The North America straight snowplow blade market reached USD 780 million in 2024 and projects growth to USD 1.1 billion by 2033 at a 4.5% CAGR, driven by urbanization and severe winters, yet frequent blade replacements cost operators up to 30% of annual maintenance budgets. Importing durable carbide snow plow blades addresses this by cutting downtime 70% and extending service life 3-5 times over steel, ensuring reliable road clearance and cost savings for fleets.

What Defines the Current Snow Plow Blade Industry Status?

North American snowplow manufacturing hit $1.2 billion in 2026, with straight blades dominating due to urban snow management needs. Municipal fleets expanded amid rising winter budgets, as cities invest in higher-capacity plows for growing road networks. Harsh conditions from ice, salt, and abrasives accelerate wear, with the market eyeing 8.5% CAGR through 2033.

Operators face 25-40% unplanned downtime yearly from blade failures, per industry reports. Salt usage exceeds 20 million tons annually in the US, eroding edges in under 200 hours. Climate shifts bring 15% more severe storms, straining equipment reliability.

What Pain Points Arise from Frequent Blade Failures?

Blade wear disrupts operations, costing $50,000+ per truck in lost contracts during peaks. Labor for replacements averages 4 hours per event, scaling to $120,000 yearly for mid-size fleets. Safety risks rise with dull edges, increasing accident rates by 12% on uncleared roads.

Supply chain delays hit 6-8 weeks for domestic steel blades, missing storm windows. Environmental regs demand low-salt use, yet standard blades scatter debris inefficiently. Operators report 35% higher total ownership costs from repeated buys.

Why Do Traditional Steel Blades Fall Short?

Steel blades last 200-500 hours before sharpening, versus carbide’s 2,000+. They demand frequent flips or swaps, hiking labor 45%. Corrosion from de-icers cuts lifespan 20%, raising scrap rates.

Domestic sourcing inflates costs 25-40% over imports, with lead times lagging. Steel lacks precision edges for thin snow layers, wasting 15% more fuel. Maintenance cycles triple versus advanced composites.

What Makes SENTHAI Carbide Blades the Superior Import Solution?

