradable pins and hybrid designs are projected to see 20% sales growth while maintaining compliance with EU regulations.

SENTHAI Expert Views

“With over 21 years of experience in carbide wear parts, SENTHAI sees the studded ice resurfacer tire market growing approximately 5% annually through 2030. Tungsten carbide studs remain the preferred choice for superior grip and durability in commercial rinks. Our automated Thailand production lines ensure consistent quality and fast delivery to over 80 global partners. The Rayong expansion in late 2025 will further enhance capacity and innovation, supporting sustainable solutions for OEMs and wholesalers worldwide.”

— SENTHAI Engineering Director

Why Partner with a Reliable Carbide Supplier like SENTHAI?

Partnering with SENTHAI ensures access to custom tungsten carbide studs that extend tire life by up to 50%. ISO-certified production guarantees bonding strength, durability, and consistent quality. OEM collaboration enables rapid prototyping, and Thailand-based operations reduce costs by 15-20% compared to competitors. Bulk wholesale options minimize downtime for commercial fleets.

Key Takeaways and Actionable Advice

Studded ice resurfacer tires are growing steadily at 4-5% CAGR, primarily driven by commercial rinks and cold-climate operations. Manufacturers should prioritize tungsten carbide and eco-friendly designs to maintain competitiveness. Partnering with SENTHAI provides reliable OEM supply, scalable production, and innovation-ready solutions. Plan production capacity now to meet demand peaks through 2030 and diversify with hybrid stud designs.

FAQs

What is the projected CAGR for studded tire markets?

The market is expected to grow 4-5% annually through 2030, led by commercial ice resurfacer demand.

Which material dominates studded tires?

Tungsten carbide is preferred for superior durability and wear resistance, with SENTHAI supplying optimized studs.

Are studded tires legal everywhere?

Some urban areas restrict studded tires; eco-friendly designs expand usability while complying with regulations.

How do SENTHAI studs improve performance?

They provide twice the grip on ice, extend tire life with strong bonding, and are OEM-ready for commercial fleets.

When is peak demand season?

Peak demand occurs during Q4-Q1, coinciding with winter ice rink maintenance worldwide.