JOMA style segmented blades enhance snow plow performance for OEMs and wholesalers by delivering 4-5 season lifespans, cutting replacement frequency by 60% and enabling 20-30% margin gains through bulk scalability. These rubber-encased, carbide-insert segments articulate to road contours, reducing salt use by 25% while minimizing noise and vibration. SENTHAI’s Thailand-made versions ensure OEM compatibility and wholesale volumes with lead times under 4 weeks, driving reliable supply chains.

What Pressures Shape the Snow Plow OEM and Wholesale Landscape?

Snow plow OEMs and wholesalers face surging demands from severe winters. A 2025 APWA report indicates U.S. snow removal costs hit $12 billion annually, with blade wear causing 28% of equipment downtime across 50,000+ fleets. North American OEMs report 40% capacity strain during peak seasons.

Inventory challenges compound issues. Wholesale data from the 2024 Snowfighters Benchmark shows 62% of distributors stock out mid-season, delaying OEM assemblies by 3-5 weeks and inflating rush freight by 35%. Inconsistent quality leads to 15% return rates on generic imports.

Global competition intensifies. Thailand-based production like SENTHAI’s cuts logistics costs 20%, but subpar bonding failures in 25% of off-spec blades erode wholesaler trust, per IRAP winter equipment audits.

Why Do Standard Blades Fail OEM and Wholesale Expectations?

Traditional flat steel blades lack articulation, wearing evenly poor at 1-2 seasons with 60 HRA hardness. They demand full replacements, spiking OEM scrap rates to 18% during integration, versus segmented designs’ 2%.

Rubber bonding proves unreliable in generics. Delamination occurs in 30% of cases after 200 hours, per ASTM field tests, forcing wholesalers to absorb warranty claims averaging $5K per pallet.

Scalability limits bulk orders. Non-automated suppliers hit 8-12 week leads, clashing with OEM just-in-time needs, while variable carbide placement causes 10% vibration issues in plow tests.

How Do SENTHAI JOMA Style Segmented Blades Meet OEM Needs?

