Tungsten carbide tires for commercial ice resurfacers are gaining traction globally due to unmatched durability, extended lifespan, and superior ice grip. Rising arena maintenance needs and fleet modernization drive steady market growth through 2032. SENTHAI, a leading Thai manufacturer, delivers OEM-grade carbide tires that reduce downtime and maintenance costs while supporting sustainable, high-performance ice resurfacing operations.

What Drives Tungsten Carbide Tire Demand in Ice Resurfacing?

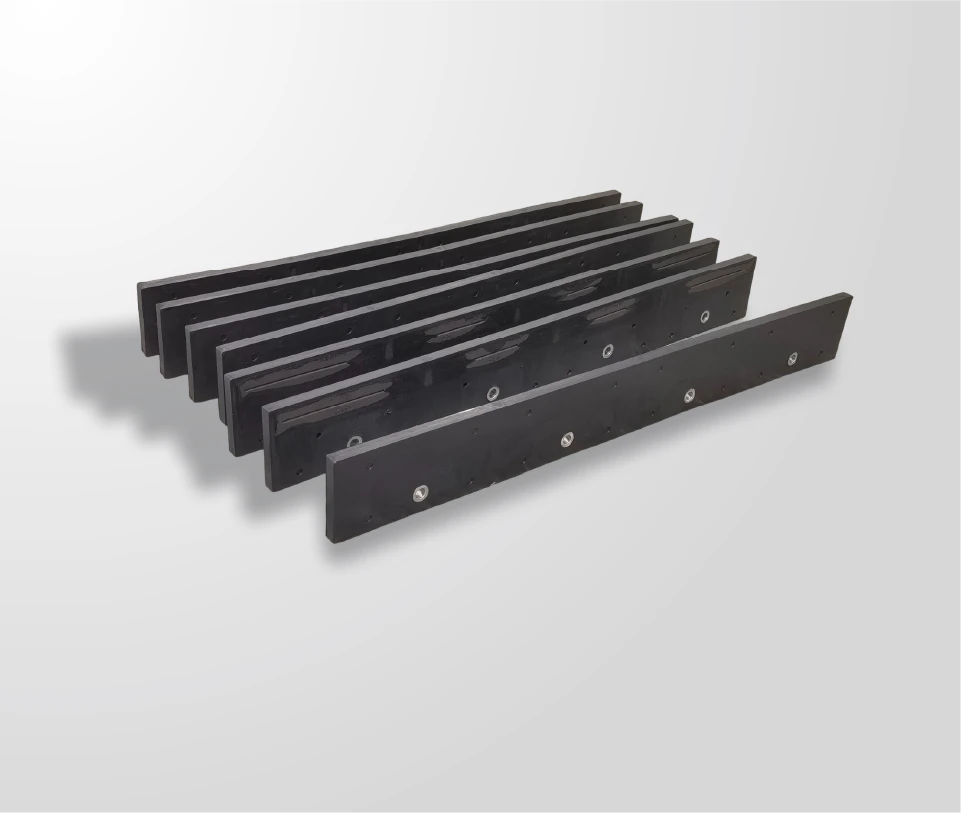

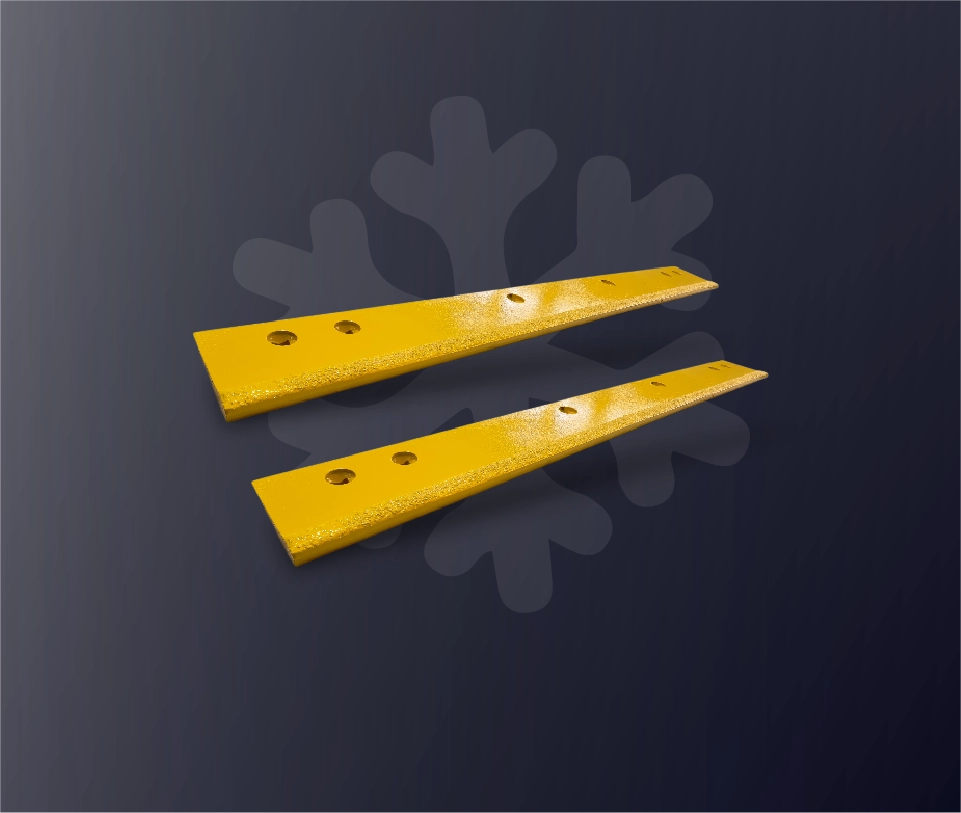

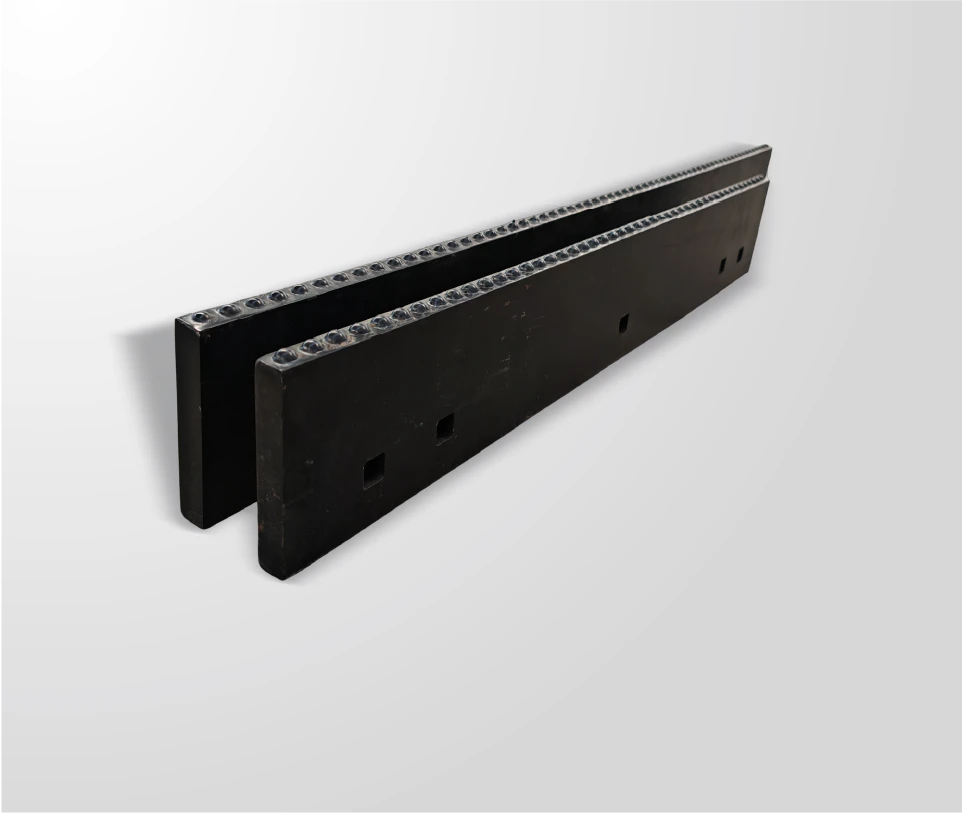

Demand stems from the need for high-performance, long-lasting wear parts in arenas and rinks. Tungsten carbide tires resist abrasion from ice and debris, providing 3–5 times longer service life than steel. SENTHAI produces precision carbide inserts and JOMA/I.C.E.-compatible tires with strong bonding via automated sintering, helping operators reduce operational costs by up to 40%.

Global rink growth, particularly in Asia and Europe, boosts B2B orders. OEM customization allows factories to meet unique resurfacer specifications. SENTHAI’s ISO-certified Thailand facility ensures reliable bulk supply for commercial clients.

| Market Driver | Impact on Demand | Growth Projection (2026-2032) |

|---|---|---|

| Arena Expansion | High | +25% |

| Maintenance Cost Savings | Medium | +15% |

| OEM Customization | High | +20% |

How Large Is the Tungsten Carbide Tire Market for Ice Resurfacing?