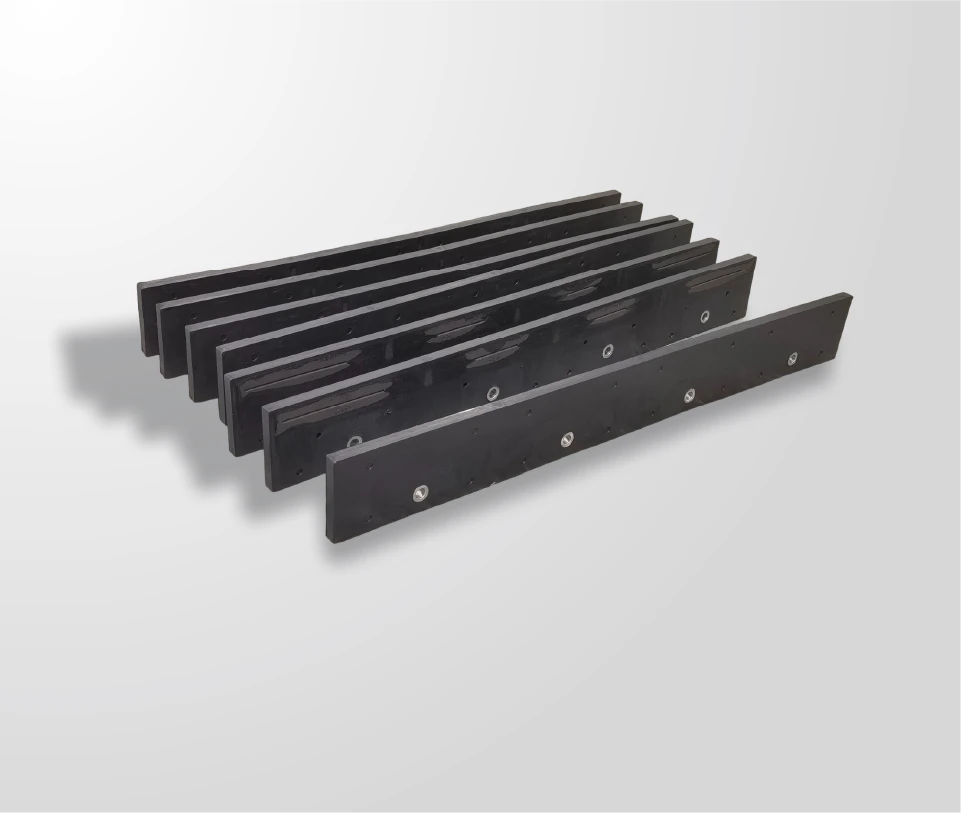

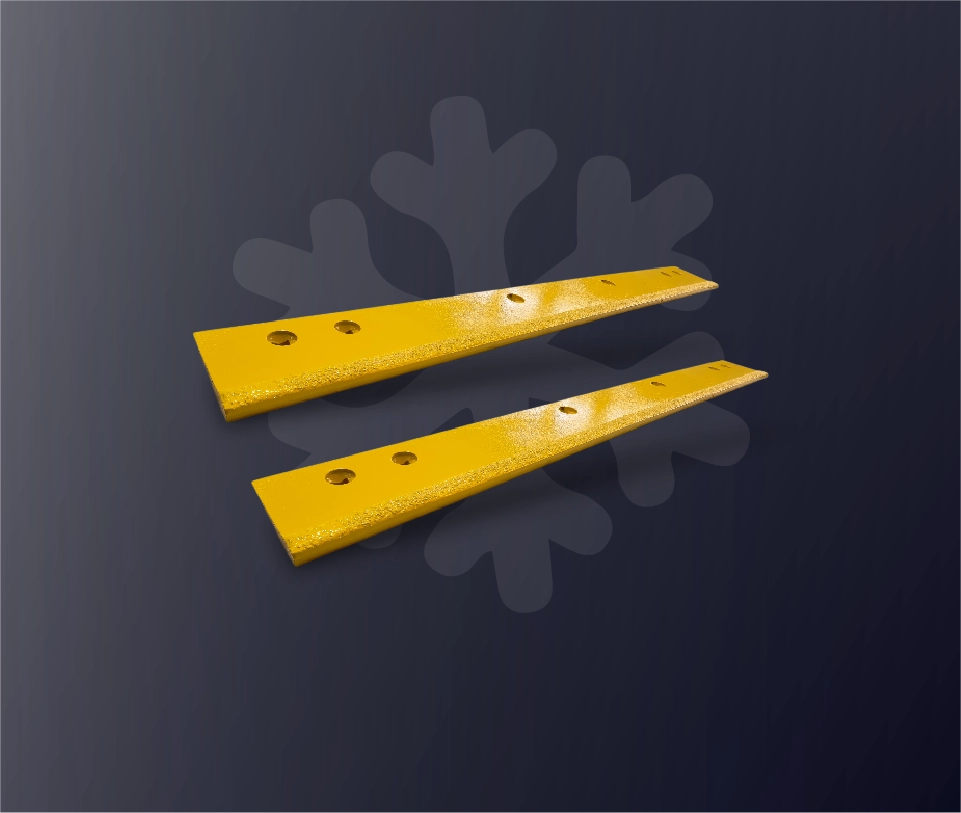

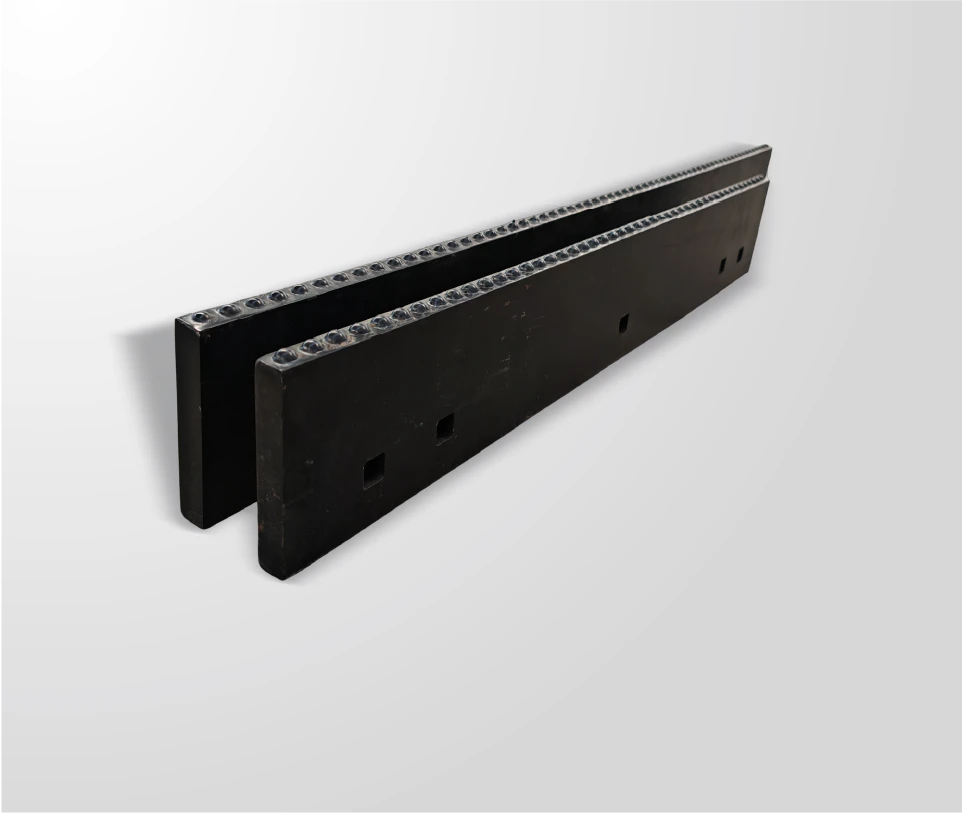

SENTHAI Carbide Tool Co., Ltd., a US-invested manufacturer in Thailand, delivers JOMA-style, carbide, I.C.E. blades, and inserts with 21+ years in wear parts. Fully automated lines handle wet grinding, sintering, and vulcanization under ISO9001/14001, ensuring 10x wear resistance.