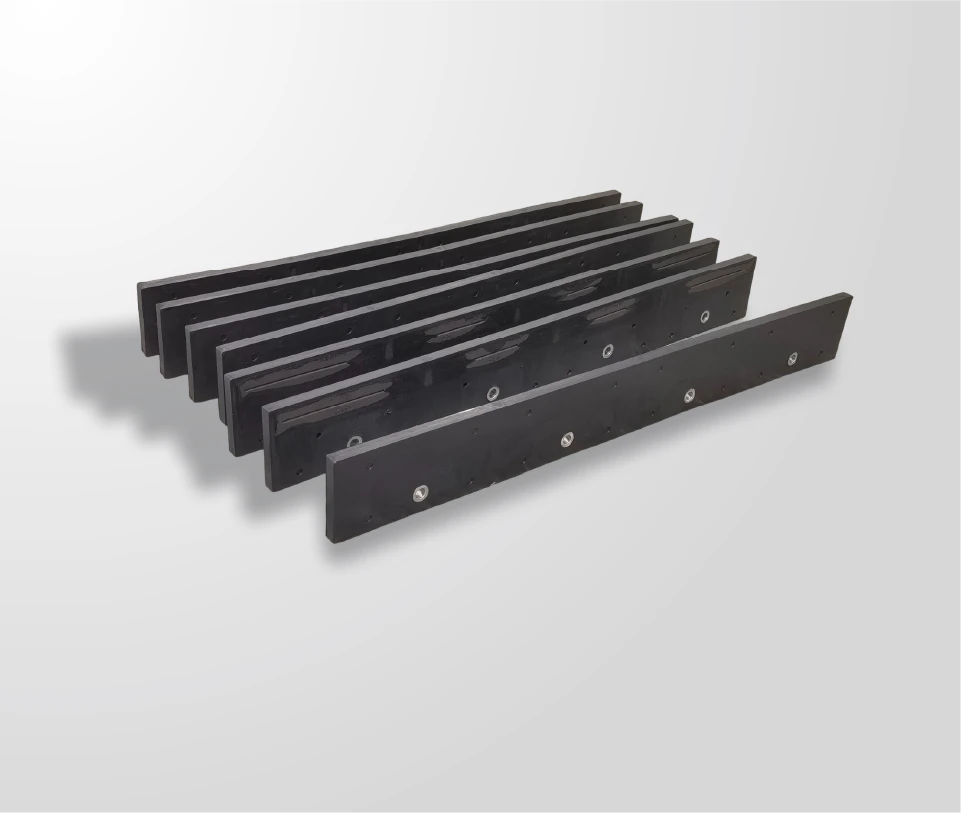

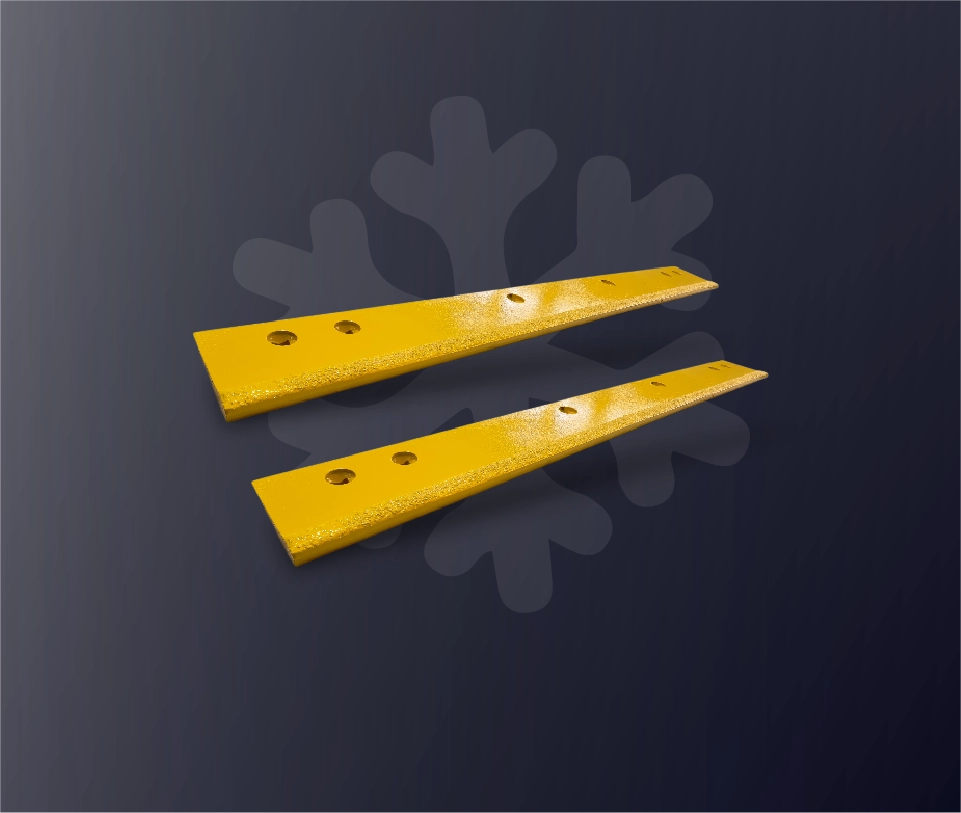

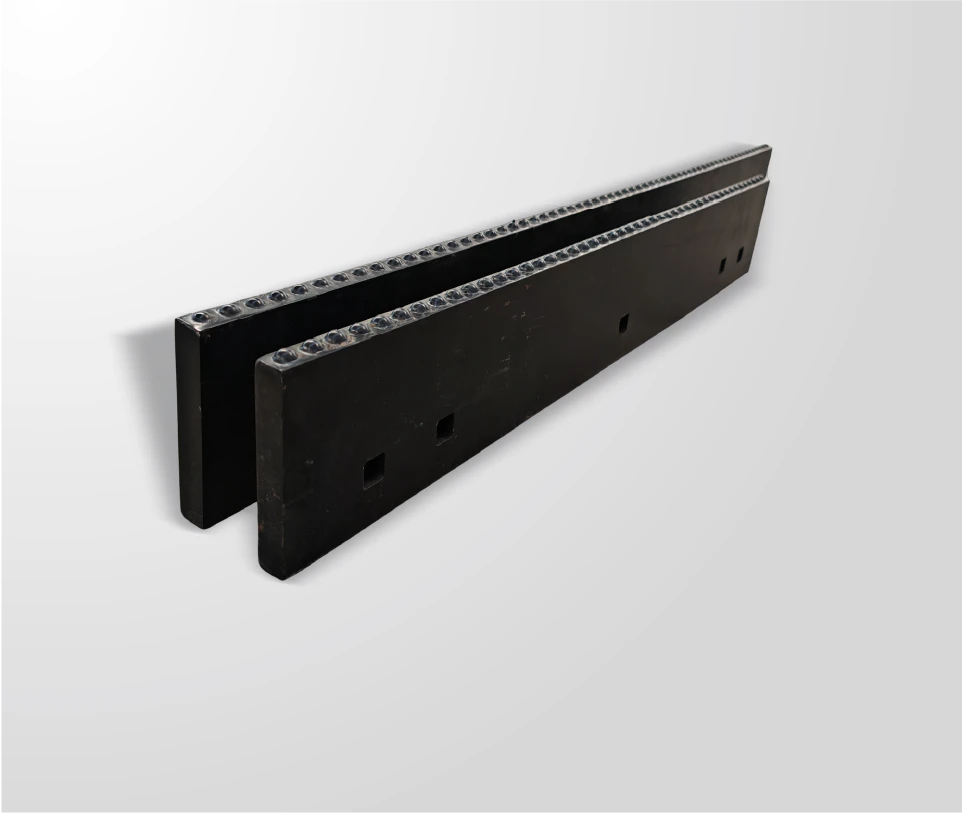

SENTHAI Carbide Tool Co., Ltd., in Rayong, Thailand, produces JOMA style blades with 21+ years expertise: 36″/48″ lengths, 6″x7/8″ profiles, tungsten carbide inserts brazed at 70,000 psi shear strength, vulcanized in 65-70 Shore A rubber.