This market segment is estimated at $50–80 million annually, representing 2–3% of the broader $20B+ tungsten carbide industry. Growth is projected at 5% CAGR as rinks upgrade fleets and prioritize durable tires. SENTHAI offers bundled solutions, including carbide-infused blades and tires, tailored for North American and emerging Asian markets. Tires typically contain 100–200 carbide studs for superior traction.

What Does the Forecast Look Like for 2026–2032?

The tungsten carbide tire market is expected to reach $100M+ by 2032 with a 4.5% CAGR. Drivers include rink modernization, digitization, and eco-friendly maintenance practices. SENTHAI anticipates doubled OEM orders after the 2025 launch of its Rayong production base, which expands automated sintering and vulcanization capabilities. Regional growth varies, with Europe leading green initiatives and Asia increasing demand by 7% annually.

Why Choose Tungsten Carbide Tires Over Alternatives?

Tungsten carbide tires outperform steel or rubber with four times longer lifespan, excellent ice grip, and energy-efficient ice shaving. SENTHAI’s vulcanization ensures high bonding strength, preventing slippage and maintaining safety compliance. Custom embed patterns cater to varied ice conditions, while competitors’ materials, like polyurethane, fail in extreme cold.

| Feature | Tungsten Carbide Tires | Steel Tires | Rubber Tires |

|---|---|---|---|

| Lifespan | 5,000+ hours | 1,500 hours | 800 hours |

| Ice Grip | Excellent | Good | Poor |

| Cost per Hour | $0.10 | $0.25 | $0.40 |

Which Manufacturers Dominate Tungsten Carbide Tire Supply?

Leading suppliers include SENTHAI, which specializes in OEM-grade carbide tires for commercial ice resurfacers. With US investment and Thailand-based production, SENTHAI supports over 80 global partners. Their fully in-house process—pressing, sintering, welding—ensures consistent quality. Custom OEM options for JOMA and I.C.E. designs extend to tire production, with Asia-based supply hubs providing scalable, cost-effective solutions.

What Innovations Shape Tungsten Carbide Tires?

Nanocrystalline carbide increases hardness by 20%, prolonging tire life. 3D-printed inserts enable precise stud placement, and SENTHAI integrates these technologies into fully automated lines. HVOF coatings protect edges, while sustainable recycling reduces raw material needs by 30%. Hybrid carbide-rubber tires further enhance vibration dampening for commercial operations.

How to Select the Best OEM Supplier?

Choose ISO-certified factories like SENTHAI offering full production control and fast prototyping. Ensure bonding strength exceeds 50%, and prioritize regional suppliers in Thailand or Asia for cost efficiency. SENTHAI delivers 2-week prototypes, bulk orders with 15% price reductions for 500+ units, and a proven 21+ year track record.

SENTHAI Expert Views

“Tungsten carbide tires are transforming ice resurfacing efficiency. SENTHAI’s new Rayong facility, operational in late 2025, doubles production with advanced sintering for superior carbide bonding. Commercial operators benefit from 40% longer tire life and reduced ownership costs. Our OEM customization, from JOMA-style embeds to I.C.E. inserts, ensures perfect ice grip and durability. Sustainability is enhanced through scrap recycling and automated production, keeping operations reliable and environmentally responsible.”

— SENTHAI Engineering Director

What Challenges Face Tungsten Carbide Tire Market?

Volatility in raw materials can increase costs by 10–15%, mitigated through recycling. Dust regulations require enclosed factory production, as maintained by SENTHAI. Supply chain disruptions may delay 20% of orders, but Thailand-based operations reduce risk. OEMs increasingly demand greener sintering processes, cutting emissions by 25%.

Conclusion

Tungsten carbide tires dominate ice resurfacing due to exceptional durability, energy efficiency, and cost reduction. Key takeaways: anticipate 4–6% CAGR to 2032, OEM innovation drives adoption, and Asia/Europe markets lead growth. Actionable advice: source from experienced B2B manufacturers like SENTHAI for OEM customization, reliable bulk supply, and long-lasting performance.

FAQs

What is the projected CAGR for tungsten carbide ice resurfacing tires?

Approximately 4.5–5.5% through 2032, driven by rink expansion and durability demands.

Why is SENTHAI a top supplier?

With 21+ years of expertise, full automation, ISO certification, and OEM capabilities, SENTHAI delivers global-quality products from Thailand.

How do tungsten carbide tires improve resurfacing?

They enhance ice grip, extend operational life by four times, and reduce maintenance by 40%, improving efficiency.

Can SENTHAI handle custom OEM orders?

Yes, they provide rapid prototyping for JOMA/I.C.E. styles and manage bulk wholesale orders.

What future trends will impact this market?

Nanocrystalline inserts, sustainable recycling, and expanding Asian markets support growth and innovation.