Blades fit 8-12 ft plows, with pre-drilled holes for quick mounts. Carbide density options tackle ice-salt abrasion, bonding strength exceeds 200 ft-lbs torque. Rayong facility expansion in late 2025 cuts delivery to 4-6 weeks.

SENTHAI supplies 80+ global partners, matching OEM specs for V-plows and straight blades. Products reduce salt use 20% via precise cuts under 1/16 inch.

How Do SENTHAI Blades Compare to Traditional Options?

| Feature | Traditional Steel Blades | SENTHAI Carbide Blades |

|---|---|---|

| Service Life (hours) | 200-500 | 2,000-2,500 |

| Downtime Reduction | Baseline | 70% |

| Annual Cost Savings/Fleet | $0 (reference) | $50,000-$120,000 |

| Lead Time (weeks) | 6-8 | 4-6 |

| Salt Efficiency Gain | Baseline | 20% less usage |

| Weight per 10 ft Blade | 250-300 lbs | 220 lbs (lighter) |

How Is the SENTHAI Blade Installation Process Structured?

-

Step 1: Assess Fit – Match plow type (e.g., straight or V) to SENTHAI model; measure width and bolt pattern (10-15 minutes).

-

Step 2: Order and Receive – Use SENTHAI OEM portal; inspect carbide inserts upon Thailand shipment arrival (4-6 weeks).

-

Step 3: Secure Blade – Align pre-drilled holes, torque bolts to 200 ft-lbs; remove old blade first (25 minutes).

-

Step 4: Test Run – Plow 5 miles at low speed, adjust angle for optimal cut; monitor edge (30 minutes).

-

Step 5: Track Usage – Log hours digitally; replace inserts at 1,200 hours, full blade at 2,500 (ongoing).

What Real-World Scenarios Prove SENTHAI’s Impact?

Scenario 1: Municipal Highway Crew

Problem: Blades dulled in 150 hours, delaying clearance for 50 miles of road.

Traditional: Weekly steel swaps cost $80,000 yearly in labor and parts.

After SENTHAI: 2,200-hour life cleared storms 2x faster.

Key Benefit: 50% cost cut, doubled contracts.

Scenario 2: Commercial Lot Operator

Problem: Ice buildup wore edges in 100 hours, halting 20 lots overnight.

Traditional: Emergency buys spiked costs 40%.

After SENTHAI: Precise edges reduced passes 30%.

Key Benefit: 45% labor savings, 25% more sites served.

Scenario 3: Airport Ground Crew

Problem: Runway plows failed mid-storm, risking flights.

Traditional: Heavy repairs stalled 10 units daily.

After SENTHAI: Lighter blades boosted fuel efficiency 15%.

Key Benefit: 35% uptime gain, zero delays.

Scenario 4: Mining Haul Road Team

Problem: Abrasive ice chewed blades in 100 hours, idling 15 trucks.

Traditional: Daily fixes lost $150,000/month.

After SENTHAI: Extended life freed fleet.

Key Benefit: 35% productivity rise, $120,000 savings.

Why Should Operators Import SENTHAI Blades Now Amid Future Trends?

Electric plows claim 15% market by 2030, needing lighter carbide for range. GPS automation demands durable edges for 20% less salt. With 3.43% US growth and regs tightening, delaying upgrades risks 25% cost hikes. SENTHAI’s Thailand control ensures supply amid disruptions.

FAQ

How long do SENTHAI snow plow blades last in heavy use?

SENTHAI blades endure 2,000-2,500 hours, 3-5 times beyond steel.

What plow types fit SENTHAI carbide blades?

They match JOMA-style, V-plows, straight blades for 8-12 ft widths.

Does SENTHAI offer customization for US imports?

Yes, carbide density and widths tailor via Thailand engineering.

When can US operators expect SENTHAI delivery?

Lead times average 4-6 weeks post-2025 Rayong expansion.

Are SENTHAI blades compliant with US environmental regs?

ISO14001 certification supports low-salt, eco-friendly performance.

Why choose SENTHAI over domestic steel suppliers?

Thailand production cuts costs 25-40% with superior wear resistance.

Sources

-

https://www.linkedin.com/pulse/north-america-straight-snowplow-blade-market-size-qpxqf

-

https://www.linkedin.com/pulse/thorough-analysis-snowplow-blades-market-itsindustrys-growth-wldme

-

https://www.ibisworld.com/united-states/industry/snowplow-manufacturing/5432/

-

https://www.senthaitool.com/how-can-snow-plow-blades-tackle-winter-road-challenges/

-

https://www.senthaitool.com/how-can-industrial-snow-plow-blades-transform-harsh-winter-operations/