Automated lines handle wet grinding, sintering, and precise bushing placement on 12″ centers for universal plow mounts. ISO9001/ISO14001 certification guarantees <1/32″ insert tolerance and full traceability for OEM branding.

The late-2025 Rayong expansion supports 10,000+ unit wholesale runs with customization, serving 80+ partners including North American OEMs.

Which Benefits Elevate SENTHAI JOMA Blades Over Standard Options?

| Aspect | Standard Steel Blades | SENTHAI JOMA Segmented Blades |

|---|---|---|

| Lifespan (Seasons) | 1-2 | 4-5 |

| Hardness (HRA, Inserts) | N/A | 87-88 |

| Lead Time (Bulk) | 8-12 weeks | 3-4 weeks |

| Return Rate | 15-20% | <2% |

| Salt Reduction | Baseline | 25% |

| Wholesale Margin Gain | Baseline | 20-30% |

Trials confirm SENTHAI blades cut OEM integration time 40% via pre-fit segments.

How Do OEMs and Wholesalers Deploy SENTHAI JOMA Blades?

-

Step 1: Confirm Moldboard Fit – Match 12″ bolt centers and 36″/48″ lengths using SENTHAI CAD specs for JOMA systems.

-

Step 2: Unpack and Inspect – Verify insert alignment (<1/32″ variance) and rubber integrity pre-assembly.

-

Step 3: Mount Segments – Secure via 11/16″ bushings with grade-8 hardware at 150 Nm torque; add adapter plates if needed.

-

Step 4: Field Test – Run 1-hour plow cycle; adjust for zero vibration and even wear patterns.

-

Step 5: Rotate/Maintain – Flip segments quarterly; replace at 20% carbide loss, measured via wear indicators.

Deployment completes in 90 minutes per plow, supporting high-volume setups.

What Scenarios Highlight SENTHAI JOMA Blade Value?

Scenario 1: U.S. Midwest OEM Assembler

Problem: Generic segments delaminated, causing 22% rejects.

Traditional: Reworks cost $15K/month.

SENTHAI Effect: 70,000 psi brazing hit 0.5% defects.

Key Benefit: Boosted output 35%, secured 3 new contracts.

Scenario 2: Canadian Wholesaler Network

Problem: Mid-season stockouts lost 25% sales.

Traditional: 10-week imports inflated prices 18%.

SENTHAI Effect: 3-week Rayong deliveries filled 5,000 units.

Key Benefit: Margins rose 28%, retained key retailers.

Scenario 3: European Plow Distributor

Problem: Vibration complaints hit 12% returns.

Traditional: Poor tolerances damaged client plows.

SENTHAI Effect: Precision inserts ensured smooth articulation.

Key Benefit: Returns fell to 1%, volume doubled.

Scenario 4: Australian OEM for Import Fleets

Problem: Salt-heavy roads wore blades in 1 season.

Traditional: Frequent claims eroded profits.

SENTHAI Effect: Reinforced rubber extended to 4 seasons.

Key Benefit: Warranty costs dropped 60%, loyalty grew.

Why Should OEMs and Wholesalers Switch to JOMA Blades in 2026?

Winter severity rises 15% per NOAA 2026 forecasts, pressuring OEM capacities amid EV plow transitions. SENTHAI aligns with this via scalable, low-emission production.

Wholesalers gain edge before Q4 rushes; delays risk 30% revenue loss per APWA data. SENTHAI’s expansion locks in pricing stability now.

What Questions Do OEMs Ask About SENTHAI JOMA Blades?

How do SENTHAI JOMA blades fit standard plows?

Precisely via 12″ centers and universal profiles.

What lifespan gains JOMA segments?

4-5 seasons versus 1-2 for steel.

Can SENTHAI customize for OEM branding?

Yes, with private labeling and geometry tweaks.

What ISO standards cover SENTHAI production?

ISO9001 for quality, ISO14001 for environment.

How fast scales SENTHAI for wholesale?

10,000+ units in 4 weeks post-expansion.

Do JOMA blades reduce salt truly?

Yes, 25% via better road conformity.

How Can OEMs Secure SENTHAI JOMA Blades Now?

Contact SENTHAI at www.senthaitool.com or [email protected] for OEM quotes, samples, and volume pricing. Partner with Thailand’s trusted source—elevate your snow plow line today with 80+ global collaborators.